Wild volatility in foreign exchange markets (and financial markets as a whole) following the import of US President Donald Trump’s offensive commercial invoices on April 2 “Liberation Day” has led to one of the most active months ever in FX institutional transactions.

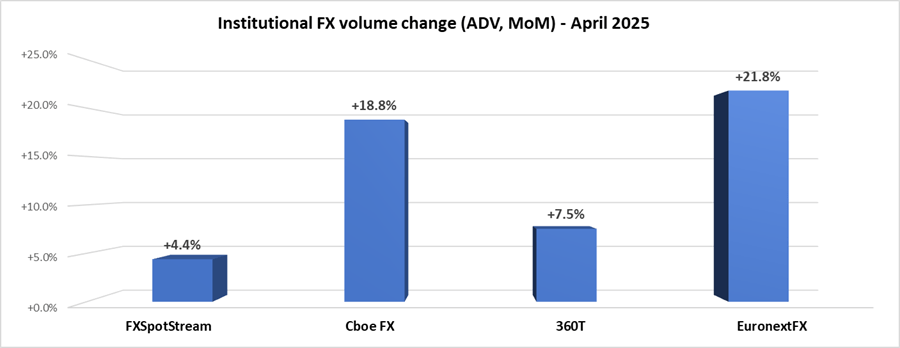

After a powerful Q1 that ended with a record march to FX institutional markets, April was even better with transactions volumes, increasing 13%. Each of the leading EFX sites investigated by FNG-FXSPotstream, CBOE FX, EuronextFX and 360T-SAW increases of activity between 4-21% in April 2025.

CBOE FX (formerly hotspotfx)

- April 2025 The average daily tumors were $ 61.90 billion, +18.8% from $ 52.11 billion in March.

EuronextFX (formerly Fastmatch)

- April 2025 ADV $ 38.16 billion, +21.8% From the March ADV of $ 31.33 billion.

Fxspotstream

- April saw FxSpotstream set a new high in terms of overall ADV at USD122.02Billion. This marked a 4.4% increase mommy (compared to March 2025) and 32.8% on a yearly basis (against April 2024). April’s ADV exceeds the previous high of high -level USD116.89billion last month (March 2025).

- April’s total ADV consists of USD91.41Billion on the spot (a new high in service) and USD30.61Billion on other products.

360T

- The average daily volumes (ADV) at 360T came to 39.58 billion $ In April 2025, up to 7.5% from $ 36.81 billion in March.