Source of Business News Parachute It says that Israel based on ETORO electronic transactions may try to start the original public offer (IPO) in the US this week as stock markets have somewhat stabilized, saying “people who are familiar with the issue”.

Bloomberg said that according to its sources, no final decision on the issue has been made and that the ETORO IPO may be further delayed.

Postponement otro ipo

ETORO filed the registration statement of “F-1” to the US Securities and Exchange Commission (SEC) on March 24, publicly stating its intention to seek IPO on Nasdaq and listing its shares under the Ticker Etor symbol. However, the scheduled ipo-in which a company that goes to the public usually travels and is found in a variety of large institutional investors before pricing the “agreement”-is located by Donald Trump’s Bombshell.

The April 2nd invoice announcement followed a 10%rapid drop in world stock markets. The volatility of the markets has led some companies, such as Etoro, the Event Stubhub ticket site and the Sweden Fintech Company Klarna Bank AB, to postpone the IPO Roadshow plans.

However, stock markets have mainly recovered these losses. The wide S&P & P500 index, in 5,686.67, is actually slightly higher than the price of April 2 (5,670.97). Same for the NASDAQ complex index, now on 17.977.73 versus 17.601.05 on April 2.

Issue webull

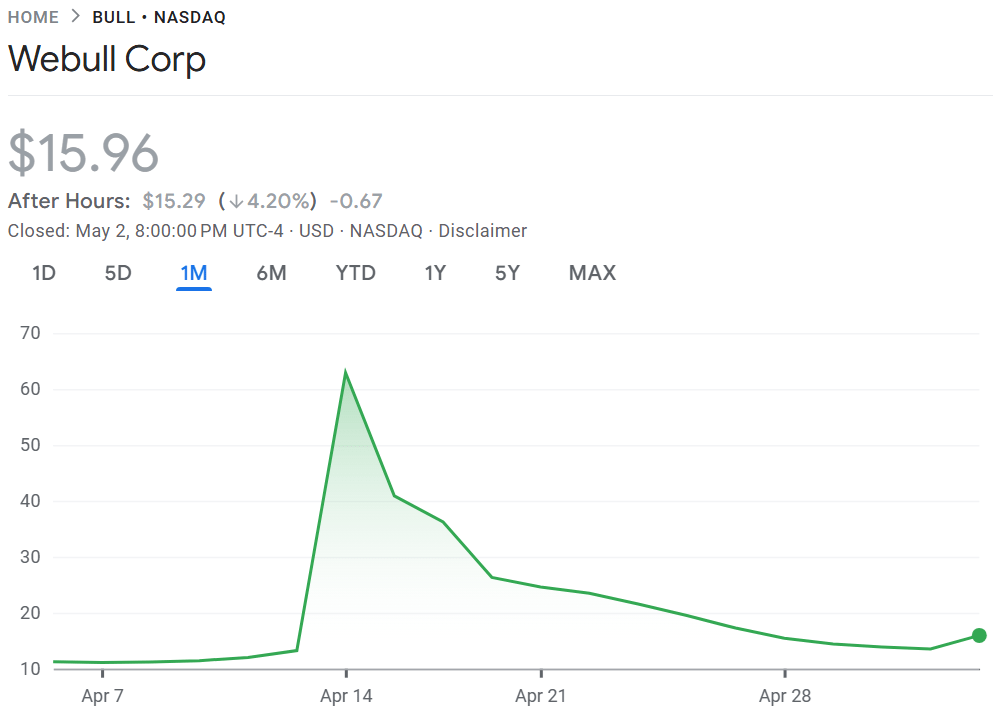

Another headwind facing the etoro iPo is what happened to compete with Neobroker Webull. Webull posted on Nasdaq on April 11 via SPAC merger (whose closure was not affected by the market after Tariff Mayhem) and on the second day of transactions saw its shares rise up to $ 79.56. Since then, webull shares have negotiated, down, 80% (!!), who now sits in just $ 15.96.

This has left a bad taste in the mouths (and pockets) of many of the investors in neo-public online brokers and could leave some ETORO natural investors on the sidelines or at least look for a much lower IPO valuation before deciding to jump on the boat.

Webull share price from SPAC-IPO to present. Source: Google Finance.

Etoro Valuation Review

While Etoro’s public deposits and statements have not yet disclosed a scheduled IPO that offers a transaction size or valuation for the company, speculation in Israeli media (such as Sphere And Calcalist) was that Etoro plans to increase somewhere in the neighborhood of $ 300-400 million, based on the valuation of the company of about $ 5 billion. (THE Ipo Renaissance Capital CenterA popular IPO monitoring site in the US has a transaction size of $ 750 million listed for ETORO).

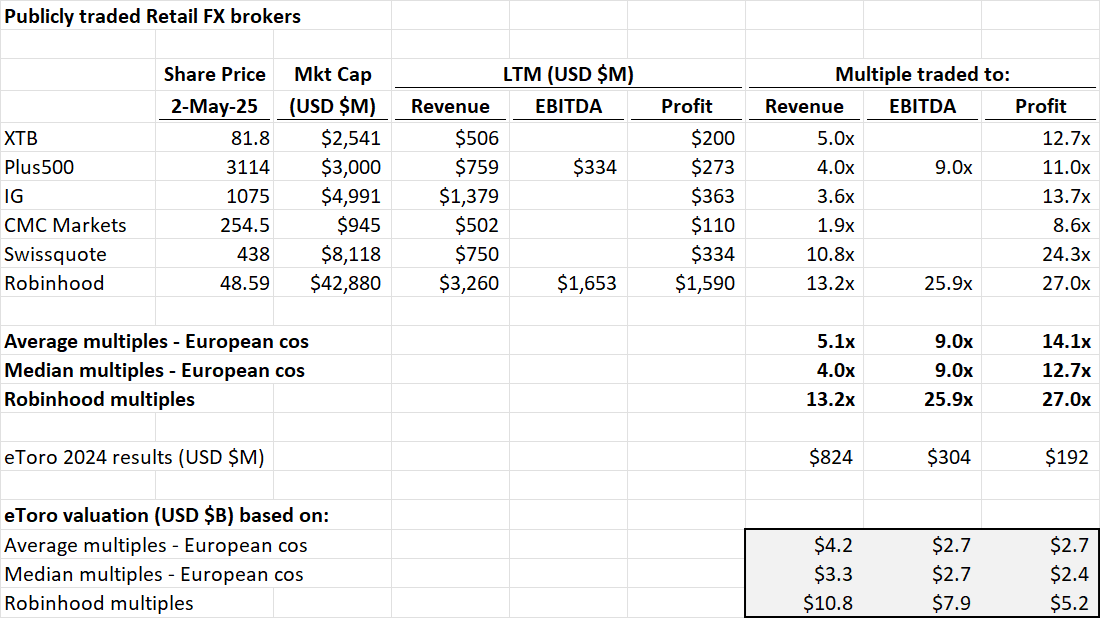

Following our previous report covering the evaluation of ETORO’s IPO and why the company is trying to make it public in the US and not in the United Kingdom or Europe, the good news is that many of the “Comps” have been negotiating since Etoro submitted the IPO Prospectus at the end of March, with many groups. Etoro has not yet expanded, XTB.

If ETORO really wants to achieve a $ 5 billion valuation in the IPO, it should convince investors that it should be more appreciated as RobinHood and less like the United Kingdom and Europe listed such as the XTB and Plus500. A United States/Europe valuation leads to an assessment of approximately $ 2.5-5.5 billion for Etoro, against a $ 5 billion valuation from the high multiples of RobinHood.

We will continue to follow this story as it develops.