Fintech Company Fis (NYSE: FIS) today reported the results of the first quarter of 2025.

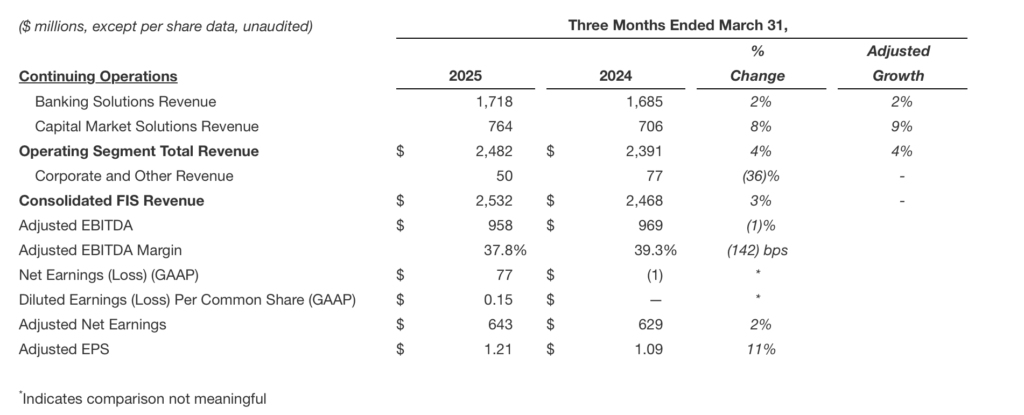

On a GAAP basis, revenue increased by 3% compared to the previous period to about $ 2.5 billion. GAAP’s net profits attributed to common shareholders by ongoing businesses were $ 77 million or $ 0.15 per diluted share.

On a customized basis, revenue increased by 4% compared to the previous year, reflecting a recurring revenue increase by 4%.

The customized EBITDA was about $ 1.0 billion and the EBITDA adjustable margin ran by 142 basis points (BPS) during the previous period at 37.8%, reflecting high -end lending and finishing revenue during the previous period.

Customized net profits from ongoing businesses were $ 643 million and customized EPS increased by 11% compared to the previous period to $ 1.21 per diluted share.

On April 17, 2025, FIS entered the final agreements (I) Buy Solutions Essuer from Global Payments Inc. For a $ 13.5 billion business value, including $ 1.5 billion of the expected net value of the tax assets or a net $ 12.0 billion purchase price, subject to usual adjustments and adjustments and (ii) Sell the rest of WorldPay’s shareholding interest in worldwide payments for pre -tax value of $ 6.6 billion net of trading and other expenses.

FIS expects to finance the issuer of the publisher by a combination of about $ 8 billion and new debt and revenue after taxes from the sale of WorldPay minorities. Following the closure of transactions, the company expects the Pro Forma Gross Mearce to be about 3.4x, removing the 2.8X gross leverage in 18 months.

Transactions are expected to close simultaneously in the first half of 2026, subject to regulatory approvals and other usual closure conditions.

On January 31, 2024, FIS sold a 55% share of World Solutions of WorldPay in private funds managed by GTCR.

Following the closure of the 2024 WorldPay sale, FIS maintained a non-controlled 45% shareholder in a new stand-alone consortium, Worldpay Holdco, LLC.