BGC Group, Inc. (Nasdaq: BGC) today reported its financial results for the quarter end on March 31, 2025.

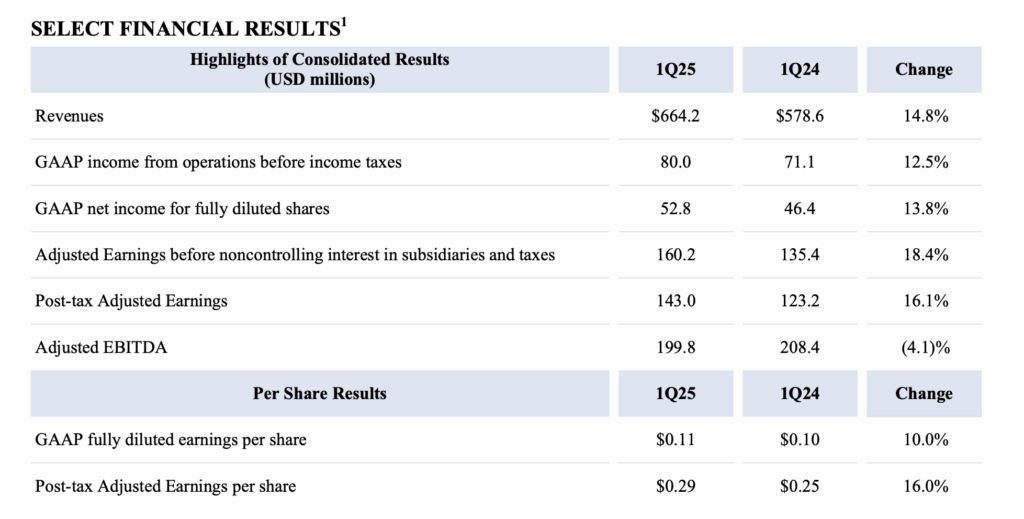

The team recorded first -quarter revenue of $ 664.2 million, an increase of $ 14.8% compared to the equivalent period last year.

Total revenue from brokerage increased by 15.7% in the first quarter of 2025.

Foreign revenue increased by 31% on a record of $ 110.0 million, reflecting widespread growth in all FX products.

Shares’ revenue was flat at $ 62.9 million, as a result of the highest European and US shares offset by lower Asian shares.

Data, network data and commercially increased by 5.2% to $ 32.5 million. This increase is mainly due to Fenics market data and Lucera, offset in part by the lower revenue after marketing due to the sale of BGC’s Capitalab business in the fourth quarter of 2024.

Intent revenue and dividends, fees from linked parts and other revenue increased by 6.4 % to $ 21.0 million due to higher interest in interest than the year before the year.

Customized pre -tax profits amounted to $ 160.2 million, up 18.4% on annual terms.

Adapted after tax profits amounted to $ 143.0 million, an increase of 16.1%, resulting in customized profits per share per share of $ 0.29, a 16%improvement.

Customized EBITDA amounted to $ 199.8 million, $ 4.1% lower than last year due to profit $ 36.6 million in the previous period, associated with a steady investment. Excluding this profit from the previous period, the custom EBITDA would increase by 16.3%.

On May 6, 2025, the BGC Board of Directors declared a quarterly cash dividends of $ 0.02 per share paid on June 1025 in category A and Category B of Common Shareholders on May 27, 2025, which is the same date as the date of practice.