Stonex Group Inc. (Nasdaq: SNEX), which holds FX retail brands such as forex.com and City Index, announced its financial results for the financial year 2025 in the second quarter ending March 31, 2025.

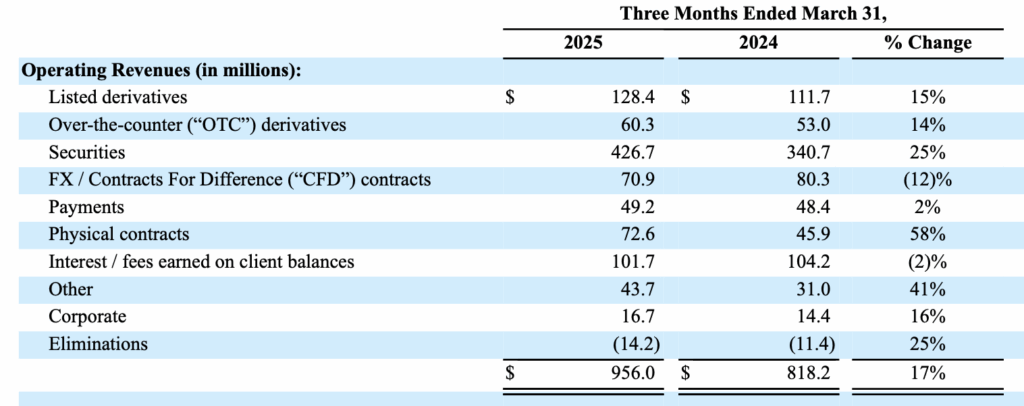

Operating revenue resulting from FX/CFD contracts declined by $ 9.4 million, as a result of a $ 9.7 million reduction in the self-directed/retail section of Stonex, which was partially offset by a $ 0.3 million increase in FX contracts.

Operating revenue from payments increased by $ 0.8 million, mainly resulting in a 20% increase in ADV payments, which was partially offset by the drop in RPM by 15% of payments.

Operating revenue resulting from natural contracts increased $ 26.7 million, as a result of increasing operational revenue from precious metals, as well as an increase in natural agricultural and energy revenue. Operating revenue associated with precious metals were adversely affected by unpaid losses in $ 4.0 million and $ 9.1 million during the three months ended on March 31, 2025 and 2024, respectively, related to natural reserves.

Operating revenue from listed derivatives increased $ 16.7 million, with the Stonex trade section increasing $ 16.4 million and Stonex’s institutional section by $ 0.3 million.

Operating revenue from OTC derivatives increased by $ 7.3 million, mainly by 11% and 4% increases in OTC derivatives and the average percentage per contract, respectively. This improved performance is mainly guided by the increased activity of customers in European and Brazilian markets.

Operating revenue from mobile transactions increased $ 86.0 million, mainly due to a 19% increase in ADV.

In all departments, operating revenue increased by $ 137.8 million or $ 17%to $ 956.0 million in the three months ended on March 3125 compared to $ 818.2 million in the three months that ended on March 31, 2024.

Net revenue increased from $ 18.6 million to $ 71.7 million in the three months ending March 31, 2025. Dilute profits per share were $ 1.41 for the three months ended on March 31, 2025 compared to $ 1.09 in March $ 31.