Following our report on Friday, FX and CFDS retailing, IFOREX, had submitted documentation for an initial public offer in London – making the second “live” IPO industry alongside Etoro, which is now on the Ipo Roadshow – FNG had the opportunity to review the company and Interesting image of iforex and how it has done.

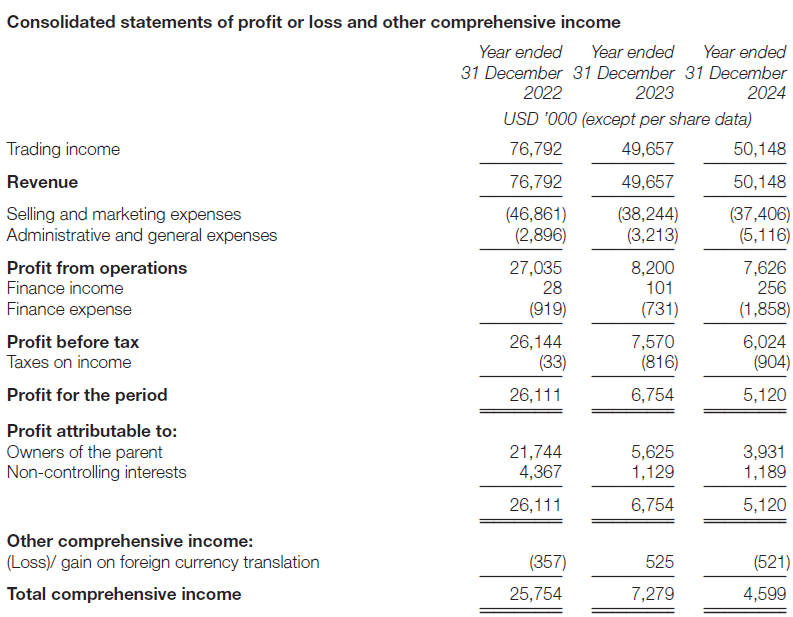

Iforex financial results

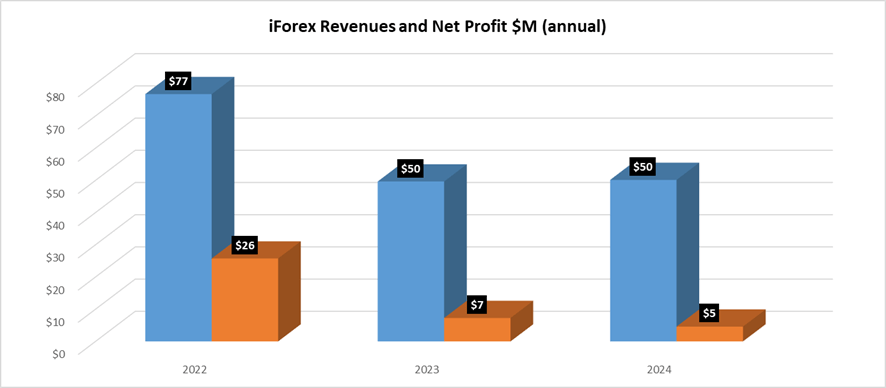

IFOREX has chosen an interesting moment to try to make it public, as its revenue has been reduced by 35% in the last two years and its profits with even more.

In 2024, IForex reported revenue of $ 50.1 million and a net profit of $ 4.6 million. These figures are close to the results of IForex 2023 (revenue: $ 49.7 million, profit: $ 7.3 million), but decreased significantly by $ 76.8 million and a net profit of $ 25.8 million in 2022.

Coins negotiation represented about 37% of the total number of IFOREX transactions in 2024.

Total customer trading volumes in Iforex amounted to $ 407 billion in 2024, or just below $ 34 billion in average monthly transaction volume.

Iforex structure

IFOREX was founded in 1996 with the control of Eyal Carmon shareholder and is executed (mainly) by Israel, led by CEO ITAI SADEH.

The team offers customer services through two key subsidiaries, CYSEC licensed ICFD LTD in Cyprus (which exploits the IFOREX.EU website) and the offshore British Virgin Islands (BVI) Unit Investment House Ltd, which manages the central website iForex.com.

IFOREX’s offshore unit represents more than 95% of total revenue from the group.

The company noted in its deposition that it would evaluate new applications of licenses based on commercial opportunity. These include Australia, Malaysia, New Zealand, the Philippines, Chile, the UAE and the United Kingdom.

IFOREX Customer Base

For the year ended on December 31, 2024, the team had 28,863 active customers, with an ARPU of $ 1,737. This is compared to 29,467 active customers in the year that ended on December 31, 2023 with ARPU US $ 1,685. The team also managed to bring 13,632 new customers to the trading platform in the year that ended on December 31, 2024 to a $ 401 CAC per customer. This is compared to 13,430 new customers in CAC 418 USD per new customer in the year end on December 31, 2023.

The Group has an internationally differentiated model of revenue with customers registered by more than 30 countries. The basic geographical areas of Iforex are as follows:

East Asia: East Asia is the largest geographical market of the IFOREX Group with revenue, representing $ 19.6 million or 39% of revenue in the year end on December 31, 2024.

Menu: Group businesses in the Middle East and African region represented $ 15.1 million or 30.3% of trading income in the year ended on December 31, 2024. As the growing population of this area, especially in the growth of the Council of Councils, Plan to apply for a license to the UAE.

South Asia: The South Asia region contributed $ 8.4 million or $ 16.7% of the negotiation income during the year ending December 31, 2024, with India being the most prominent country. At the moment, India does not have a legal framework that facilitates the negotiation of CFDs by land companies.

Latin America: Latin America’s customers represent US $ 4.4 million or 8.8% of trading income in the year ended December 31, 2024.

Europe: The team receives customers from the EEA Member States (with the exception of Cyprus and Belgium) through the ICFD CYSEC license and the passport rights granted to the ICFD. Customers from European countries who are not members of the EEA (for example, Switzerland) are boarding through FIH. Revenue from Europe’s customers accounts for $ 2.6 million or 5.2% of trading income during the year ending December 31, 2024. The Group believes that in a highly competitive and advanced market, such as Europe, which is also highly regulated, the size of the market, In the name that will help the team grow.

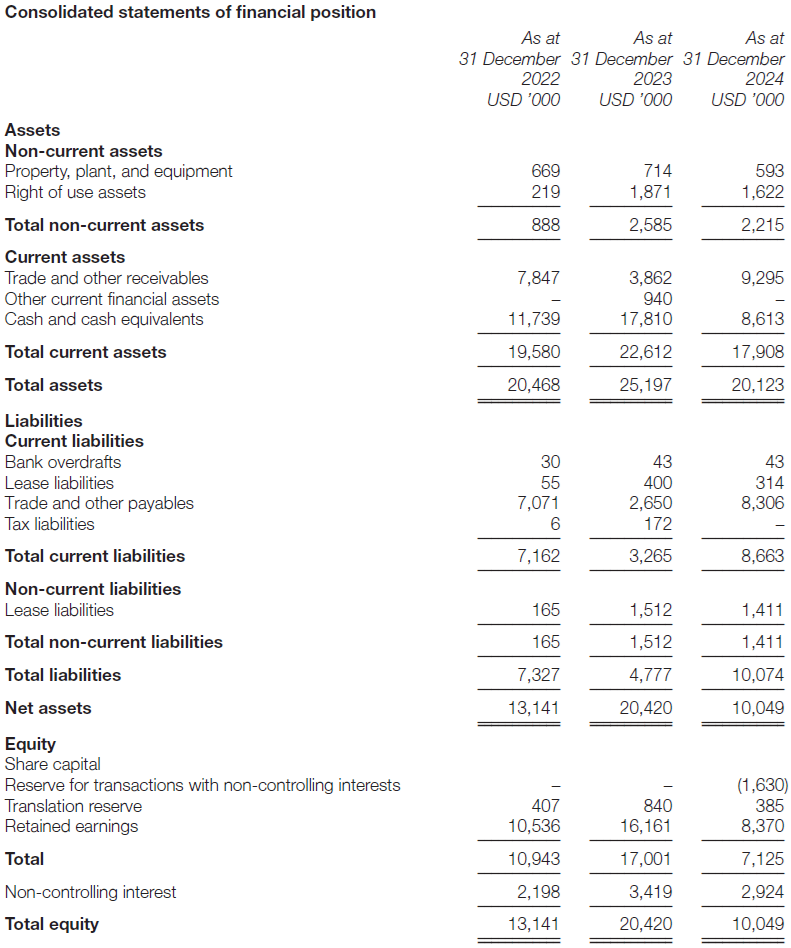

Financial situations iforex 2024

The consolidated results account status and the IFOREX Group balance sheet for the years 2022 to 2024 follow below.