Euronext capital market infrastructure today published its results for the first quarter of 2025.

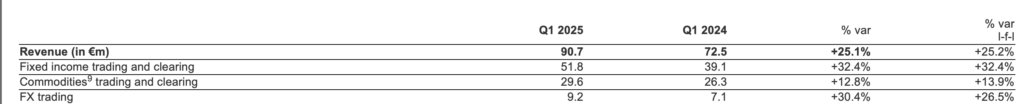

Revenue from FX trading increased by 30.4%to € 9.2 million in the first quarter of 2025, reflecting record volumes and a blend of volume positively.

Revenue from fixed income and revenue from liquidation reached € 51.8 million in the first quarter of 2025, increased 32.4% compared to the third quarter 2024 due to fixed income trading activity supported by favorable market conditions.

Revenue from the goods and revenue from the liquidation amounted to EUR 29.6 million in the first quarter of 2025, up 12.8% compared to Q1 2024, reflecting volumes and liquidation of dynamic agricultural products and dynamic agricultural trading and clearance.

Financial derivatives that negotiate and liquidate revenue were EUR 14.4 million in the first quarter of 2025, decreased by 4.8% compared to Q1 2024.

The custom EBITDA was € 294.1 million (+17.0%) and the customized EBITDA margin was 64.1% (+1.6PTs).

The custom net income was € 183.5 million (+11.8%) and the custom EPS was € 1.80 (+13.9%).

The net revenue was € 164.8 million (+17.9%) and the EPS mentioned were € 1.62 (+20.0%).

The net debt to EBITDA4 was 1.4 times in late March 2025, as part of the Euronext strategic plan of the Innovate for Growth 2027 strategic plan. On April 22, 2025, Euronext had successfully acquired the € 500 million bond issued in relation to the acquisition of Euronext Dublin in April 2018.

The Board of Directors, with the approval of the Supervisory Board, decided to propose approval at the annual General Meeting of the dividend payment of € 2.90 per usual share (based on the total number of eligible shares). The dividend will be distributed evenly (Pro Rata the number of shares held) to ordinary shares on the date of registration on May 27, 2025 (the ex-dividend date is set on 26 May 2025 and the payment date is set on 28 May 2025).

This dividend represents a 50% payment ratio of the reported net income, according to the current Euronext dividend policy.