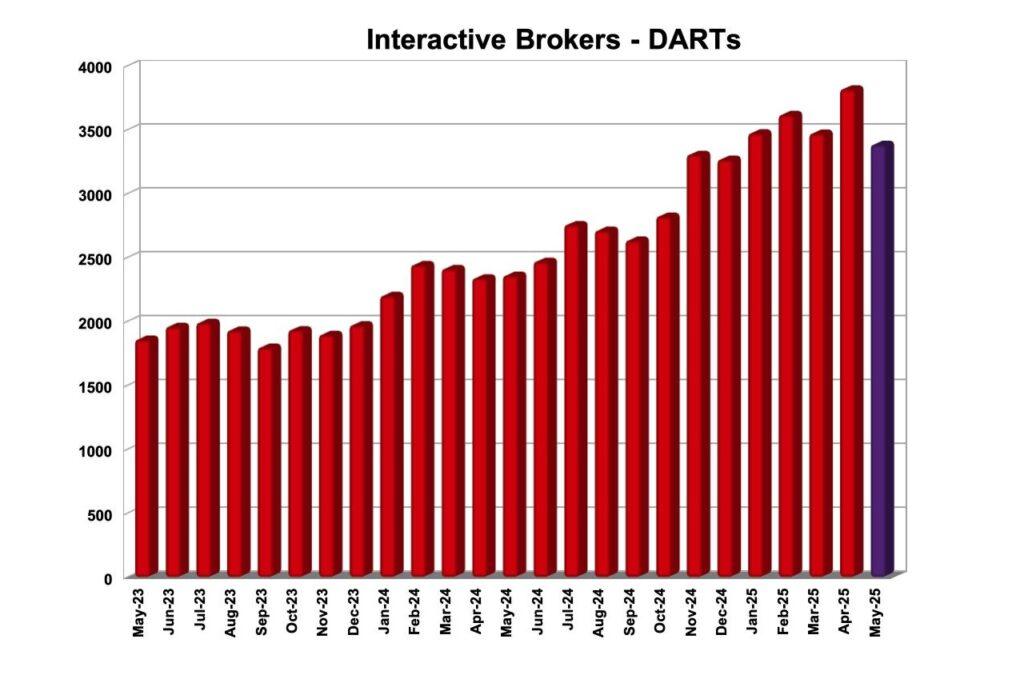

Major Interactive Brokers Group, Inc. (Nasdaq: IBKR) just published the basic functional measurements for May 2025.

The interactive brokers recorded 3.384 million daily average revenue transactions (darts) in May 2025, 43% higher than in May 2024 and 11% lower than April 2025.

The end of customer capitalization amounted to $ 628.2 billion, 29% higher than the previous year and 7% higher than the previous month. Finishing the Customer Margin Loans of $ 61.2 billion, 15% higher than the previous year and 5% higher than the previous month.

The number of customer accounts reached 3.79 million customer accounts, 32% higher than the previous year and 2% higher than the previous month.

The company reported 196 annual average clearance arrows per customer.

The average commission per cleared attachment was $ 2.61, including exchange, clearance and regulatory fees.

Interactive Brokers recently published its financial results for the first quarter of 2025.

The reported net revenue amounted to $ 1,427 million for the first quarter of 2025 and $ 1,396 million as it was adjusted. For the quarter of the year, they reported net revenue was $ 1,203 million and $ 1,216 million as they were adjusted.

Revenue from the Commission increased by 36% to $ 514 million in higher customer trading volumes. The volume of customer trading in stocks, options and future fulfillment contracts increased by 47%, 25%and 16%respectively.

The revenue of income before income tax amounted to $ 1,055 million for the first three months of 2025 and $ 1,024 million as it was adjusted. For the quarter of the year, he said the income before income tax was $ 866 million and $ 879 million as it was adjusted.

Net interest revenue increased by 3% to $ 770 million in higher average customer margin loans and credit balances.