After a powerful first half of the financial 2025, the CMC Markets PLC (LON: CMCX), London -based electronic trading team, which gave its results to slow down in the second half of the year, ie October 2024 until March 2025.

CMC Markets Management Changes

The company also announced some changes in senior executives. David Fineberg, CMC’s deputy chief executive from 2019, has been leaving the CMC Council and will go to the newly created role in the world leader of strategic partnerships, focusing on strengthening basic institutional relations and accelerating development through corporate relations.

Laurence Booth, a world leader of CMC capital markets, will participate in the Board of Directors and add the title of Executive Director, which is valid on June 5, 2025.

Matthew Lewis, today’s head of Anz and director of the CMC Board of Directors, will also withdraw from the Board of Directors, but will continue to focus fully on the expansion of the group’s fingerprint in the Anz area, in particular on stock and digital assets.

CMC Markets FY 2025 Results

But back to the results of CMC…

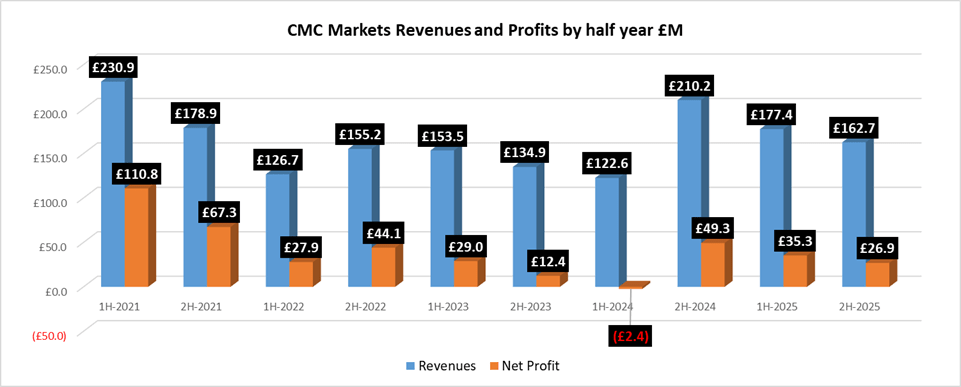

CMC reported revenue of £ 162.7 million for the second half of FY2025, for a second consecutive period, in a somewhat alarming trend for the electronic broker, which has been under pressure from its traditional competitors, such as IG Group and Plus500

CMC Markets’ net profit also declined for a second consecutive six -month period, which enters 26.9 million pounds in the second half of FY2025.

For the full financial year 2025, CMC Markets reported revenue of £ 340.1 million and a net profit of £ 62.2 million.

CMC Purchases Reaction Price

CMC shares reacted to the news with the negotiation of approximately 12% As markets opened on Thursday. Interestingly, the shares of CMC Markets are almost exactly where it was at 284.5p (Wednesday’s closing price) last year, though they have gone a bit from a strike hitting up to 349p in late 2024 and sinking as low as 183.4p earlier.

CMC Markets Markets Map Charter, in the last 12 months. Source: Google Finance.

CMC traces future plans

CMC led to release the results, describing what is called “three vertical future state”. In addition to the existing brokerage platform directly to the consumer (D2C) and CMC’s B2B institutional services, the company has risen to Web 3.0 technologies, including decentralized funding and supervision, which CMC stated that it represents a constituency.

In response, CMC launches a third strategy vertical: Defi and web 3.0 opportunities designed to place CMC at the forefront of the next generation of financial services. The basic initiatives that have already been delivered include the start of 24/7 trade, improved capabilities of the Ministry of Finance and Digital Assets and the acquisition of Strikex, offered in the infrastructure and infrastructure infrastructure.

Full release of CMC Markets in FY 2025 The results can be observed here.