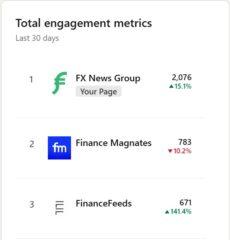

This week she presented some more examples of why FNG has become, by far, the most read, more communal and more reliable FX and CFDS Industry News sites. (Here is Linkedin Analytics’ Antagonist Statistics for the last 30 days – FNG articles get several x the commitment more than “other types”.)

Except for about half a dozen Exclusive FNG Articles that include reports on C-Suite executive moves in brokers such as Startrader and EC markets …

Except for about half a dozen Exclusive FNG Articles that include reports on C-Suite executive moves in brokers such as Startrader and EC markets …

Last week, CMC Markets, one of the “original” and traded public brokers online, said its latest financial results for the financial year 2025.

The FNG chief – focusing on what was the real “new” – read “CMC Markets sees revenue reduction by 8% and a 24% profit reduction in 2 hours FY2025”.

Other “FX News” locations, basic parrots in the company’s rosy statements in its press release, published titles such as “CMC Markets, ending the FY25 with an annual 33%profit jump”.

CMC shares were immediately reduced by 17%.

Now, what coverage do you think the people who matter (traders, shareholders, regulators, industry trusts …) who really read? Or pay attention?

And who do you think they rejected (or, just didn’t bother to read at all) as more advertising nonsense?

Which newsletter do you think that decision -making and traders are opening and reading every day?

Some of the most read and commented news stories in the FX/CFD industry to appear in the last seven days in FNG included:

Top news of the FX and CFDS industry this week

CMC Markets is monitoring the decline of revenue by 8% and a 24% decline in profit in 2 hours FY2025. After a powerful first half of the financial 2025, the CMC Markets PLC (Lon: CMCX) electronic trading team has reported the results of 2025 (the financial year ending March 31, 2025), indicating the slowdown both at the top and the bottom of the year 20, 20.

CMC Markets is monitoring the decline of revenue by 8% and a 24% decline in profit in 2 hours FY2025. After a powerful first half of the financial 2025, the CMC Markets PLC (Lon: CMCX) electronic trading team has reported the results of 2025 (the financial year ending March 31, 2025), indicating the slowdown both at the top and the bottom of the year 20, 20.

CYSEC issues the statement on allegations against the Cypriot brokers forex. An interesting exchange just happened between the Cyprus regulator CYSEC and Mayor Paphos Pedonas Pedonos, after the latter have made accusations that drug networks from Mexico and other Latin American countries are providing profits through CFDs based on Cyprus and CFDs. What does Cysec say about the subject?

CYSEC issues the statement on allegations against the Cypriot brokers forex. An interesting exchange just happened between the Cyprus regulator CYSEC and Mayor Paphos Pedonas Pedonos, after the latter have made accusations that drug networks from Mexico and other Latin American countries are providing profits through CFDs based on Cyprus and CFDs. What does Cysec say about the subject?

The public erases social trade. The electronic investment of public.com, which started life as an application for social transaction, has announced that it is now leaving a social transaction. And the reason given? AI, of course. In a blog post entitled “Sunsetting Social”, Public explained that when it started for the first time, a key feature of the product was the ability to see other people’s transactions and their ideas around markets – everyone comes together in a social food. It was a new idea that helped publicize not only a place on trade but a community.

The public erases social trade. The electronic investment of public.com, which started life as an application for social transaction, has announced that it is now leaving a social transaction. And the reason given? AI, of course. In a blog post entitled “Sunsetting Social”, Public explained that when it started for the first time, a key feature of the product was the ability to see other people’s transactions and their ideas around markets – everyone comes together in a social food. It was a new idea that helped publicize not only a place on trade but a community.

IG is working with support to start Crypto trading in the UK. The United Kingdom’s top online investment and trading platform (Lon: IgG) has announced that it has launched Crypto Trading, making the first business recorded in the United Kingdom to allow customers to buy, sell and maintain cryptographic assets. The launch comes as the adoption of encryption continues to grow in the United Kingdom and follows the recent revelation of the government’s plans for a UK encryption regime.

IG is working with support to start Crypto trading in the UK. The United Kingdom’s top online investment and trading platform (Lon: IgG) has announced that it has launched Crypto Trading, making the first business recorded in the United Kingdom to allow customers to buy, sell and maintain cryptographic assets. The launch comes as the adoption of encryption continues to grow in the United Kingdom and follows the recent revelation of the government’s plans for a UK encryption regime.

RobinHood completes the acquisition of Bitstamp’s $ 200 million. US markets Neobroker RobinHood (Nasdaq: Hood) have announced that it has closed the acquisition of Bitstamp a global encryption exchange. Bitstamp, founded in 2011 with offices in Luxembourg, the United Kingdom, Slovenia, Singapore and the US, has agreed to be acquired by Robinhood in July 2024 for $ 200 million. The acquisition introduces RobinHood’s first institutional cryptographic business.

RobinHood completes the acquisition of Bitstamp’s $ 200 million. US markets Neobroker RobinHood (Nasdaq: Hood) have announced that it has closed the acquisition of Bitstamp a global encryption exchange. Bitstamp, founded in 2011 with offices in Luxembourg, the United Kingdom, Slovenia, Singapore and the US, has agreed to be acquired by Robinhood in July 2024 for $ 200 million. The acquisition introduces RobinHood’s first institutional cryptographic business.

Top executive movements of the FX industry this week

❑ Exclusive: Moe Padhani joins Startrader as a head of trading officer.

❑ Exclusive: Equiti Exec Yassin Mismar sales unite fundingpips.

❑ Exclusive: EP markets hire Exec Fivos Georgiades transport transport as executive.

❑ Exclusive: Primexm Bizdev Alan Samuel’s manager leaves for Pluridio.

❑ Acropolis FX The head of Busan Development Bryan Seegers departs.

❑ Exclusive: Startrader hires Allan Maira and Clarice Frost for business.

❑ B2prime hires the head of institutional sales of Onezero Stuart Brock.

❑ Tech Tech Provider Axcera hires Lubomirir Marasi as a commercial manager.