The online negotiation with large interactive brokers has clashed with one of its former customers, Robert Scott Batchelar, over deposits in a trial citing the broker who committed the negligence of engineering.

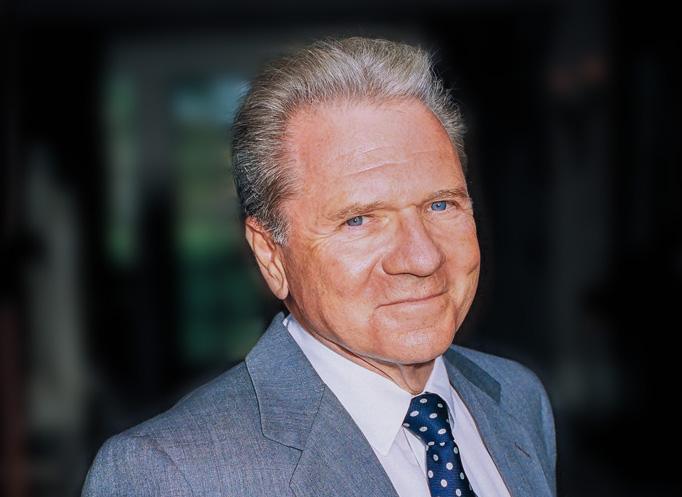

Documents submitted to the Connecticut District Court reveal that interactive brokers are seeking a protective mandate prohibiting the deposition of Thomas Peterffy, the Chairman of the Board of Directors and the former CEO of Interactive Brokers Group, Inc. (“IBKR”).

In this lawsuit, Robert Scott Batchelar blames interactive brokers, LLC of negligent design of his software, so that an automatic clearing of his account positions costs him thousands of dollars more than he should have.

Let us note that Batchelar began this lawsuit in December 2015, filed a complaint claiming claims for breach of the contract, negligence and commercially irrational clearance of committed collateral. Batchelar states that the current theory of his responsibility is that the automatic moisture software of interactive brokers was designed, coded, maintained and used to allow for a clearing transaction less favorable to the customer than the terms of clearing transaction.

Interactive brokers explain that Batchelar has only one requirement in this action after all his other claims to have been rejected by bias and this claim concerns the supposed negligence of engineering. Batchelar claims that the IBKR ‘broker-transient or automated clearance code was designed, implemented and maintained and that an unintentional encoding error resulted in malfunction. The plaintiff has already received seven deposits, including deposits of higher engineers responsible for the software in question.

The broker notes that the president did not plan, implement, program or maintain the IBKR’s automated clearing software anywhere during the classroom period. IBKR employs more than 700 software engineers, including those who are responsible for liquidation software. The President did not participate in the creation of the software.

Therefore, the President does not have unique personal knowledge about this claim and the engineers who have already been abolished are much more up -to -date on automated liquidation software. He has no knowledge of the supposed unintentional encoding error or claimed malfunction.

On the contrary, his focus was, and has always been, in the high-level business and the management of the IBKR-depending on the role and duties of senior public company executives for a financial institution that employs thousands of employees and services of millions of accounts.

However, on May 7, 2025, the class adviser served a notice of the president’s filing for July 9, 2025.

On June 6, 2025, a conference conference and discovery conference conference was held. The call made it clear that Mr Peterffy’s deposition remains a point of disagreement.