The first liberalization of ETORO’s financial results on the internet as a company negotiating to the public probably did not go as smoothly as the company hopes, with the company reporting both revenue and profit for the third225, as the encryption activity slowed down in its principles.

The price reaction of ETORO stock

Etoro’s shares (Nasdaq: ETOR) decreased by 12% on Tuesday and continued to decline in post -purchase transactions, closing the day to $ 66.96 after earlier to hit a high level of just under $ 80 (or $ 79.96, to be precise). To be fair, Etoro’s shares had increased by more than 20% on the days that led to the announcement of Q1 results and is still well above the $ 52 IPO price per share from mid -May.

Etoro Price Price IPO to present. Source: Google Finance.

ETORO Q1 2025 RESULTS

But back to the details of Etoro’s Etoro Q1 results…

First, as we have described earlier, it is somewhat difficult to distinguish what we consider as “really” Etoro’s revenue, as the company mentions the gross “encryption revenue” and “cost of encryption revenue” separately, rather than complying the two to “crypt”. Thus, the company reports enlarged revenue (in the third quarter, $ 3.76 billion) and costs ($ 3.68 billion). We have proceeded and exceeded the cost of encryption to obtain the following net data and profits for the company. (Net profits are not affected by calculation).

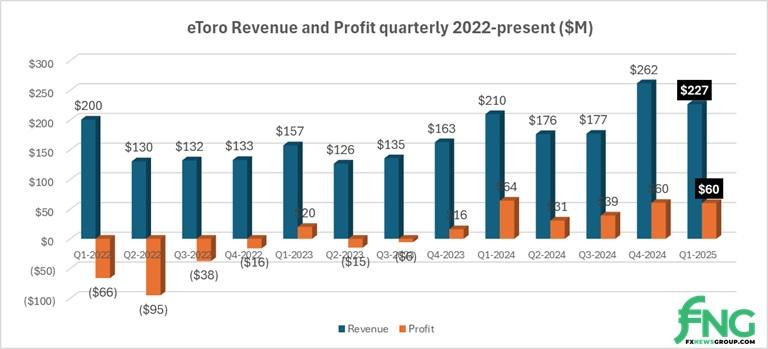

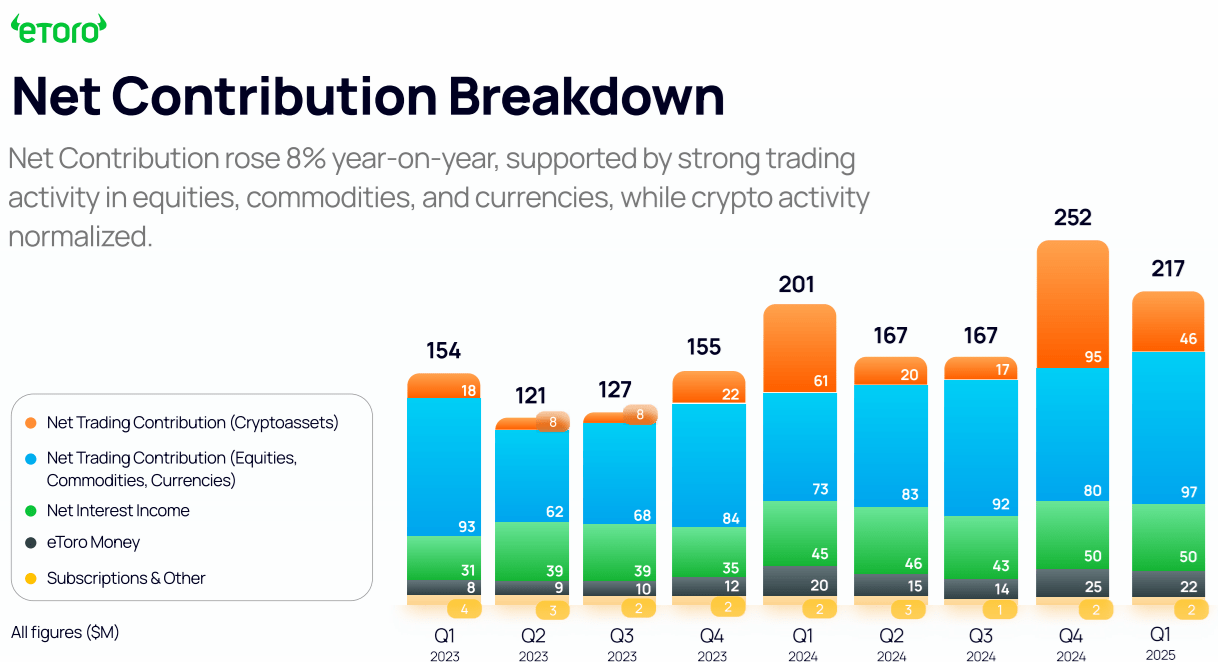

By our calculations, Etoro’s revenue decreased by 13% in Q1 2025, amounted to $ 227 millionversus $ 262 million in 424. The net profit in Etoro amounted to $ 59.95 million in quarter 2025compared to $ 60.41 million in the quarter 2024 and $ 64.12 million in the first quarter last year. The reductions came as encryption marketing slowed down, reducing 37% of total supplies to Etoro compared to 50% in the third quarter. Etoro seems to do better when Crypto Trading is growing between its customers, with Q4 2024 and Q1 2024 being primary examples.

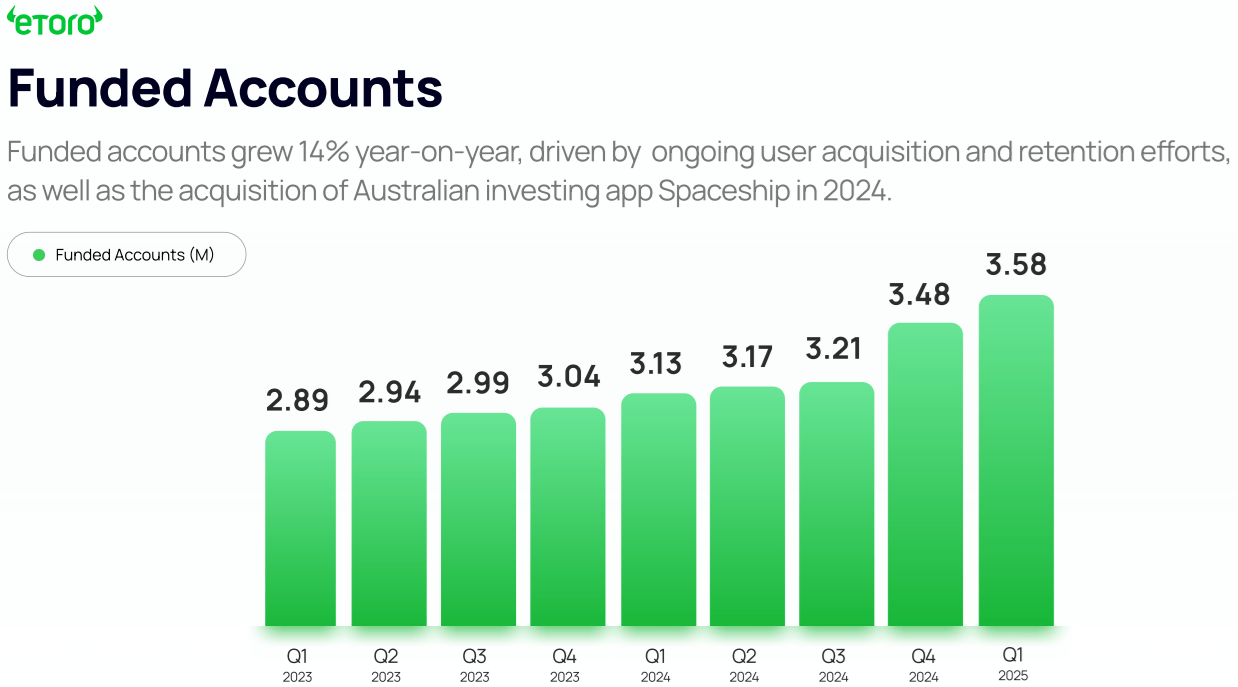

With some other measures Etoro had a solid Q1 and things seem to go well on Q2. The number of funded accounts in Etoro continued to rise, hitting 3.58 million, compared to 3.48 million at the end of 2024. On May 31, 2025, Etoro had 3.61 million funded bills and $ 16.9 billion in $ 20.8 billion in $ 20.8 billion.

The full release of results of ETORO Q1 2025 And financial statements can see here.