The electronic negotiation of the Grand Group Holdings PLC (LON: IgG) today announced its results for the 12 months ending May 31, 2025 (“FY25”).

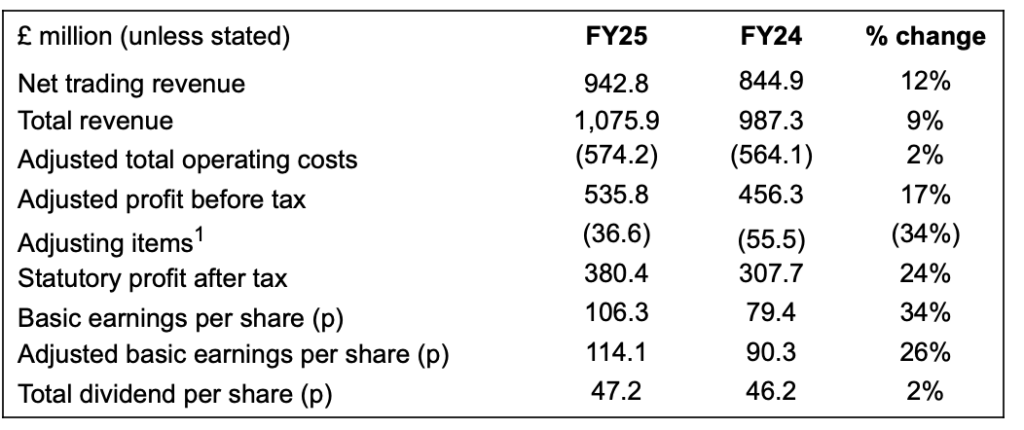

Total revenue amounted to £ 1,075.9 million, to 9% increase in the previous year (FY24: £ 987.3 million), reflecting market support and good initial progress implementing the IG strategy.

Net revenue from negotiations reached £ 942.8 million (FY24: £ 844.9 million), increased by 12%, in which Tastytrade Net Trading increased by $ 21% in US dollars.

Net revenue from interest from £ 133.1 million (FY24: £ 142.4 million) decreased by 6% from the previous year, reflecting the lowest interest rates in fixed cash balances.

Adapted earnings before tax amounted to £ 535.8 million (FY24: £ 456.3 million), increased by 17% on a margin of 49.8% (FY24: 46.2%). The legal profit before tax amounted to £ 499.2 million (FY24: £ 400.8 million), 25%.

IG reported fundamental EPS 114.1 PENCE (FY24: 90.3 PENCE), increased by 26% to 24 fy. The legal basic EPS was 106.3 PENCE (FY24: 79.4 PENCE).

IG today announced the team’s intention to launch a new shares of £ 125 million in H1 FY26, without prejudice to stock prices and other capital claims.

During FY25, IG marked some strategic and operational milestones.

IG completed the acquisition of Freetrade on April 1, 2025, enhancing the proposal of shares and investments directly to the customer. Freetrade strongly executed FY25, with a total of revenue increasing by 22% to £ 29.1 million and contributing £ 4.8 million to team revenue two months after completion.

Active customers increased by 137% to 820,000 resulting in the acquisition of FreeTrade, which added 457,300 active customers. On an organic basis, active customers increased by 5% to 362,800 (FY24: 346.200).

The group’s first transactions increased by 26% to 88,400, including 5,400 due to FREETRADE. On an organic basis, the first transactions increased by 19% to 83,000 (FY24: 69.900).

IG has come from multiple Legacy and Sandbox initiatives that did not give acceptable returns, such as Spectrum, Brightpool, Raydius, Bad Trader, Small Exchange and its commercial activities in South Africa.

Breon Corcoran, CEO commented:

“In the first year by applying our strategy, we have made good initial progress that gives our priorities to improve our product, integrate a high performance culture and enhancing efficiency. I am satisfied that we are approaching our customers and accelerating the speed of the product.

“During the year, we also remodeled our upper leadership team with new managers for three of our five commercial divisions. These leaders have already had a significant impact, enhancing the performance and acceleration of change by enhancing high performance culture.

“I am looking forward, we are sure that we will meet market expectations for total revenue and EPS cash the FY26. In addition to FY26, we expect that total revenue will come to a medium to high -digit percentage percentage per year on an organic basis, accelerating it.