The Deutsche Börse group today published a set of stable financial measurements for the second quarter of 2025.

The FX & Digital Assets has recorded a further increase in the average daily volume traded in the second quarter. Growth spread to all sections and customer products. In addition to new customers, the increase in volatility FX was also a strong driver of the highest commercial activity. The unit increased its net revenue with no Treasury results to EUR 45.2 million (Q2/2024: € 39.6 million).

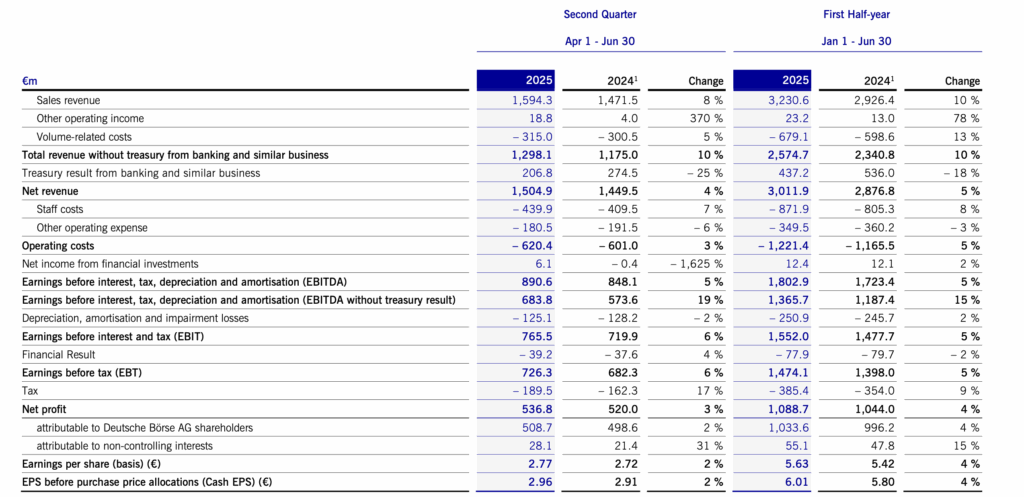

The group’s net revenue increased by 4% from the quarter of the year to EUR 1,504.9 million in the second quarter (Q2/2024: € 1,449.5 million). The result of the Ministry of Finance, which includes mainly net interest revenue and margin fees, amounted to EUR 206.8 million (Q2/2024: € 274.5 million).

Net revenue without the outcome of the Ministry of Finance increased to € 1,298.1 million (Q2/2024: € 1,175.0 million). This represents an increase of 10%.

Net revenue in the trading and clearance department, goods, sector, include a positive non -repetitive impact of approximately 10m euros from the refund from compensation after the expiration of the EX and NASDAQ agreement to obtain electricity and liquidation companies for the Nordic Market in the second quarter.

Deutsche Börse’s operating costs of € 620.4 million (Q2/2024: € 601.0 million) increased by 3 % compared to the previous year, mainly due to higher investment and inflation. Operating expenses in the same quarter of the previous year included an emergency effect of approximately € 15 million from the terminated agreement between EEX and NASDAQ.

Profits before interest, taxes, depreciation and depreciation (EBITDA) increased by 5% to € 890.6 million (Q2/2024: € 848.1 million). The EBITDA excluded Treasury income amounted to € 683.8 million (Q2/2024: € 573.6 million), a 19%increase.

Revenue from financial investments included in EBITDA increased to € 6.1 million (Q2/2024: EUR 0.4 million).

In the second quarter of 2025, the net profit attributed to the shareholders of Deutsche Börse AG amounted to EUR 508.7 million (Q2/2024: € 498.6 million).

Earnings per share amounted to € 2.77 (Q2/2024: € 2.72) based on an average of 183.5 million shares.

Gregor Pottmeyer, financial director of Deutsche Börse AG, commented:

“Our team has achieved further secular development in the second quarter. This is the result of the long -term strategic development strategy, which focuses particularly on the innovation of products, the acquisition of new customers and the market share profits.

Combined with the main derogatory increase in costs, we also achieved strong business economies in the second quarter. So we are very confident about the second half of the year and confirm our forecast for the whole year despite a reduction in market volatility. ”