Tradeweb Markets Inc. (Nasdaq: tw), a global online shopping operator for rates, credit, shares and money markets, said financial results for the quarter today on June 30, 2025.

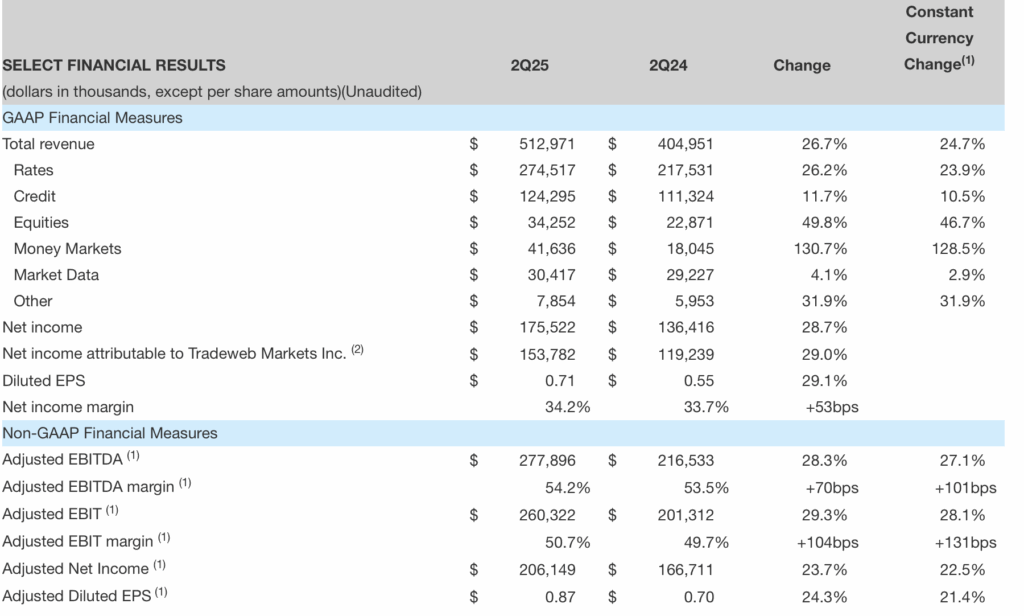

The company reported $ 513.0 million in quarterly revenue, an increase of 26.7% (24.7% on a fixed monetary basis) compared to the previous period.

International revenue amounted to $ 215.2 million in the second quarter of 2025, an increase of 40.8% (35.8% in constant current) compared to the previous year.

The company published an average of $ 2.6 trillion (“ADV”) for the quarter, an increase of 32.7% compared to the previous year.

The company recorded net revenue of $ 175.5 million and adjusted net income of $ 206.1 million in the quarter, increased by 28.7% and 23.7% respectively from the previous year.

The custom EBITDA for the quarter amounted to $ 277.9 million, compared to $ 216.5 million for the previous year.

Tradeweb has published $ 0.71 diluted profits per share (“diluted EPS”) and $ 0.87 custom diluted profits per share for the quarter.

The company declared a quarterly dividend per share by $ 0.12, by 20.0% per share from the previous year.

Billy Hult, Managing Director of Tradeweb:

“Tradeweb gave a strong second quarter, despite the macroeconomic challenges around the April 2025 invoices, increasing tensions in the Middle East and the Central Bank’s policy decisions, which continued to test all -time resiliences.

On this background, we continued to work with customers on strategic initiatives in traditional markets and in the field of digital assets. Our recently announced collaboration with Novaprime will bring new information and workflow tools to the mortgage, helping us unlock the value throughout the Trade Life Cycle. In addition, as Ai continues to shape market evolution, we were pleased to welcome Sherry Marcus as the head of Tradeweb’s AI in May. Sherry’s extensive experience and leadership will help promote AI’s potential to new levels of complexity.

We have introduced the immediate trading stock market for corporate treasurer through a seamless integration between the ICD gate and the institutional platform – demonstrating the capabilities and innovation, we are able to provide customers through our fourth channel customer. Based on our successes in credit, we were excited to import portfolio electronic transactions for European state bonds – expanding this innovative protocol to this category of assets. “