BGC Group, Inc. (Nasdaq: BGC) today reported its financial results for the quarter ending June 30, 2025.

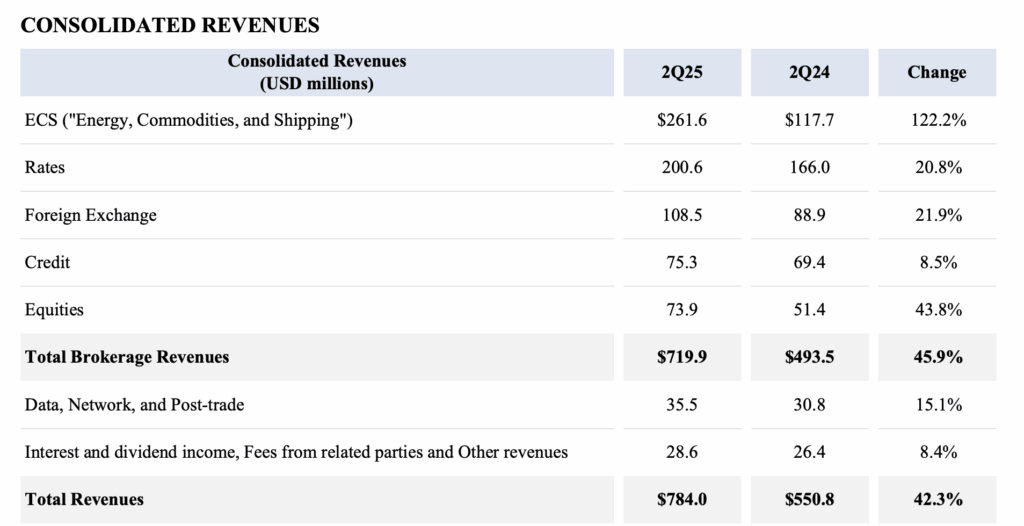

Revenue from exchange rates increased by $ 21.9% to $ 108.5 million, due to the strong increase in FX options and emerging market coins.

In all departments, the BGC group reported a quarterly revenue of $ 784.0 million, an increase of $ 42.3% compared to last year. Except for OTCs, revenue was $ 665.7 million, up 20.9% – also a quarterly record.

Revenue from EMEA, America and APAC increased by 50.3%, 40.3%and 17.4%respectively.

The BGC Group published customized profits of $ 173.6 million, up 38% from the year.

Adapted after tax profits amounted to $ 153.7 million, an increase of 34%, resulting in customized profits per tax level per share of $ 0.31, 34.8%improvement.

Customized EBITDA amounted to $ 213.3 million, 31.4% higher than last year.

On July 30, 2025, the BGC Board of Directors declared a quarterly cash dividends of $ 0.02 per share paid on September 3, 2025 in Category A and Category B of Common Shareholders on August 20, 2025, which is the same date as the date of practice.

Sean Windeatt, Executive Director, commented:

“We have presented historical results, creating a record revenue of $ 784 million, a 42 % increase over last year, with the exception of OTCs, revenue increased by 21 %, exceeding the last quarter revenue.

FMX had the best quarter, with record volumes and market share on both FMX UST and FX platforms. Total revenue from Fenics increased by 19 %, with Fenics growth platforms rising by 30 %, resulting in strong double -digit growth from FMX, portfoliomatch and Lucera.

After our most recent acquisition, we launched a cost reduction program, which we expect will be completed by the end of the year and deliver at least $ 25 million to annual savings through workshops. These savings will boost our profitability, lead the margins higher, and we expect them to provide long -term value of shareholders. ”