Electronic transactions with large interactive brokers has added tax planning to the portfolio.

The taxpayer in the portfolio is a tool that will help you appreciate the taxes for your stock market activity. This tool allows you to select the desired investment accounts to include and use taxable sources of income outside your investment bills.

You can customize the various tax rates used to determine your tax estimate and see the total estimated tax and combined tax sources subject to taxation.

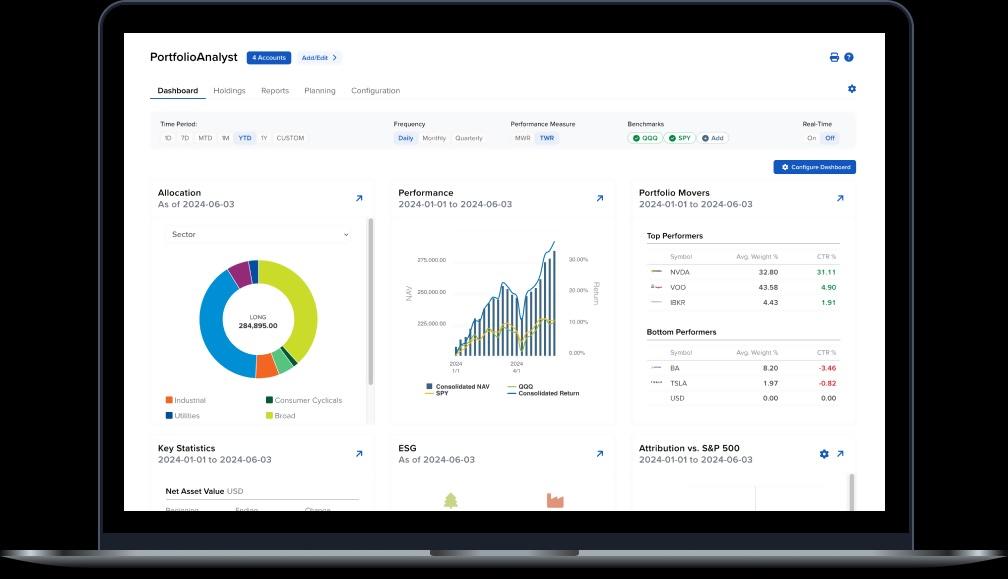

The portfolio integrates your financial accounts, monitors the account performance and activity of the account and provides a wide set of tools for the analysis of the entire portfolio and planning for the future.

Use portfolioanalyst to analyze the performance of the consolidated portfolio from the class, sector, financial media, region and country, date and total for a selected period. Review of portfolio and risk concentration with various measures, including maximum withdrawal, Sortino ratio, Sharpe ratio, Calmar ratio, alpha, beta, positive periods, negative periods and others. Interruption in specific portfolio measurements, such as portfolio movements, ESG, intended income, fixed income, Greeks and more.

There is no cost for using the portfolio and a free account includes access to a series of tools that helps you understand your current financial image. If you are already IBKR customer you will also have access to real -time data from your IBKR account and some advanced tools.