- The price of Chainlink could face a Bearish Pullback from $ 27.22 resistance and seek support from the $ 22.7 and $ 20 floor.

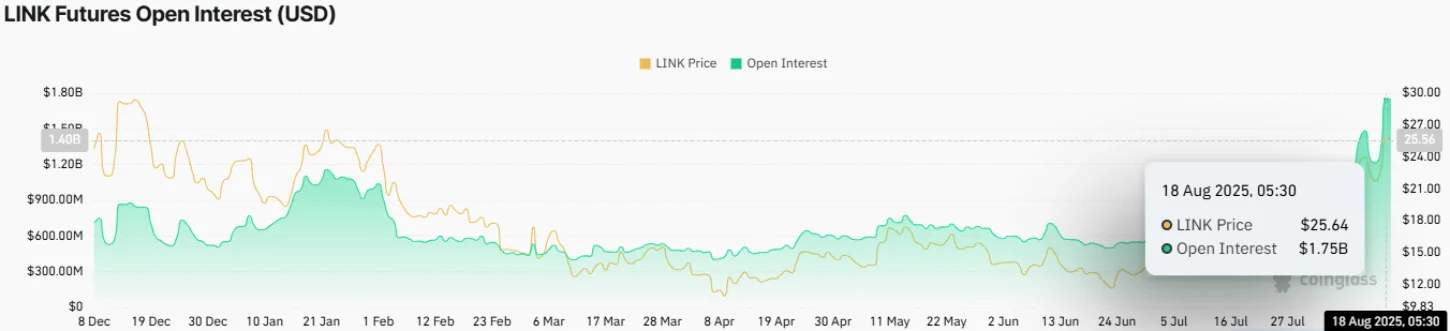

- The Link Futures Open has been bounced at a high height of $ 1.75 billion, indicating the increasing conviction by derivatives for a possible price jump.

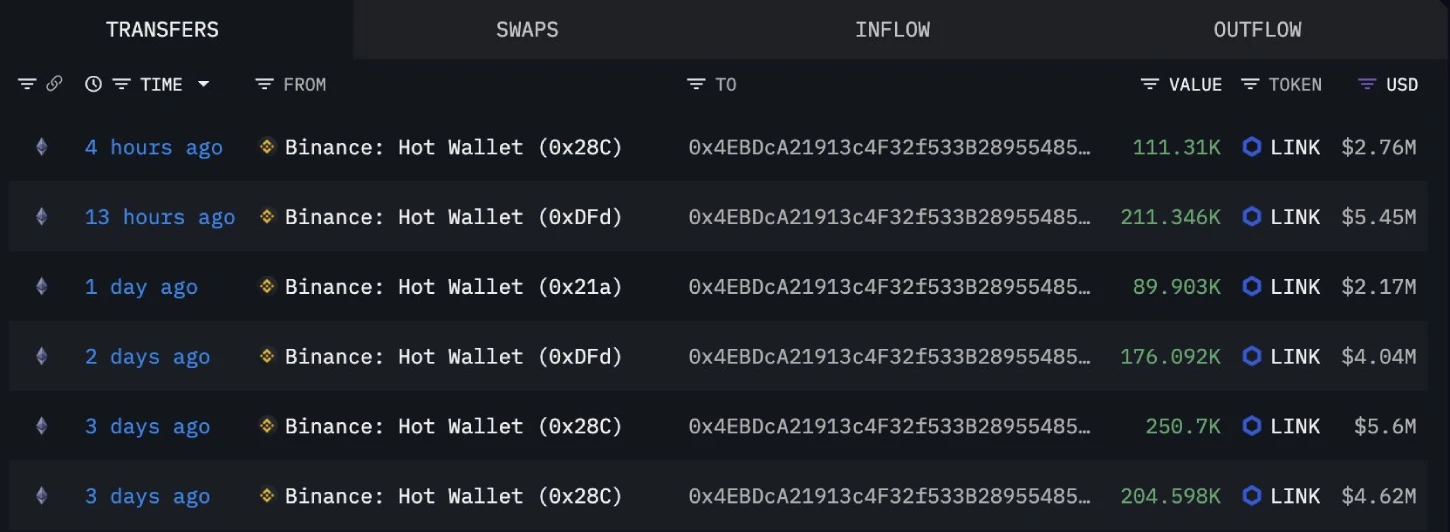

- The chain data shows that a cryptographic whale bought 322,655 links (worth about $ 8.2 million) from the Binance exchange before US transactions.

The price of the link chain watched increased volatility during Monday’s Monday market, reflected by a long daily wax and only 0.55% increase. The sudden change in prices movement was caused by the conflict between the broader market absorption and the growing demand for the link between investors. Will this Altcoin lose current market trend or keep its value to hunt a higher target?

Increases of link prices amid accumulation of whales and future fulfillment

Link, the inherent encryption of the Oracle Decentralized Network, has seen a remarkable increase of $ 21 in its current commercial value of $ 25.6, which represents a 22%increase. Subsequently, the ceiling of assets market has been reinforced

The upward trend reflects a steady belief from buyers as it came around a wider market market that prompted Bitcoin below $ 117,000.

This current chainlink price is supported by increasing adoption and active accumulation by large investors. According to the tracker on the chain, LookA “0x4ebd …” encryption address withdrew 322,655 Association (worth about $ 8.2 million) from the binance exchange before US purchase hours.

Following the recent purchase, whale withdrawals have reached $ 1,043,949 (worth $ 24.64 million) over the last 3 days. Buying pressure reflects strong confidence in high network investors despite correction across the market.

Adding to the Bullish note, Open Interest (OI) data reflects a firm faith of future traders towards the possible movement of Chainlink prices. According to Coinglass DataThe value of future OI links has increased from $ 1.22 billion to $ 1.75 billion in the last two days, reflecting 43%.

This increase shows that traders open new positions on the market pending a major move. Usually, the increase in OI with the price indicates the increase in large derivatives market, which reflects the increasing expulsive narrative for price.

Also read: Blockchain Lender Figure Technology Files for 400 million $ ipo

Basic support for monitoring in chain prices correction

Along with the wider market recovery, the recent increase in Chainlink prices was a combined impulse by many factors, including cooperation with Intercontinental Exchange (ICE), the start of the reserve link, institutional adoption and increasing appeal.

However, from the technical point of view, the price showed an example of a cup of a cup and a handle plan. This diagram setting is characterized by a long -shaped accumulation zone followed by a temporary pleasure to recover convenient impulse.

On August 9, the price of coins gave a decisive unblocking of $ 20’s throat resistance, signaling buyers’ victory in a 6 -month accumulation. After unblocking, the price of Chainlink won significant potential to reach the $ 25 signal.

However, the 4 -hour chart shows the air traffic pressure pressure on the $ 26 mark, evidenced by a long -range rejection candle. If market selling pressure insists, the price of coins could enter a post-rally pullback to stabilize its current upward trend and recover the exhausted inflated momentum.

The previous trend of this Uptrend shows a constructive removal to the Retramics level 23.6% to 50%. Thus, the expected reversal of the Chainlink price could seek support on the floor of $ 22.7 and $ 20, which coincided with FIB 23.6% and 32.6%.

If buyers manage to keep these levels, the currency price is likely to hit the $ 30 signal.

Also read: Dogecoin Price Eyes $ 0.26 As a Waline Activity Buy-The-Dip Steate