Antom, a provider of traders’ payment and digitization services under Ant International, announced today the launch of an Agentic Payment solution, which has a first APM Secure APM solution.

Antom is also one of the first Mastercard and Visa partners in pilot trading -based cards for AI agents.

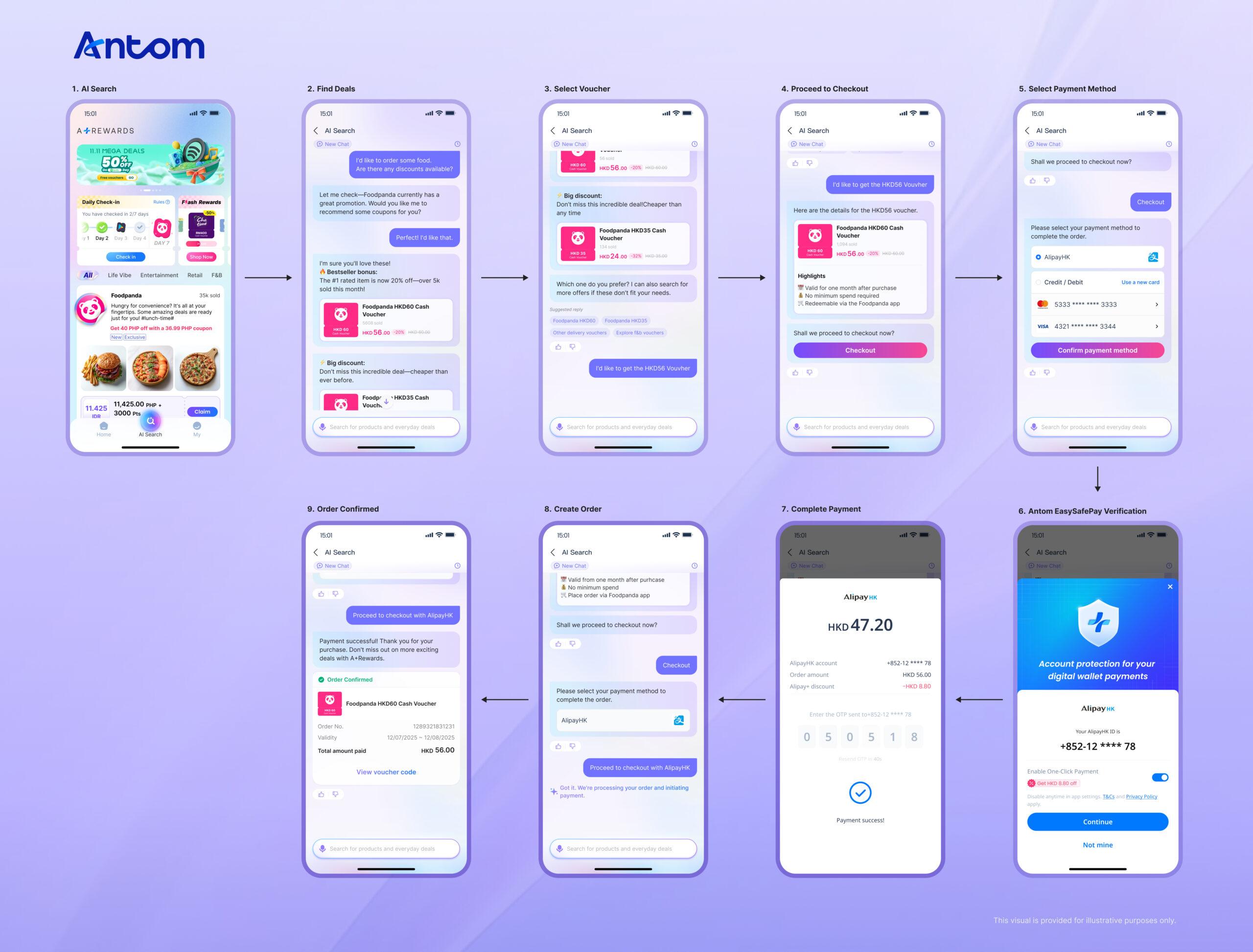

In a commercial environment, one of the most critical opportunities for AI agents is to complete the payments in a flexible way and reliably to meet the expectations of users. Antom’s payment solution is expected to respond to this need by covering the widespread payment method, offering a convenient APM and card checkout. It has a AI payment command model and improved assets management to ensure precise recognition of the user’s intent, ensuring the security of transactions and the provision of increased transparency for users.

Based on the model protocol (MCP), this Agangic payment solution supports built-in payments through interactions based on AI agents dialogue, covering both confirmed purchase and conditional applications, pre-existed transactions, such as purchases within a predetermined cost of sales or sales. The Antom Agangic Payment solution is now open to GitHub.

Many payment systems still require multiple clicks during the control process. In practical scenarios, the intent of payment is confirmed in multi -path natural language conversations, requiring a new model of authorization and detection.

Antom can connect AI agents to different APMs, including a wide range of digital wallets. With Antom Easysafepay, the first streamlined solution of the industry for the APM, the payment process is faster and simpler. Antom Easysafepay allows users to connect their digital wallets directly to the payment page without redirecting to external applications, naturally adjusting the payments that started by the agent.

Antom Easysafepay combines convenience with strong safeguards. It utilizes AI risk management and risk and mobile safety systems based on the calculation of multiple parties (MPCs) to detect and involve fraudulent transactions, preventing the abuse of electronic fishing, fraud and identity, by reducing the risk of acquiring accounts.

With the top risk control technology, Antom sets a new framework for the security industry. Behavior with the rules of the PCI (PCI SSC) security council, manages payment assets through cryptographic measures and creates a model of AI-Ready analysis and authorization for each transaction. This model links the basic transactions parameters with proof of intent to create verifiable credentials, allowing end to end detection. Thus, users can maintain control and promotion of how agents act and differences can be resolved through privacy questions based on privacy.

Antom’s structured and customized solution is designed to help AI agents support different payment methods, such as cards, wallets and banking, reaching a wide customer basis effectively while reducing completion costs.

Antom is one of the first partners to work with Mastercard via Mastercard Agent Pay and Visa via the Intelligent Commerce Visa in Asia-Pacific to explore card-based changes, promoting AI Commerce with a safe and uninterrupted checkout experience. They will push reliable and personalized practical payments with tools of control, authentication and trading control tools.

This launch reflects Ant International’s AI strategy by combining its deep expertise in the Fintech sector, relieving AI’s capabilities and AI support at the platform level. The aim is to support developers, financial institutions and traders to embrace the trade of the AI confidential.

“Paying Agentic is a fundamental step to allow AI agents to create real value in our daily lives,” said Antom’s General Manager, Ant International. “The rise in Payment of Agentic requires the re-examination of how to design payment systems. We look forward to co-establishment of protocols and frames with partners throughout the financial, technological and trade to ensure that practical payments are smooth and reliable.”