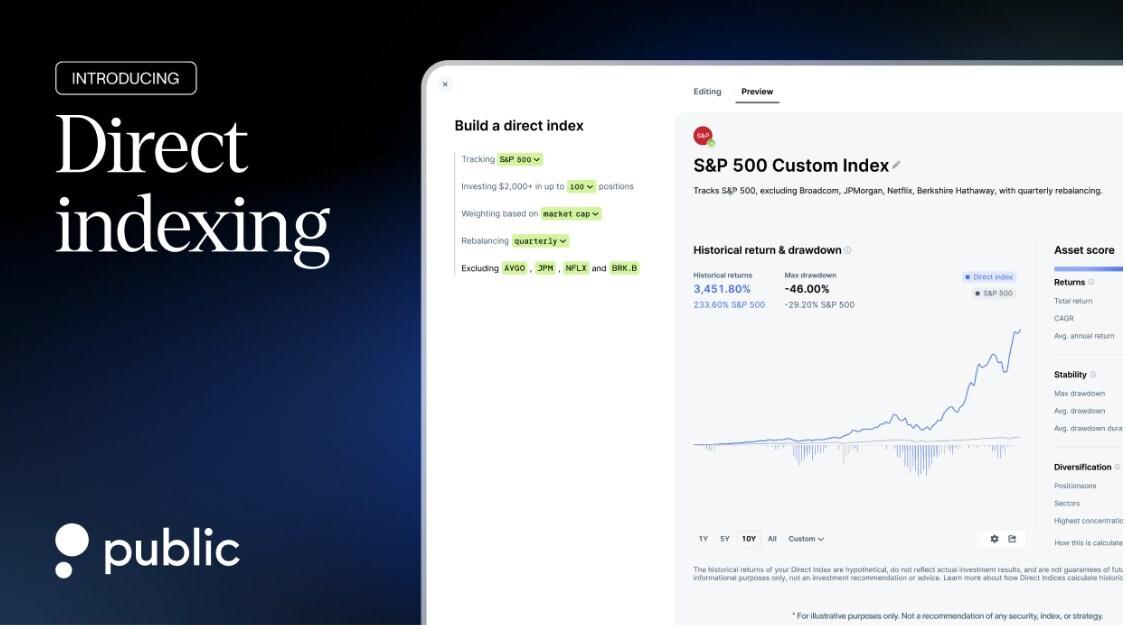

Public Investing Platform has allowed its members to create their own direct index from a wide range of fundamental markers.

Immediate indexation is a strategy where, instead of investing in a derivative of the index, such as an EIO, investors hold each share directly in the index, allowing automated tax strategies and personalization of the index. Members can access over 100 different indicators from SOLACTIVE and S&P to hold and tailor their preferences, as well as optimize tax savings through tax loss.

Traditionally, immediate indexing is only available in high -value investors, with average minimum investment requirements that can be in five or six elements. Recently, with the few reduced, immediate index has gained attraction between retail investors as a strategy for controlling their portfolios and the public makes it even more accessible with a minimum investment of $ 1,000 and an annual management fee of just 0.19% per index.

Members can now have even greater control of their investment strategies, while at the same time benefiting from possible tax savings through automated tax loss harvesting.

“The sophisticated investors want to control their portfolios. Our new product of direct indexing not only gives people the wider spectrum of indicators, but also the complete control of the companies in which they want to invest and who do not,” said Leif Abraham, co-director. “Essentially giving people the opportunity to convert indicators like S&P 500 to their own personalized S&P index.”

Public members can choose or create direct indicators from a wider range of indicators to the entire S&P family, including the S&P 500® and specific sectors such as IT or Health Care. Immediate indexing will allow retail investors to possess the actual share of the share capital and provide investors greater control over gravity and adaptation of investment compared to investment in a total of one ETF.

Immediate indexing in the public is now alive for all members of iOS, Android and Web.