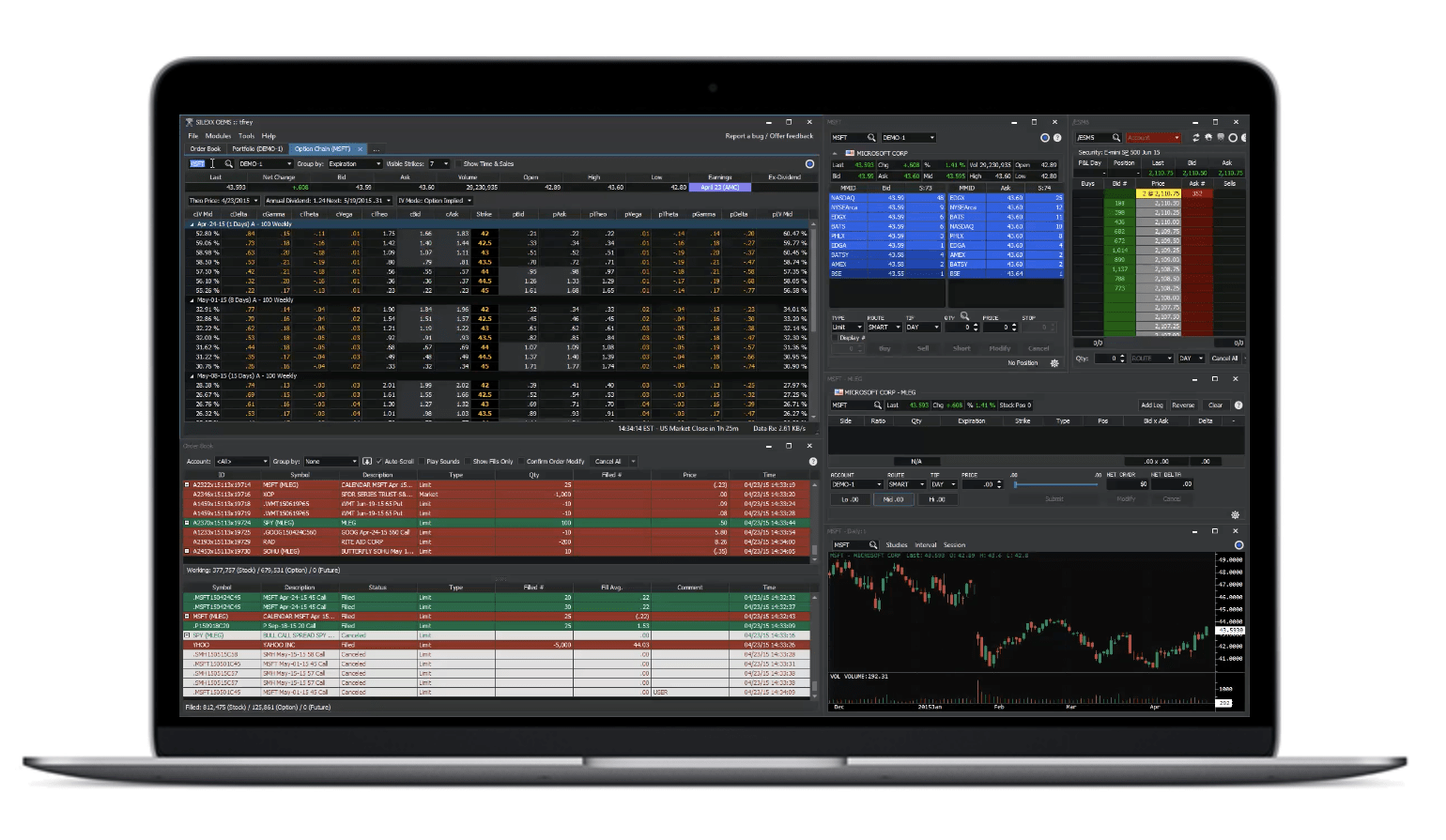

CBOE SILEXX, a multi -order execution management system (OEM) that serves the professional market, has revealed a set of improvements in the context of version 25.13.

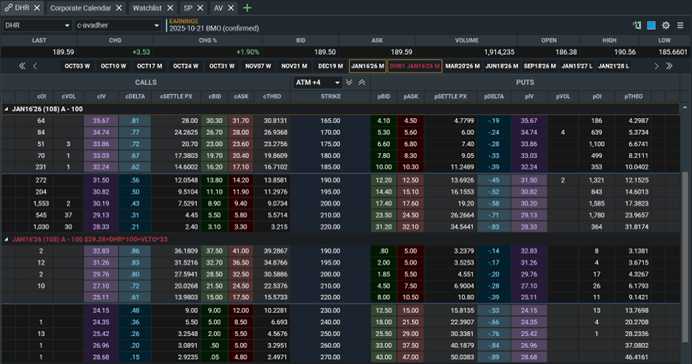

- Chain of Selection Calculations now represent non -standard settlement options

Calculations in the selection chain are now precisely reflecting the non -standard settlement options in determining the ITM and OTM status. This improvement ensures that users receive accurate information for all types of options on the platform.

There are some corrections. The underlying section in the selection chain that appears incorrectly 0001-01-01 for profits and ex-dividend when there was no earnings date, this has been corrected and the columns will not show a price if there is no.

The ITM/OTM shading in the chain of options did not update in real time as the underlying value changed, leading to an incorrect shading compared to the underlying value. Users will now see an accurate ITM/OTM status that reflects current market prices.

The position screen did not show an expiry line if a net amount was zero, that is, it spreads. Now, shots will be presented with a net amount of zero, including relevant details such as Greeks, premium and P& L, when individual legs have non -zero quantities.