Marex Group PLC (NASDAQ: MRX), a differentiated platform for global financial services, today provided a preliminary Q3 2025 update.

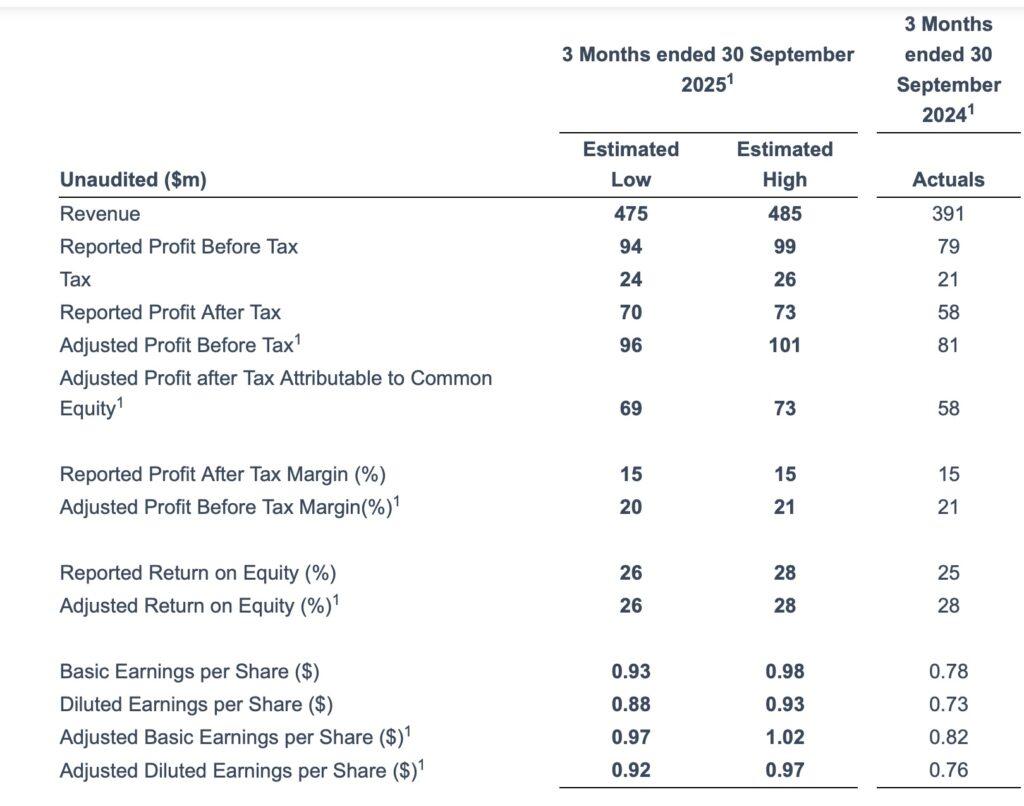

Based on the preliminary unsubstantiated financial information, Marex expects that the revenue for the quarter will range from $ 475 million to $ 485 million (+23% annual) and a customized profit prior to the corrugated tax from $ 96 million to $ 101 million (+22%).

The customized return on equity is approximately 27% with customized profit before the tax margin of about 21%.

Marex expects to report full Q3 results on Thursday, November 6, 2025.

Ian Lowitt, Managing Director of the team, said:

“After the recent move at our stock price, we wanted to address investors ‘questions about our third quarter, customers’ balance and the impact of exchanging volumes on our business. I am pleased to mention another strong quarter in which we maintained.

After a powerful first half, where revenue increased by 23% and the custom profit before tax 1 increased by 27%, both revenue and customized earnings before tax1 in the third quarter is over 20% on an annual basis. This growth was achieved in a more difficult functional environment, as the volumes of exchanges in CME and Ice decreased more than 15% on average in Q3 compared to Q2. This quarter reflects the power and durability of the franchise we have built – the one designed to grow and perform in a series of market environments.

Customer Customer Balance has increased every quarter of Q1 2024 every quarter and increase by 4% this quarter to $ 13.3 billion (Q2 2025: 12.8 billion dollars), as we continue to add new customers. This dynamic with customers continued in October, when we recently hit a record of more than $ 10 billion in US customer assets, as reported by the Futures Futures (CFTC) Committee. We remain very excited about our prospects for the rest of the year and beyond. ”