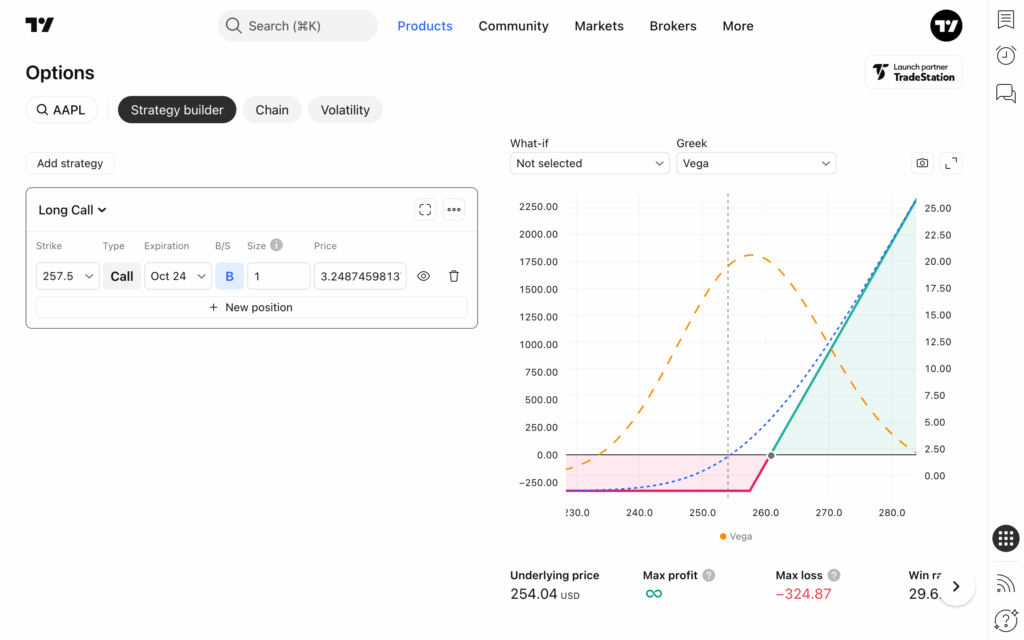

TradingView’s strategy builder allows traders to model the scenarios that have been adapted-if they can see how their strategy behaves under different market conditions before it really happens.

What scenarios were applied to the first edition of the strategy, but there were only a few static scenarios that users could not change. Starting with recent updates, the strategy builder allows you to create custom scenarios and place them in the selection diagram, in addition to the default lines.

The default strategy diagram displays the payment line, the T+0 P & L bar and a selected Greek line. All of these lines are calculated on the basis of current market conditions, including the current point over time and the current prices of tacit volatility.

The operation of the scenario that allows users to calculate charts with modified market conditions. One could either choose a different time (tomorrow or a week later, etc.) or a tacit change of variability level or both.

Scenario controls are above the diagram. By default, the drop -down menu contains three predetermined scenarios: time +5 days, IV +10% and IV -10%.

If you click on a checkbox left in any of them, the corresponding line will appear in the diagram.

But the goal of predetermined scenarios is to point out the opportunity for users. The real power of the scripts is the ability to create your own custom scenarios, save them and apply them whenever needed. To create a custom scenario, click the add-op … Menu item on a drop-down list.

In OpenED Add What-IF Dialog, you can set parameters of a custom scenario:

- Time shift. In days. It could be either positive (+1 is tomorrow, +2 is the day after tomorrow, etc.) or negative (-1 is yesterday, etc.)

- Iv shift. In percentage. Could also be either positive or negative.

- Line style. Dot, dash or compact line. The color will be automatically selected depending on how many scenarios you have chosen to add to a graph.

Once you click the Add and Close the dialog button, a new scenario is created and added to the diagram. The appearance name of a scenario will be created automatically, based on the parameters.

Viewing many scenarios

Suppose someone holds a long OTM call (almost ATM) in AAPL for about 3 months until the end. A bad scenario for this position is when the price does not go up and the call option expires from the money.

But this is not the only danger. Even if the stock market markets sideways near the strike, the choice may still lose value due to the theta or the fall of implicit volatility (IV). Both results eat away in the premium, leaving the dealer with losses, even if the price did not move against them.

This is where many scenarios that are in touch. You can draw not only a “non -change price” scenario, but also add lines for “Time Passes by One Month” and “IV Falls by 10%” to see how these factors interact. With the layer of many scripts in the same chart, you have a much clearer picture of what really threatens your position and how durable they are under different market conditions.

To place many scenarios in a graph, just select them in the drop -down list.