Online trading company Swissquote has introduced the Market Monopoly Index targeting trading opportunities in monopoly and oligopoly markets.

Monopoly and oligopoly market structures occur when a single dominant firm or a small group of powerful firms control the market. Competition is extremely limited due to high barriers to entry, economies of scale and regulatory restrictions.

A great example of this is the aviation sector – some nations have one airline, others have a small number that seem to align their pricing power whenever they want. In Switzerland, you can fly with SWISS, Edelweiss, Helvetic Airways and EasyJet Switzerland, while in Greenland, you’ll bow to the country’s only carrier – the not-so-imaginatively named Air Greenland.

Monopolies and oligopolies matter because their market dominance allows them to control prices and distribution and enables them to shape consumer behavior and influence industry dynamics.

Companies that operate in these environments have business models that are built to endure and adapt as they go about their daily lives – that is, they dominate global industries with scale and pricing power.

Operating in markets where there is limited competition provides room for stable and predictable revenues, healthy margins and resilience to different economic cycles, which means greater profitability in recoveries.

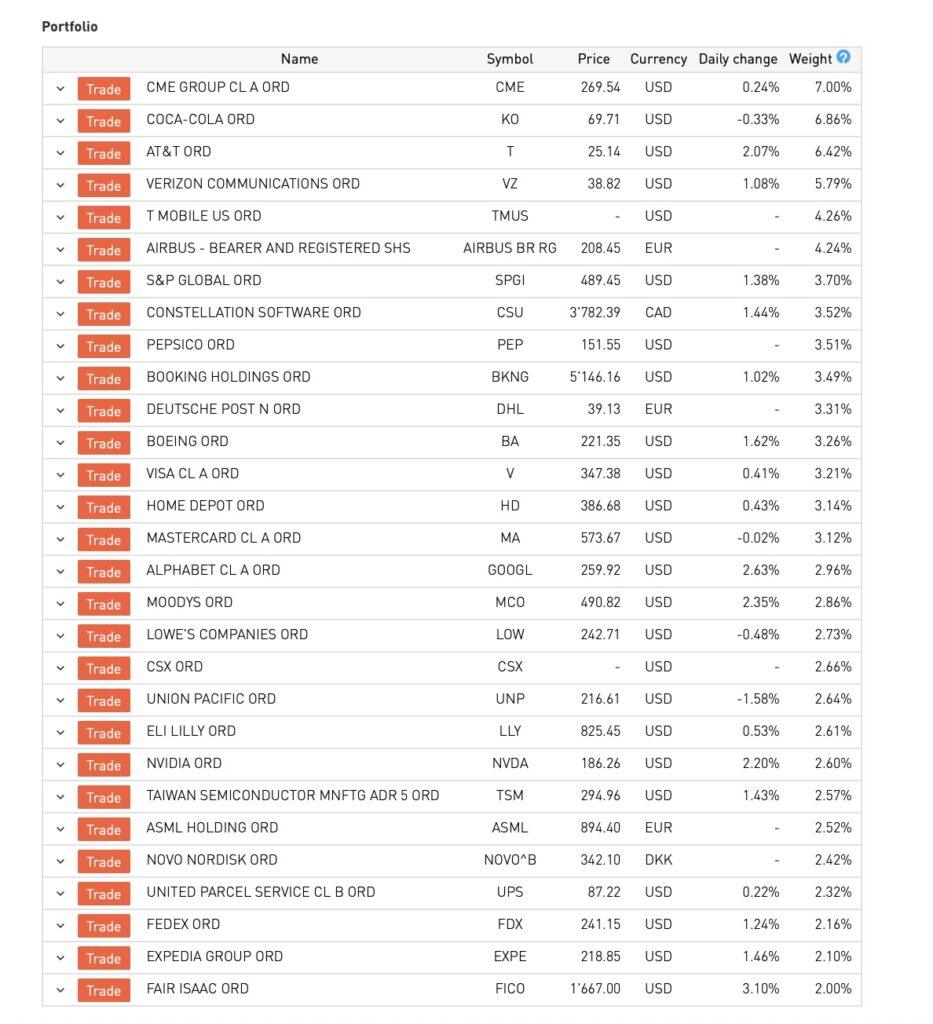

Swissquote’s Market Monopoly Index selects industry leaders that operate in monopolistic conditions or as part of a fiercely competitive group and leverages the structural advantages of these concentrated industries. The goal of this theme is to deliver long-term value through companies that have the ability to control the rules of the game.