Tradeweb Markets Inc. (NASDAQ:TW), a global operator of online markets for interest rates, credit, equities and money markets, today announced financial results for the quarter ended September 30, 2025.

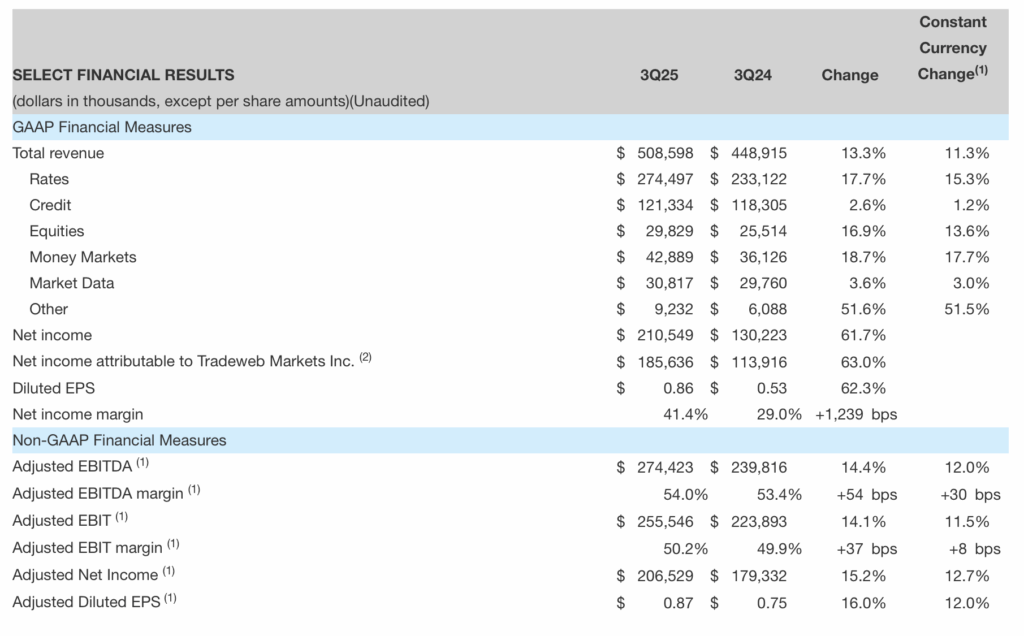

Tradeweb reported revenue of $508.6 million for the third quarter of 2025, an increase of 13.3% (11.3% on a constant currency basis) compared to the prior-year period.

International revenue was $211.2 million in the third quarter of 2025, an increase of 24.8% (19.7% on a constant current basis) compared to the prior year period.

Average daily volume (“ADV”) for the quarter was $2.6 trillion, an increase of 11.8% compared to the prior-year period.

Net income for the third quarter of 2025 was $210.5 million, an increase of 61.7% over the prior-year period.

Diluted earnings per share (“Diluted EPS”) were $0.86 for the quarter.

The Board of Directors declared a quarterly dividend of $0.12 per share of Class A common stock and Class B common stock. The dividend will be paid on December 15, 2025 to shareholders since December 1, 2025.

Billy Hult, CEO of Tradeweb, commented:

“We delivered a strong third quarter with record trading volume and ADV, driven by broad-based growth in rates, equities and money markets. Despite historically low interest rate volatility and continued geopolitical uncertainty, we continued to execute on opportunities that allowed us to drive significant changes in our markets – and this commitment was reflected in our consistent momentum and volume.”

This quarter was also defined by a number of market milestones in both our legacy and emerging businesses – including the successful execution of the first fully electronic multi-asset portfolio list bilateral trade and the first fully automated European sovereign bond RFQ trading. We advanced the goal of creating more interconnected markets and 24/7 liquidity by partnering with the Canton Network to offer the first real-time, fully on-chain financing of US Treasuries against USDC. Additionally, along with other investors, we led Fnality’s Series C funding round, supporting the development of a global next-generation settlement network.

These initiatives highlight the central role we play in the evolution of global markets – and our commitment to working closely with clients to build a more transparent global fixed income market. As we look to 2026, we will remain focused on leading initiatives that drive innovation and drive intentional change.”