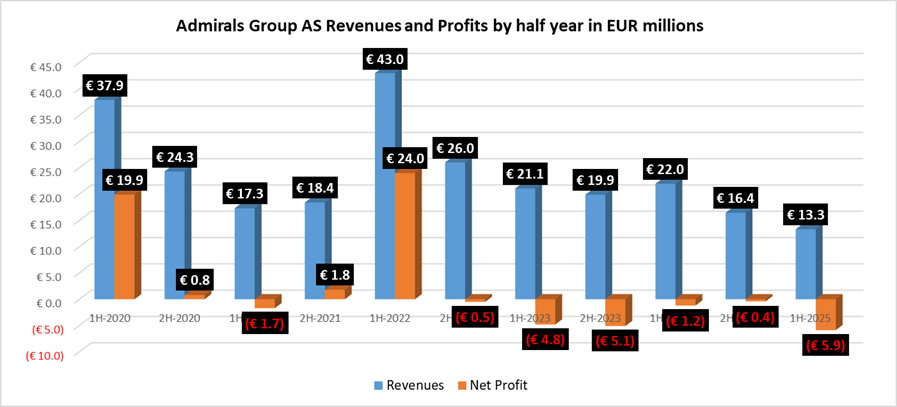

Things seem to have gone from evil to worse in Estonia based on FX retail trade and CFDS Broker Admirals Group As.

Following the posting of the long -standing multi -year in the second half of 2024, although they operated near Breakeven, the Admirals saw an additional 19% reduction in revenue to just $ 13.3 million ($ 15.5 million) in the first half of 2025.

On the bottom, the Admirals published a net loss of € 5.9 million ($ 6.9 million) at H1 2025, the worst result since we started watching data for the company in 2020.

In a brief statement, the Admirals described the first half of 2025 as a period “characterized by a lower customer commercial activity in the Group’s basic markets”, saying that the company proved its “commitment to operational discipline and strategy”.

In 2024, the Admirals voluntarily suspended the boarding of new European customers for Admirals Europe Ltd, in alignment with recommendations by the CYSEC regulator in Cyprus. Following the application of all the required measures, the Admirals reiterated boarding the customer in the EU in March 2025, redefining with a basic market. The Admirals reported that the efforts to acquire users were intensified in the second quarter of 2025.

The Group Admials AS H1 2025 Following and Balance Sheet status follows below.

Financial status

| (in thousands of euros) | 30.06.2025 | 31.12.2024 |

| Real estate | ||

| Cash and cash equivalents | 41,906 | 41,607 |

| Owed by investment companies | 16.935 | 18.736 |

| Financial assets in fair value through profit or loss | 910 | 1.228 |

| Loans and claims | 4,320 | 8,315 |

| Stocks | 259 | 665 |

| Other assets | 2.099 | 2.092 |

| Tangible fixed assets | 1.449 | 1.359 |

| Assets | 2.077 | 2.541 |

| Intangible assets | 2.651 | 3.304 |

| Total assets | 72,606 | 79,847 |

| Liabilities | ||

| Financial obligations to fair value through profit or loss | 328 | 334 |

| Obligations and tanks | 3.206 | 3.326 |

| Deferred tax liability | 0 | 0 |

| Securities | 4.104 | 4.103 |

| Lease obligations | 2.351 | 2.818 |

| Total obligations | 9.989 | 10.581 |

| Justice | ||

| Share capital | 250 | 250 |

| Shares | -956 | -456 |

| Reserve capital | 25 | 25 |

| Translation reserve | -756 | 30 |

| Retained earnings | 64.054 | 69,417 |

| Total share rights due to parent owners | 62,617 | 69,266 |

| Uncontrolled interest | 0 | 0 |

| Total shareholder | 62,617 | 69,266 |

| Total obligations and shares | 72,606 | 79,847 |

Integrated Income Statement

| (in thousands of euros) | 30.06.2025 | 30.06.2024 |

| Net profit from the negotiation of financial assets in fair value through profit or loss with customers and liquidity providers | 14,125 | 23.003 |

| Stock Exchange Revenue and Supply | 593 | 785 |

| Stock markets and supply payroll expenses | -1,365 | -1,793 |

| Other income related to commercial activities | 159 | 290 |

| Other expenses related to activity | -195 | -324 |

| Net revenue from negotiation | 13.317 | 21,961 |

| Other income similar to interest | 0 | 37 |

| Incident revenue was calculated using the effective interest method | 827 | 467 |

| Interest expense | -233 | -234 |

| Other income | 195 | 261 |

| Other expenses | -384 | -264 |

| Net Damage to Changes in exchange rate | -1,257 | -488 |

| Profit / (loss) from financial assets to fair value through profit or loss | 0 | -145 |

| Staff expenses | -6,147 | -7,064 |

| Operating costs | -10,716 | -13,864 |

| Depreciation of tangible and intangible assets | -1,074 | -1,406 |

| Depreciation of the property of the right of use | -380 | -392 |

| (Loss) before income tax | -5,852 | -1,131 |

| Income tax | -12 | -21 |

| (Loss) for the reference period | -5,864 | -1,152 |

| Other total income / (loss): | ||

| Items that can then be rebuilt in profits or losses: | ||

| Currency Translation Adaptation | -786 | 470 |

| Total other total income / (loss) for the reference period | -786 | 470 |

| Overall integrated (loss) / income for reference period | -6,650 | -682 |

| Net (damage) due to parent owners | -5,863 | -1,170 |

| Net profit attributed to non -control interest | 0 | 19 |

| (Loss) for the reference period | -5,863 | -1,151 |

| Total integrated (loss) due to parent owners | -5,863 | -700 |

| Total Integrated Income attributed to non -control of interest | 0 | 19 |

| Total integrated (loss) for the reference period | -5,863 | -681 |

| Basic and diluted earnings per share | -2.38 | -0.47 |