In 2023 the Australian Financial Complaints Authority received 102,790 complaints from consumers and small businesses who were unable to resolve disputes directly with their finance companies. That was a 23 percent jump from 2022, according to the preliminary data snapshot.

Australia’s financial dispute resolution system has for the first time recorded 100,000 complaints in a calendar year.

“The volume of complaints escalated to AFCA is growing at an unsustainable rate,” said David Locke, AFCA’s Chief Ombudsman and CEO.

“Complaints related to AFCA fraud have almost doubled between 2022 and 2023. We are still very concerned. We are also seeing the impact of rising interest rates and pressures on the cost of living, with complaints relating to financial hardship also significantly higher,” said Mr Locke.

Consumers secured $304 million in compensation and refunds after coming under AFCA, which was up 38 percent from the previous year.

Consumers secured $304 million in compensation and refunds after coming under AFCA, which was up 38 percent from the previous year.

AFCA recorded 8,987 fraud complaints, up 95 percent from 4,611 in 2022. Financial hardship complaints totaled 5,396, up 29 percent from 2022.

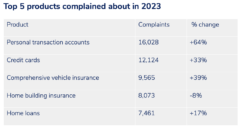

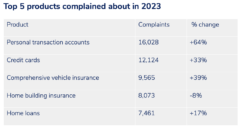

Complaints also increased about other financial products covered by the AFCA, which include banking and finance, insurance, investment and advice, and superannuation.

“We should also see a downward trend in complaints overall, with financial firms working better to support their customers and deal with complaints quickly and efficiently internally. We believe that many financial firms could do a better job of handling complaints within their internal complaints processes, so only the most complex cases reach AFCA – which is the role we need to play,” Mr Locke said. “Instead, the volume of complaints reaching us puts unnecessary strain on the external dispute resolution system and inevitably causes further delays for consumers.”

AFCA was set up after the 2017 Ramsay Review recommended a single system for handling disputes previously handled by the Financial Ombudsman Service, the Credit and Investment Ombudsman and the Superannuation Complaints Tribunal. It started operating on November 1, 2018.

Since its inception, AFCA has received more than 420,000 complaints, helping secure $1.3 billion in compensation or refunds to consumers. Additionally, AFCA’s systemic issues work – where it identifies broader issues than a single complaint – has resulted in 4.9 million people receiving more than $380 million.