Israeli Business News Website Cosmetic It says Retail FX and CFDS Broker Avatrade have issued an Israeli capital market request to approve a change in the company in the company, which will see one of the two founders of Avatrade and the exit of Avatrade shareholders and Enter Antersenters Avatrade and a new investor team.

Owned avatrade

Avatrade was founded in 2006 (originally known as AVAFX) by Emanuel Kronitz and Negev Nosatski, who have 35% interest in the company. The proposed transaction will see Israeli businessman Zvika Barinboim (and other investors in his team) to get a 50% share in Avatrade, buying Kronitz’s interest in the company, as well as the shares of other minority shareholders, including the long -term CEO of Avatrade Shuki. Shuki Abramovich joined the company in 2009 after led an investment to Avatrade by his former employer, Clal Insurance. (Clal was later acquired by Kronitz and Nosatski).

Negev Nosatski will remain (and possibly slightly increase his entries) to Avatrade as part of the transaction.

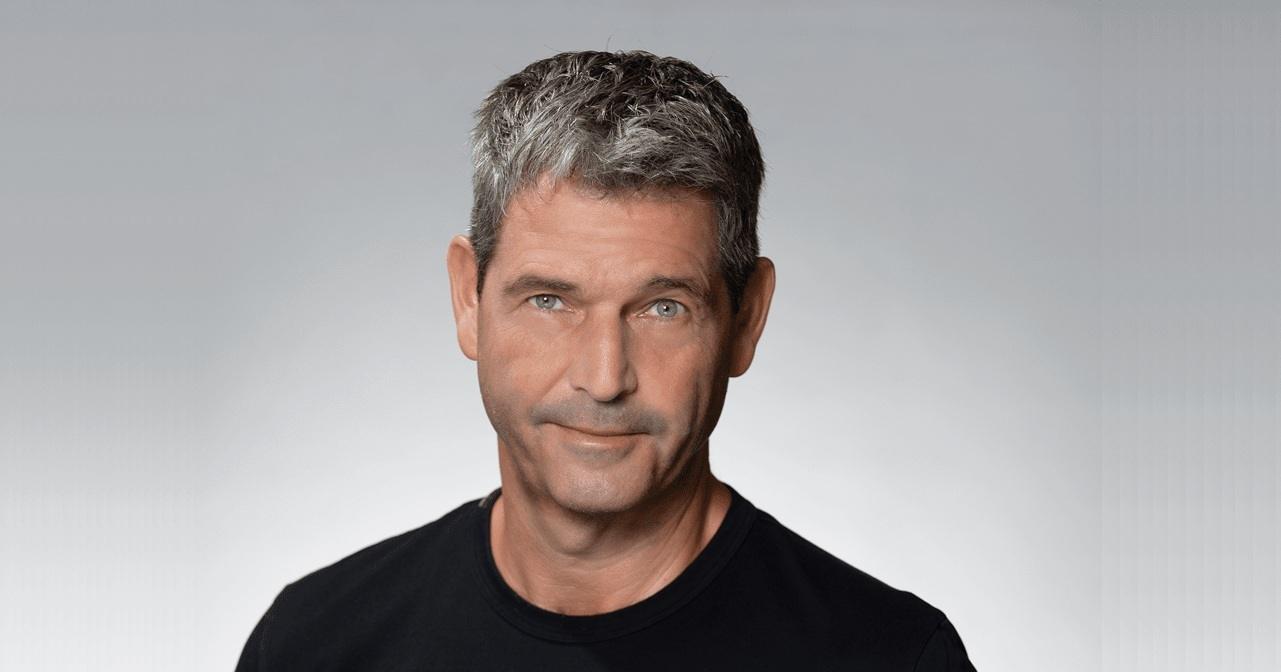

And Barinboom Bear

Zvika Barinboim (depicted above), which has a variety of technological and real estate, tried to enter the “FX” business in 2021, trying to obtain B2B Provider Finalto and CFDS Broker Markets.com from Tech Tech Playtech. However, this transaction was rejected by Playtech shareholders and Finalto and Markets.com were later sold by Playtech to investment investment in Hong Kong.

We noted that at about the same time in 2021, Avatrade reported that she was seeing an IPO in London, valued at the range of $ 1 billion, but this transaction never went down the ground.

According to CosmeticThe proposed transaction with the Barinboim Avatrade Group team in the $ 400-500 million area. In addition to the acquisition of Emanuel Kronitz and some other minority shareholders, the Zvika Barinboim Group will introduce new funds to the company as part of the agreement.

FX and CFD M & A Transactions

The sale of Avatrade marks the third major sale of a retail FX and CFDS broker this year. In March 2025, SAXO Bank-based control was purchased by the SAFRA Group in valuation of $ 1.74 billion and Oanda was acquired by Prop Trading FTMO in February for an uncovered amount (but probably in the middle of the low range). Last month Israel in Israel Etoro was publicly made in Nasdaq with more than $ 4 billion valuation.

About Avatrade

Avatrade has mainly managed Israel since its founding, with offices at the Israeli high -tech Center of Herzliya. The company is officially its home in Ireland and has been licensed from the Central Bank of Ireland, with subsidiaries who have been licensed in Israel (exploiting the trademark “Atrade”), Australia, South Africa, Cyprus, Japan and the UAE. Avatrade has 20 branches and employs 450 people worldwide. The estimates are that Avatrade makes about $ 60 billion in monthly transactions, with an annual EBITDA in the range of $ 90 million.