Bank of America Corp (NYSE: BAC) has just released its financial report for the third quarter of 2025.

World market revenue of $ 6.2 billion increased by 11% from the quarter of the year, leading to higher sales and negotiation and investment revenue.

The department published a net income of $ 1.6 billion.

Global sales and market -in revenue increased by 9% to $ 5.4 billion, including net debit valuation adjustment (DVA) of $ 14 million. Excluding net DVA, the result increased by 8%.

Fixed income, coins and basic products (FICC) revenue was 5% higher than last year, $ 3.1 billion, including a net DVA.

Shares revenue increased by 14% to $ 2.3 billion, including the exemption of net DVA.

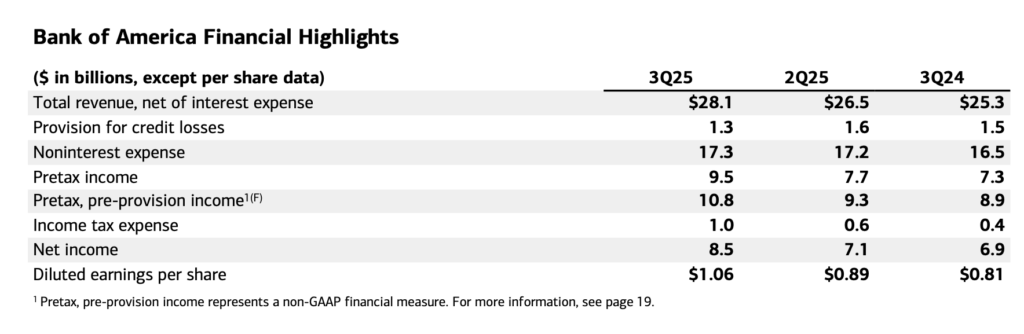

In all departments, net income reached $ 8.5 billion compared to $ 6.9 billion in the quarter of the year.

Diluting profits per share were $ 1.06 compared to $ 0.81, up 31% on an annual basis.

Revenue, interest costs of $ 28.1 billion ($ 28.2 billion FTE) increased by 11%, reflecting the highest income from net interest (NII), investment banking and asset management fees and sales revenue.

President and CEO Brian Moynihan commented:

“The strong increase in net income led to the third quarter of diluted profits per share increased by 31% from last year.

The strong increase in loan and deposit, coupled with the effective placement of the balance sheet, resulted in revenue from net interest. We also saw strong performance from businesses facing the market. As revenue increased at a much faster interest rate than costs, we drove good operating leverage and performance index of less than 62%.

With continuing organic development, each business line reported improvements of top and threshold lines. Thanks to our teammates for a strong quarter. “