Bank of America today announced its financial results for the first quarter of 2024.

The global markets segment posted net income of $1.7 billion. Excluding net DVA, net income was $1.8 billion in the first three months of 2024.

Global Market revenue for the first quarter of 2024 was $5.9 billion, up 5% from the prior quarter, driven by higher investment banking fees and sales and trading income.

Non-interest expense of $3.5 billion was up 4%, driven by investments in the business, including technology.

Sales and trading revenue of $5.1 billion rose less than 1%. excluding net DVA.

Fixed income, currencies and commodities (FICC) revenues fell 6% to $3.2 billion due to a weaker macro trading environment, partially offset by improved mortgage trading. Equity revenue rose 14% to $1.9 billion, driven by a strong performance in derivatives trading.

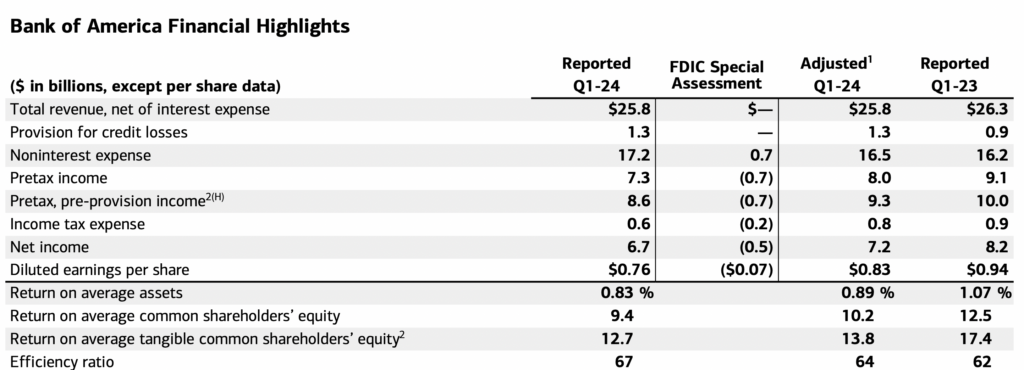

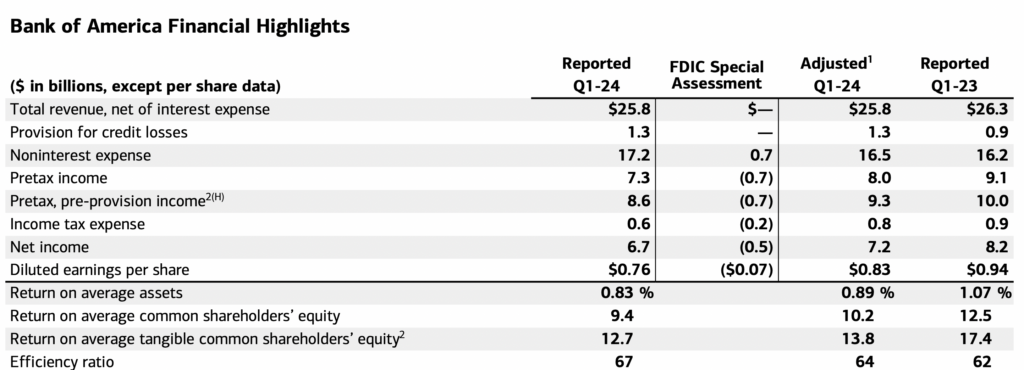

Across the board, Bank of America reported net income of $6.7 billion, or $0.76 per diluted share, compared with $8.2 billion, or $0.94 per diluted share, in 1Q23.

Adjusted net income for the period was $7.2 billion (excluding the FDIC special assessment).

Net interest income of $25.8 billion was down $440 million, or 2%, including higher investment banking and asset management fees, as well as sales and trading income and lower net interest income (NII). .

NII fell 3% to $14.0 billion ($14.2 billion FTE), as higher deposit costs more than offset higher asset yields and modest loan growth.

President and CEO Brian Moynihan commented:

“We reported a strong quarter as our businesses performed well, adding customers and deepening relationships. We reached 36.9 million consumer checking accounts, with 21 consecutive quarters of net checking account growth. Our Wealth Management team generated record revenues, with record client balances and investment banking recovery. Bank of America’s sales and trading businesses continued their strong momentum in 2023 this quarter, posting their best first quarter in over a decade. Continued strong earnings management and strong cost management position our company to continue to hold market leadership positions across all of our businesses.”