Bank of America Corp (NYSE:BAC) has just published its financial report for the third quarter of 2024.

The global markets division posted a net profit of $1.5 billion, up from the previous quarter and the prior quarter.

Global Marketplace revenue was $5.6 billion, up 14% from the year-ago quarter, driven by higher sales and trading revenue and investment banking fees.

Sales and trading revenue of $4.9 billion was up 12% (including net DVA).

FICC revenues increased 8% (including net DVA) to $2.9 billion, driven primarily by improved client activity and trading performance in currencies and fixed income products. Equity revenues increased 18% (including e.g. net DVA) to $2.0 billion, driven by strong client activity and the performance of cash and derivatives trading.

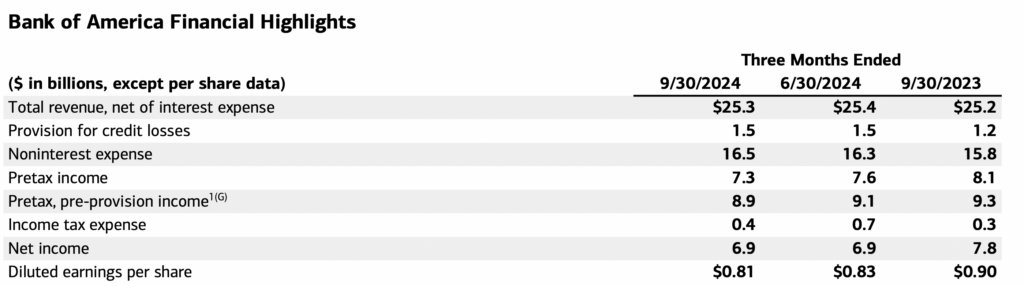

Across the board, Bank of America reported net income of $6.9 billion, or $0.81 per diluted share, compared with $7.8 billion, or $0.90 per diluted share, in 3Q13.

Net interest income was $25.3 billion ($25.5 billion FTE), up $178 million, reflecting higher asset management and investment banking fees, as well as sales and trading income and lower net interest income.

President and CEO Brian Moynihan commented:

“We reported solid earnings results, delivering higher average loans and a fifth consecutive quarter of consecutive average deposit growth. Net interest income increased in the second quarter, on top of double-digit, year-over-year growth in investment banking and asset management fees, as well as sales and trading income. We also continue to benefit from our investments in the business. Thanks to our teammates for another good quarter. We continue to drive the company forward in any environment.”