Bank of America Corp (NYSE: BAC) has just released its financial report for the second quarter of 2025.

The net income from the global market section amounted to $ 1.5 billion, out of the $ 1.4 billion outcome in the quarter of the year.

Proceeds from the world markets was $ 6.0 billion, 10% higher than a year ago, they are mainly driven by higher sales and trading revenue.

Revenue from sales and trading of $ 5.3 billion increased by $ 14% (excluding net DVA, up 15%). FICC revenue increased by 16% (excluding net DVA, increased by 19%) to $ 3.2 billion, leading to strong macroeconomic performance. Revenue of $ 2.1 billion shares increased by 10% (including décor DVA), on the rear of improved trade performance and increased customer activity.

In all departments, net income amounted to $ 7.1 billion or $ 0.89 per diluted share, compared to $ 6.9 billion or $ 0.83 per diluted share.

Revenue, interest costs of $ 26.5 billion ($ 26.6 billion FTE) increased by 4%, reflecting the highest revenue from net interest (NII), sales revenue and revenue from commercial data, and low -tax management.

The provision for $ 1.6 billion in credit loss increased from $ 1.5 billion in the 2nd quarter and in the 1st quarter.

President and CEO Brian Moynihan commented:

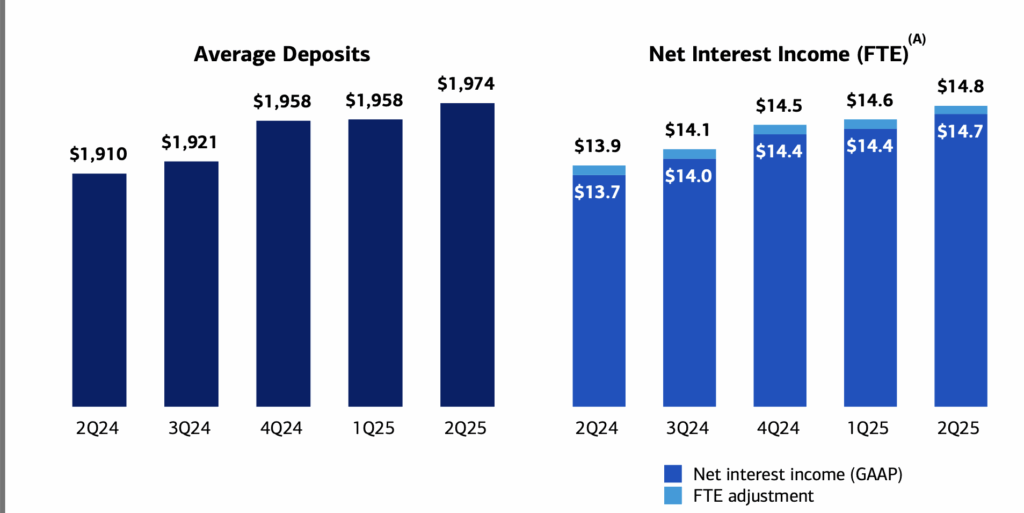

“We delivered another fixed quarter, with a seven percent profit from last year. Net interest income increased for the fourth quarter, reflecting eight consecutive quarters of deposits and seven percent on an annual basis.

Consumers remained durable, with healthy expenditure and quality of assets and the rates of commercial borrower increased. In addition, we saw good dynamics in our shopping businesses. So far this year, we have supplied more funds to our businesses and returned 40 percent more capital to shareholders in the first half of this year than last year. ”