BGC Group, Inc. (NASDAQ:BGC) today announced its financial results for the fourth quarter and full year ended December 31, 2023.

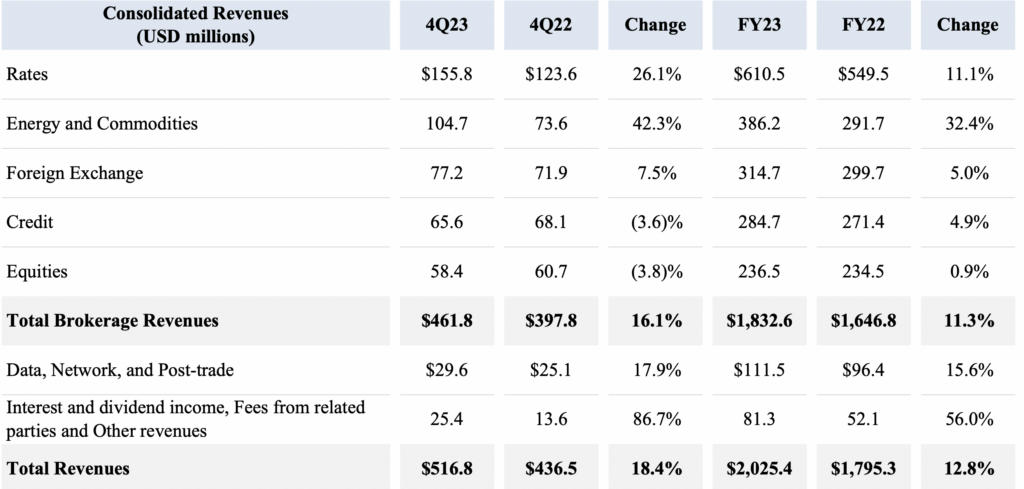

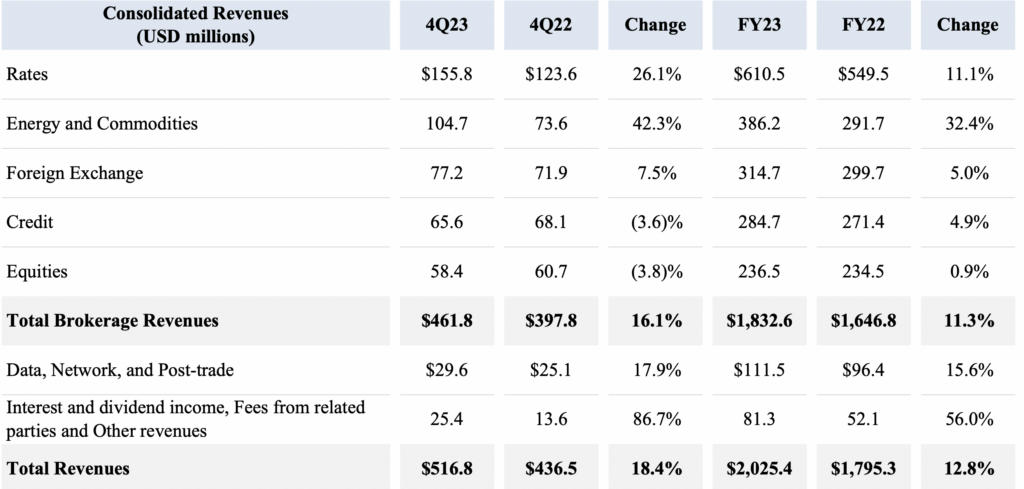

BGC’s revenue rose 18.4 percent to $516.8 million and represented its highest-ever revenue performance for the fourth quarter. This growth came from the Americas and EMEA which improved by 21.9 percent and 20.5 percent, respectively.

BGC generated strong double-digit growth across all earnings metrics during the quarter, with margins expanding across the business. Adjusted Earnings before taxes increased 27.3 percent to $110.8 million with margins improving 149 basis points to 21.4 percent, the thirteenth consecutive quarter of year-over-year margin growth. Adjusted earnings after taxes rose 29.2 percent to $101.3 million, or $0.21 per share, an improvement of 31.3 percent. Adjusted EBITDA improved 22.3% to $151.6 million for the fourth quarter.

Howard W. Lutnick, President and CEO, commented:

“BGC had its best fourth quarter, with record revenue and adjusted earnings. Our revenue improved over 18 percent, capping off a strong year where we achieved accelerated year-over-year revenue growth every quarter.

We expect favorable macro trading conditions to continue throughout 2024. With our global reach and scale, we will continue to capitalize on interest rate and energy market volatility, as well as higher fixed income issuance in both sovereign as well as corporate bonds.

We are pleased with the CFTC’s recent unanimous approval of FMX to operate an exchange for US interest rate futures, the largest and most widely traded futures contracts in the world. We plan to launch the FMX Futures Exchange in the summer of 2024 and plan to discuss our strategic partners and further details on or before our first quarter earnings call.”

On February 13, 2024, BGC’s board of directors declared a quarterly cash dividend of $0.01 per share payable on March 19, 2024 to Class A and Class B common stockholders of record on March 5, 2024. The ex-dividend date will be March 4 2024.