- The Bitcoin price broke out from the basic resistance of a flag plan, marking the continuation of the prevailing recovery.

- A multilevel demand pressure from BTC retail investors and large -scale investors could create a significant supply of supply on the market.

- The BTC price is behind the rapidly changing exponential mobile averages of 20 and 50, indicating that the short -term voltage is enhanced.

Pioneer Cryptocurrency, Bitcoin, is taking a short dive -0.46% during Friday’s market hours to market $ 116,970 today. Despite the completion of the sale, the daily wax highlights a long -tail wax, indicating an intact demand pressure on the market. This purchase pressure can be attributed to multilevel demand by retail investors and cryptographic whales, mainly overcoming the new BTC version by miners. Is the Bitcoin price ready to hit a new high in August?

Shrimp and whales are joined in an aggressive Bitcoin market

Since last weekend, the price of Bitcoin has shown a brief recovery of $ 111,919 in the current commercial value of $ 116,923, increasing 5.13%. The market pressure followed the regulatory developments in the United States as the President signed executive orders to allow encryption at 401 (k) S and to stop banking discrimination against digital assets.

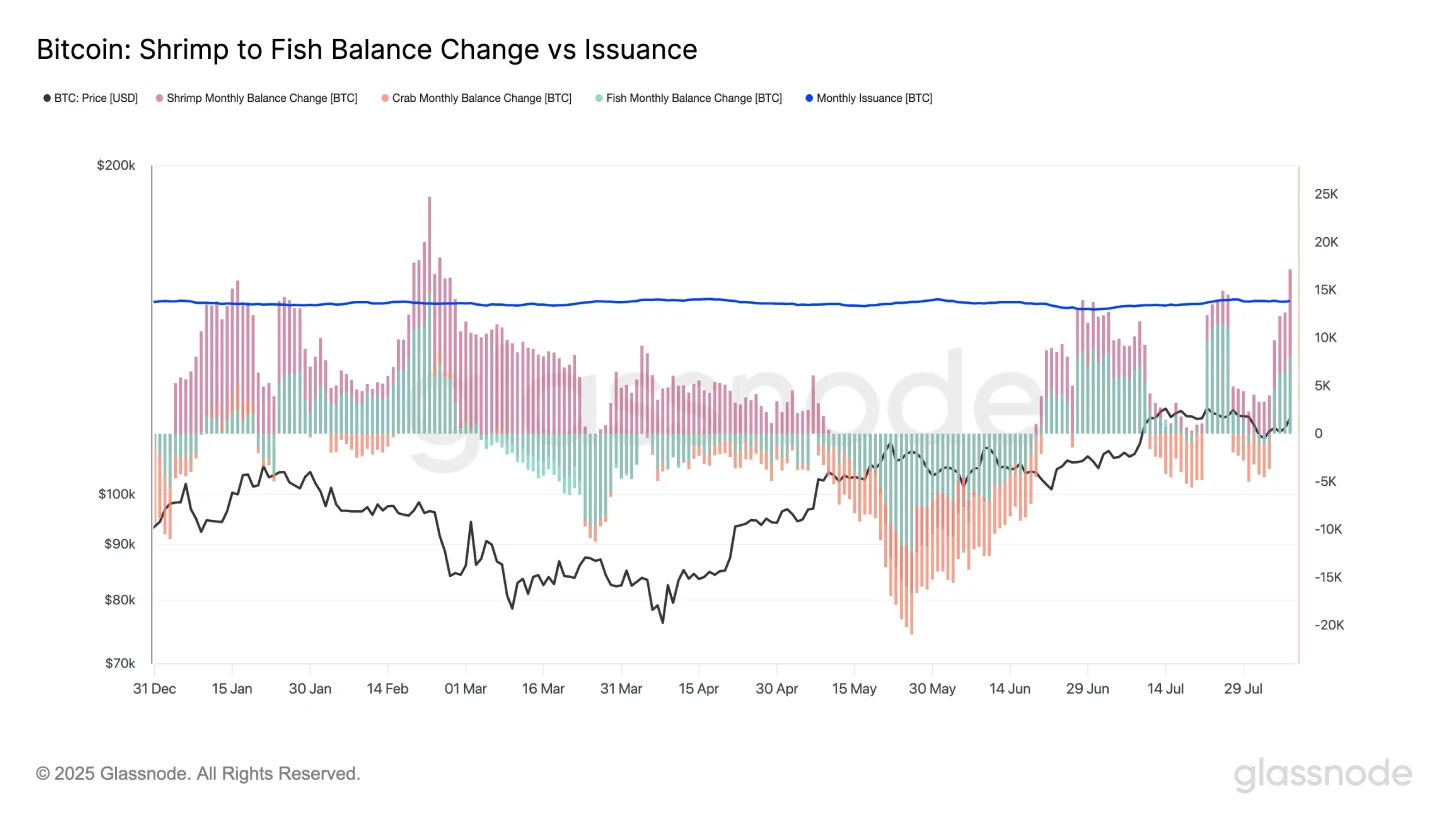

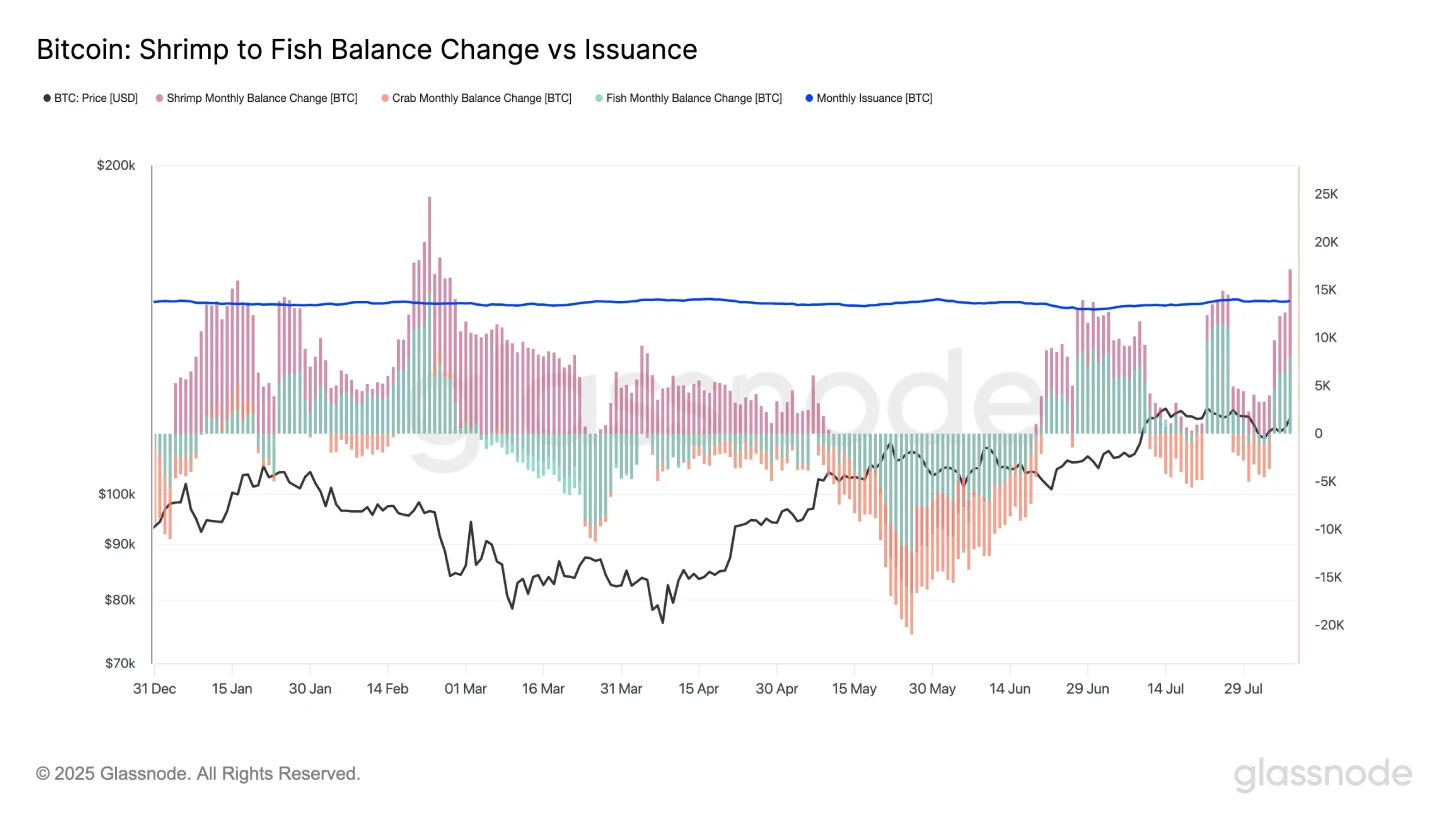

However, the price of the coin has won additional momentum, as small BTC-dubbed owners as “shrimp to fish” groups or wallets with less than 100 BTC-quiet the available offer at a pace exceeding the new version.

According to the detailed platform GlassThese retail addresses maintain a monthly balance increase of more than 17,000 BTC, which exceeds +13.85K BTC created through mining.

Specifically, shrimp (wallets with less than 1 BTC) add almost 10K BTC, underlining a persistent demand from retail investors. Despite the recent price volatility, retail condemnation remains strong and therefore the continued accumulation of these wallets could put pressure on the price over time.

By adding the note, high network investors also tighten their handle to BTC. According to the blockchain tracker LookA new -legged wallet, 175k5c, withdrew 100 BTC (worth about $ 11.71 million) from the binance exchange just an hour before the report.

While another whale, BC1QGF, received 263 BTC (worth $ 30.82 million) from Falconx to boost its current participation to $ 891.5 BTC worth $ 104 million.

This demand for multiple layers by retailers and large -scale investors could create a significant supply of supply on the market, boosting the Bitcoin price for higher rally.

BTC price teasing unblocking the Bullish flag pattern

The daily analysis of the Bitcoin price map shows that its recent correction was echoed in two downsloping trends of a bull flag plan. The diagram adjustment is usually located on an established upward course where its long pole projects its dominant upward course and a temporary removal to regain the momentum.

On August 7, the price of BTC gave a bullish unblocking of the motif resistance tendency, signaling the continuation of the dominant recovery. With today’s downtick, the price shows a post-breakout pullback in the violated trend, validating its suitability for a higher rally.

A long lower wick in Bitcoin’s daily candle highlights prolonged demand pressure, signaling strong buyer support. This momentum could supply a 5.63%rally by placing the BTC to review the high resistance of all time to $ 123,233.

If the pattern is in force, the Bitcoin value could lead to an extension of $ 137,000.

However, if the candle reviewed the flag range, the sellers could try to regain control over this asset for another correction.

Also, read: XRP is growing as Ripple and sec End Legal Battle with the dismissal of joint appeal