- BTC’s sovereignty has plunged to 59%, marking an increasing interest in alternative cryptocurrencies and possibly the onset of an “Altcoin period”.

- A brief decrease in future future fulfillment shows that the currency price could fight to lead a high -end rally to the short -term trend.

- The formation of a growing wedge pattern marks a possible correction for the price of bitcoin.

Pioneer Cryptocurrency Bitcoin shows a remarkable 2.4% increase during Wednesday’s US market hours to market $ 122,989. The broader optimistic feeling and hopes of reduction in September interest rate fuel this rally, with a currency price of just 1.5% smaller than a new high. However, the technical panel shows a strong air traffic provision of about $ 122,000 with the risk of signaling standards for a possible response. In addition, the data in the chain underlines a declining trend in the dominance of Bitcoin, which indicates capital rotation in Altcoins. Will the Bitcoin Price Rally be delayed?

BTC sovereignty is reduced to 59% in the middle of Rally Altcoin

In the last two weeks, the Bitcoin price has shown a V -shaped recovery from $ 111.987 to $ 122.989, showing an increase of 9.8%. Subsequently, the ceiling of the assets market bounced at $ 2.44 trillion. Market pressure has been improving from the notable increase in the Spot BTC ETF, increasing institutional adoption and US regulatory development, including encryption investments in retirement accounts 401 (K).

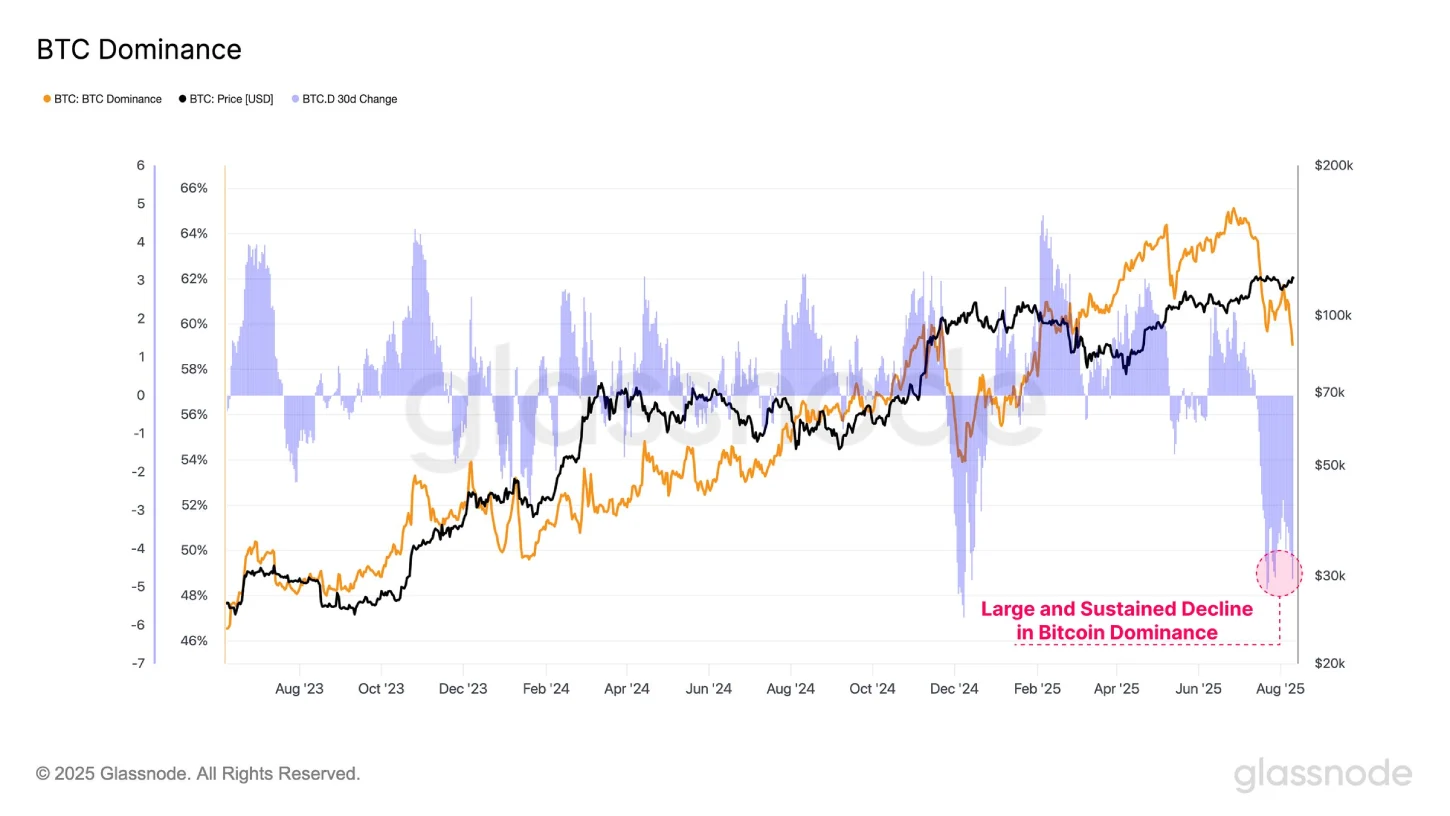

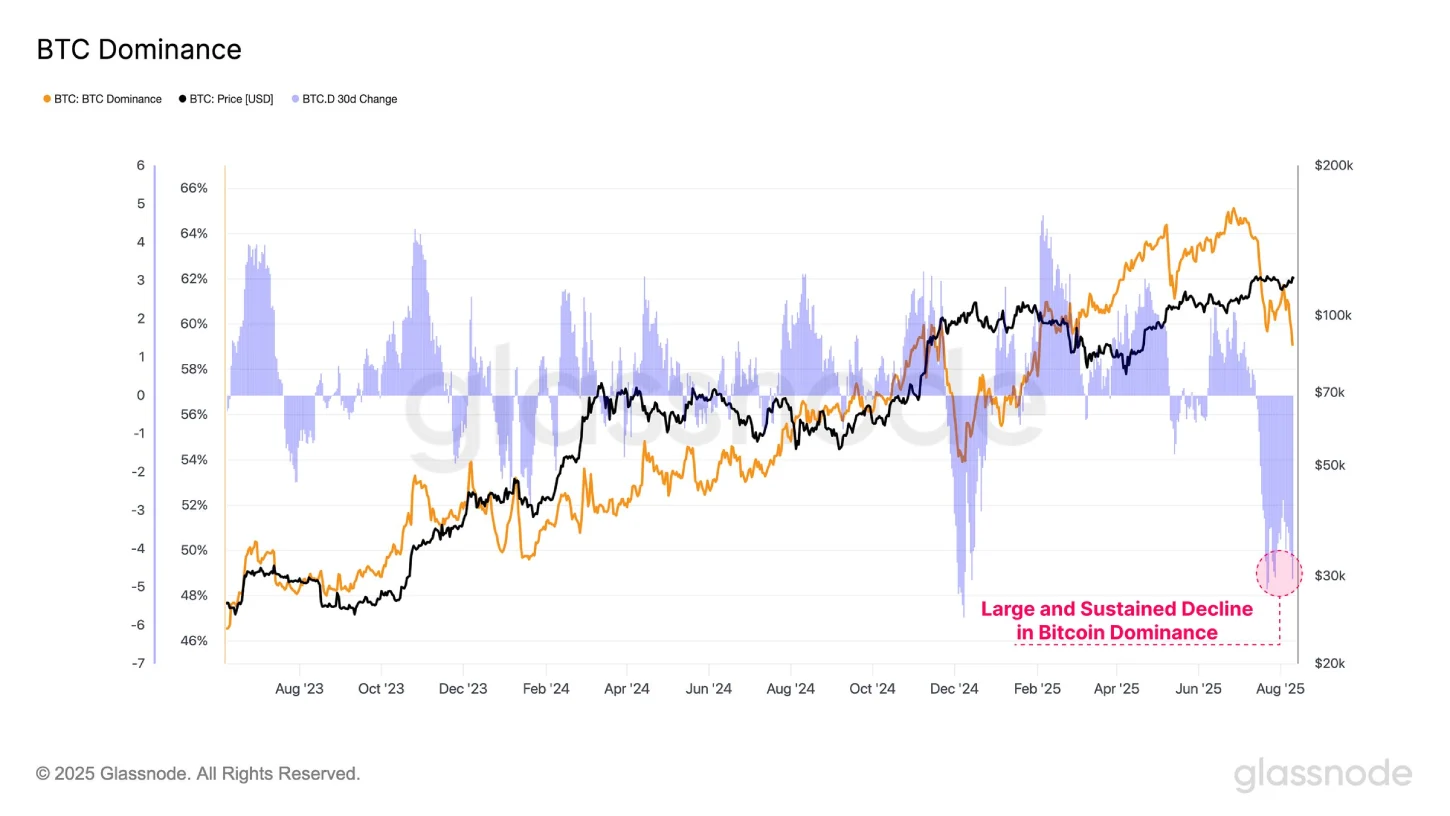

Despite the upward trend, the Altcoin market has significantly surpassed Bitcoin since last week, led by Ethereum Price Rally. According to Glassnode data, Bitcoin’s dominance has reported a significant reduction from 65% to 59% in the last two months.

This marks one of the steepest drops BTC domination This year amidst high capital rotation in alternative cryptocurrencies. Historically, a significant decline in Bitcoin dominance reinforces an era of Altcoin.

The Altcoin season is pushing to 75%, marking a broader shift in investor feeling, as market participants adopt a danger behavior to hunt higher returns.

Taking, the reduction in Bitcoin domination is less likely to cause sales pressure on its price. However, if the trend persists, BTC prices recovery could fight to gain strong dynamics and adopt behind the altcoins.

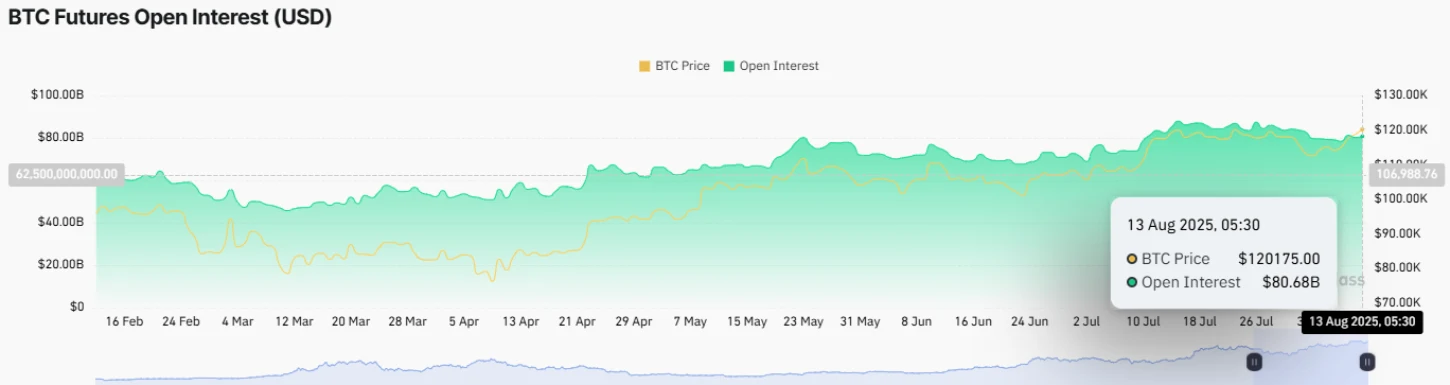

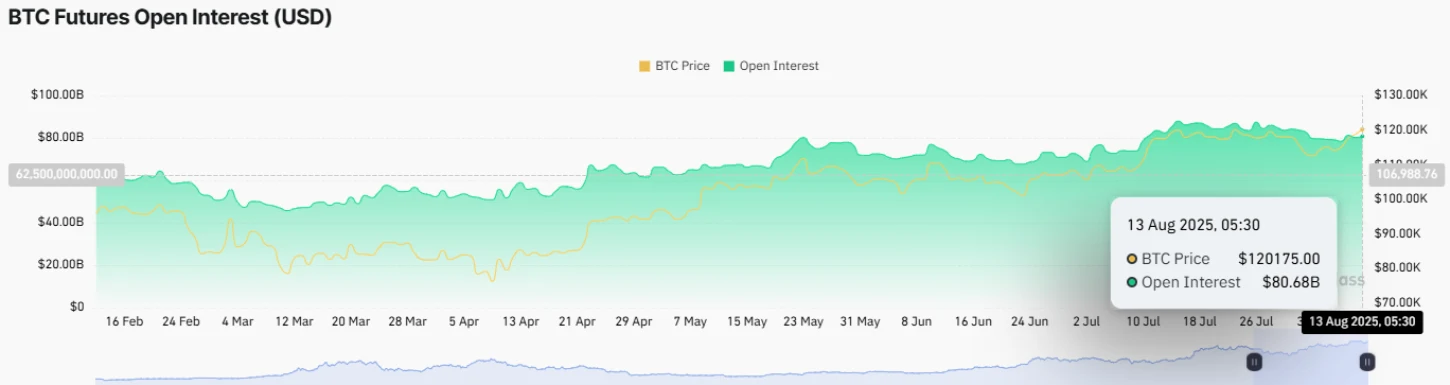

In addition, derivatives market data show a reduced interest from future traders, as the value of open interest (OI) shows a brief fall despite prices jump. According to Coinglass DataBTC’s Oi slope has fallen from $ 87.3 billion to $ 80.68 billion in the last three weeks, representing a $ 7.6%decline.

This decline shows that traders are leaving their existing positions in the future market or hesitant to enter a new trade. The lack of input from speculators could slow down the recovery momentum in the BTC.

Bitcoin price drives a firm recovery with a standard wedge

With a profit of 2.4%, the Bitcoin daily chart shows a strong green candle ready to hit the high resistance of all time. If today’s candle is closed at the current price of $ 122,989, a new high is likely to happen tomorrow, if not today.

A possible unblocking will speed up the swollen momentum and lead the coin price another 7% to hit $ 132,767. This horizontal plane today coincides closely with a traditional level of rotation (R2), the resistance of the voltage of the growing wedge motif, creating the next important supply zone to encryption buyers.

The price jump will also push the RSI momentum (relative power) to overcoming, increasing the risk of correction after the Rall. A history of this motif shows that a Bearish reversal within it has often led to prolonged correction to the lower voltage.

So far, these corrections have boosted the Bitcoin price in the refreshed momentum of recovery. However, a distribution below the bottom will accelerate the sale pressure for a prolonged drop.

Also read: Bitmine expands stock sale to 24.5 dollars for ETH purchases