- Bitcoin’s 30 -day active supply of a decline shows a slowdown in market activity to build the next major traffic.

- The Bitcoin Price leads to a brief integration trend between the horizontal levels of $ 123,236 and $ 111,999.

- BTC’s fear and greed index decreased to 60%, indicating a feeling of greed among market participants for a higher recovery.

The renewed recovery of the Bitcoin price received a brief response on Saturday, August 23, where it decreased more than 1.5% in trade to $ 115,273. However, this sales pressure supported by a weak volume indicates a lack of condemnation from sellers and higher opportunities for the continuation of the enlarged. The recent slowdown in the BTC supply movement further stresses that the market is shaping for the next major move. Will the top encryption go up for $ 130,000, or is it an important correction?

Power movement cools as Bitcoin prepares for the next big movement

Last Friday, the Bitcoin price showed a sharp recovery from $ 111.919 weekly support with almost 4% profit. A primary catalyst behind this jump was the observations of the Federal Reserve Jerome Powell in Jackson Hole, where it hints at possible interest rate cuts in the midst of shifting the financial risks.

Despite Powell’s careful tone, market optimism has reinforced the majority of large cryptocurrency for a sharp recovery. However, the recovery was needed on Saturday and the BTC sank to $ 115,273 with a 20% drop in trading volume. The lower volume during Pullback indicates reduced sales pressure, leaving room for a possible recovery if the buyer’s participation enhances.

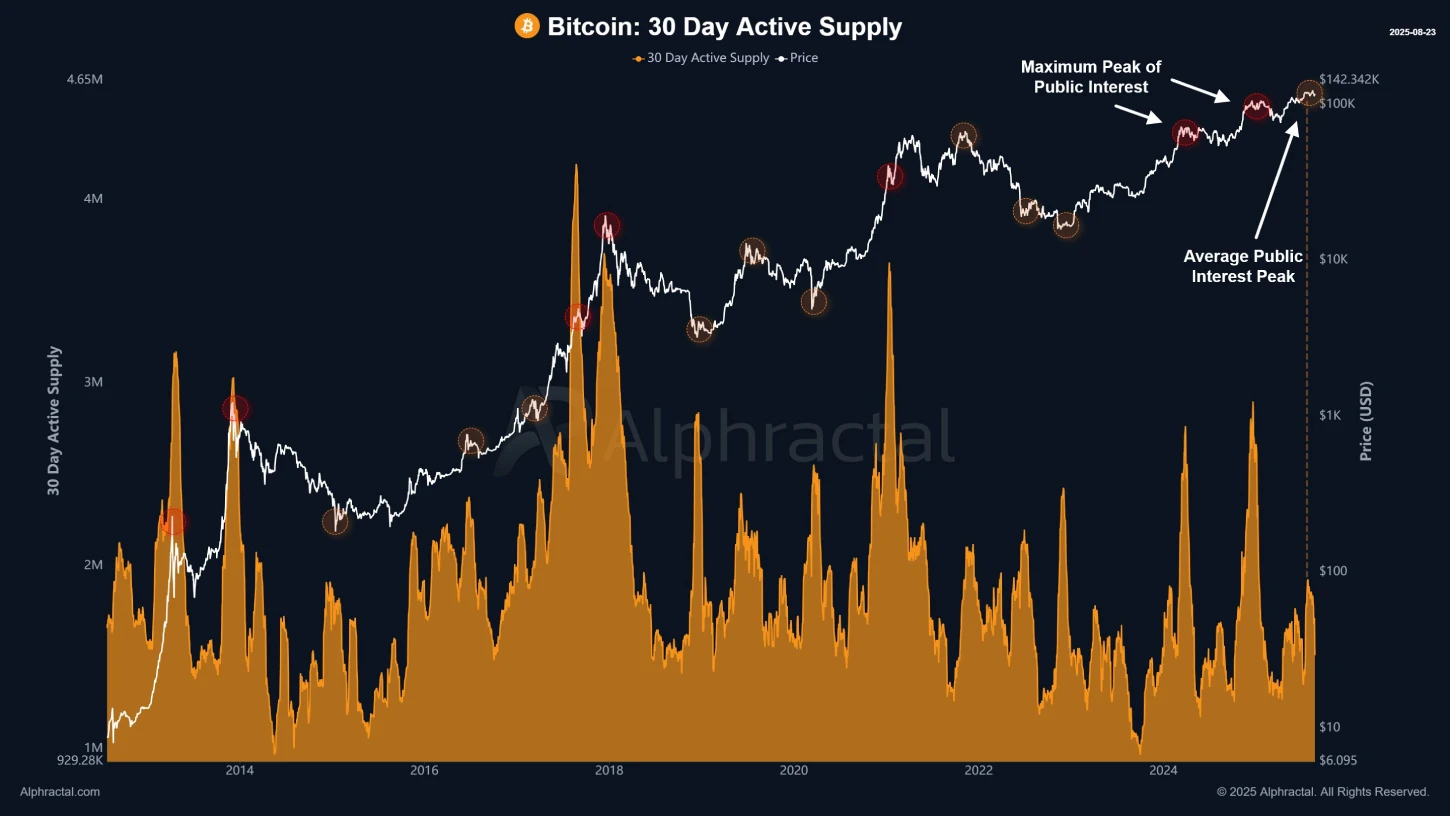

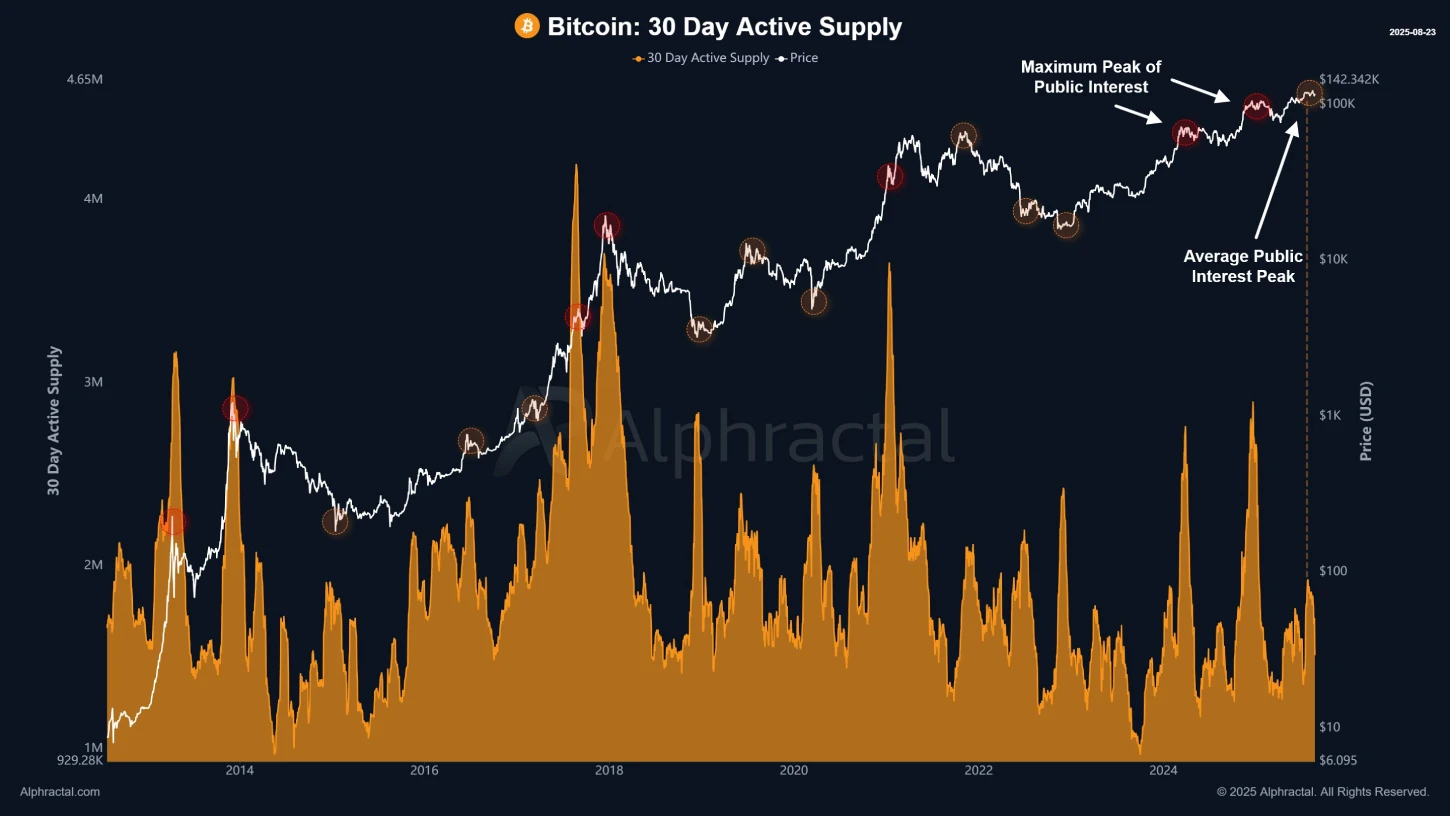

Low volume often allows buyers to make expulsive impulse for the next jump. The latest data in the chain Active 30 -day supply of Bitcoin It supports this enlarged narrative. This measurement monitors the number of unique currencies that moved last month, acting as a thermometer for market interest in the BTC.

A growing trend in this measurement indicates a new capital influx and stronger investor activity. Historically, these spikes have been aligned with market peaks and bottom, as greed or fear often leads investors to carry coins quickly.

On the other hand, a descending trend in BTC’s 30 -day active supply shows a quieter phase, with fewer coins in motion. Such a cooldown usually follows periods of extreme activity.

Currently, the Bitcoin supply movement has slowed down, indicating a clearer backdrop after a recent increase in market enthusiasm. This moderation could offer Bitcoin price a short breath to build its potential for the next big movement.

Bitcoin price enters unification after rall

The short -term Bitcoin value voltage analysis shows a lateral shift in the dominant recovery phase. In the last six weeks, the coin price was twice reversed by the strength of $ 123,236 and bounced twice by the new $ 111,999 support, indicating a tendency to integrate into action.

After the July rally, this side trend could allow buyers to recover the exhausted inflated momentum before the next unblocking. Coin prices negotiation over the daily exponential average (20, 50, 100 and 200) emphasizes the broader market feeling.

Currently, currency buyers are struggling to violate the midline resistance of this integration trend at $ 117,838. If buyers reversed this resistance to support, an accelerated inflated momentum could push the BTC value against the high resistance of all time to $ 123,236.

A possible unblocking with a daily candle closure will mark the continuation of the prevailing upward order, with the traditional level of rotation showing the next key resistor at $ 138,820.

On the contrary, if sellers force a distribution below $ 111,900 support, the currency price could enter a deeper correction to the mark of $ 105,357.

Also Read: Grays scale files for XRP ETF, increases 7% per day