Broadridge Financial Solutions, Inc. (NYSE:BR) today announced financial results for the third quarter ended March 31, 2024 of the 2024 fiscal year.

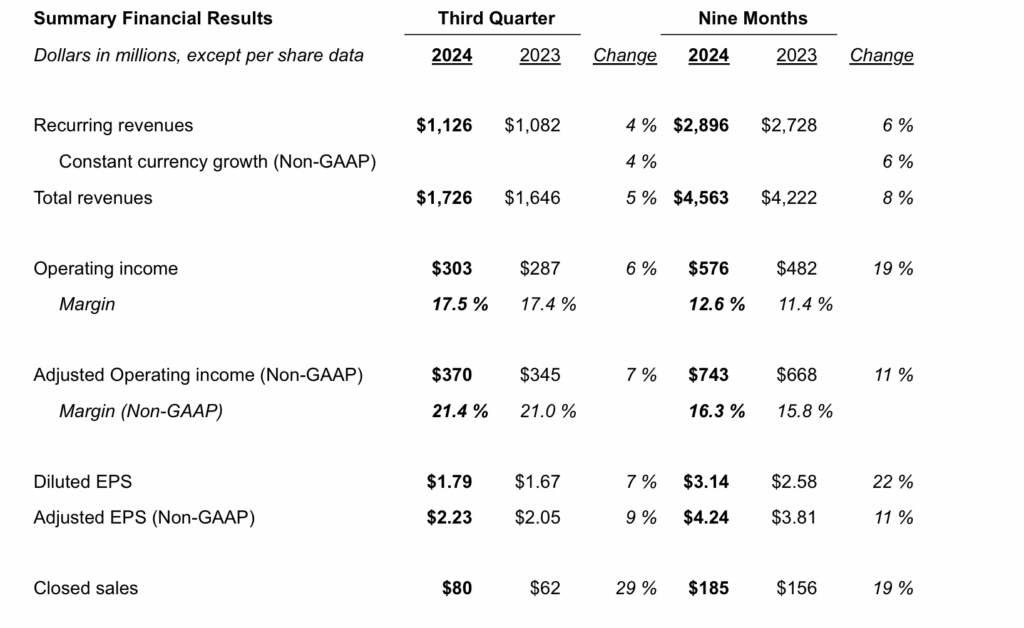

Total revenue increased 5% to $1,726 million from $1,646 million in the year-ago period.

Recurring revenue increased $44 million, or 4%, to $1,126 million. Recurring constant currency (Non-GAAP) revenue growth was 4%, all organic, driven by Net New Business and Internal Growth.

Event-based revenue increased $15 million, or 29%, to $67 million, driven by equity brokerage contests in the quarter.

Distribution revenue increased $21 million, or 4%, to $533 million, thanks to a roughly $30 million increase in postage offset by lower communications volumes.

Operating income was $303 million, an increase of $16 million, or 6%. Operating income margin increased to 17.5%, compared to 17.4% for the prior-year period, primarily due to higher Recurring income and higher event-based income.

Adjusted operating income was $370 million, an increase of $25 million or 7%. Adjusted operating income margin was 21.4% compared to 21.0% for the prior year period. The combination of higher distribution revenue and higher variance revenue had a net benefit of 20 basis points.

Net interest expense was $35 million, a decrease of $3 million, primarily due to a decrease in average borrowing, partially offset by an increase in interest expense from higher borrowing costs.

The effective tax rate was 19.8% compared to 20.6% in the previous period. The effective tax rate for the quarter ended March 31, 2024 resulted primarily from a higher excess tax benefit related to equity compensation, relative to pre-tax income, compared to the prior year period.

Net income rose 8% to $214 million and adjusted net income rose 9% to $267 million.

Diluted earnings per share rose 7% to $1.79, compared with $1.67 in the prior period and

Adjusted earnings per share rose 9% to $2.23, compared to $2.05 in the prior period.

Tim Gokey, CEO of Broadridge, commented:

“Entering our fourth quarter, Broadridge is poised to deliver another year of solid and consistent growth. For fiscal 2024, we expect recurring constant currency revenue growth at the low end of the guidance range of 6-9% and reaffirm our outlook for adjusted EPS growth in the mid-range of 8-12%, as well as record closing sales of $280-320 million. We also expect to achieve our full-year target of 100% free-flow conversion, positioning Broadridge to return additional capital to shareholders while also funding mergers and acquisitions.”