BBVA completes global deployment of ADA cloud data platform

BBVA has completed the global rollout of ADA (Analytics + Data + AI), the group’s data platform, which is now operational across all geographies within BBVA’s footprint. BBVA has completed the global rollout of ADA, following its implementation in Argentina and Peru. With this milestone, the bank has successfully completed a transformation that allows it […]

Interactive Brokers Launches Karta Visa Card

Electronic trading major Interactive Brokers Group Inc (NASDAQ:IBKR) is now offering eligible Interactive Brokers LLC customers the ability to open a Karta Visa card to make purchases worldwide with a card linked to their IBKR account. The Karta Visa card enhances Interactive Brokers’ cash management services by adding a USD card with no foreign transaction […]

Alpaca joins the Global Dollar Network, providing customers with access to USDG in Solana

Alpaca, a broker-dealer and brokerage infrastructure API provider, today announced that it has joined the Global Dollar Network (GDN). This will provide customers with access to USDG on Solana, one of the most used blockchains with benefits such as high performance and low cost. This marks a major milestone in Alpaca’s crypto infrastructure: the first […]

Virtu posts 16.7% YoY growth in Q3 2025 revenue

Virtu Financial, Inc. (NYSE:VIRT), a provider of financial services and products that leverages cutting-edge technology to deliver innovative, transparent trading solutions to its clients and liquidity in global markets, today announced results for the third quarter ended September 30, 2025. Total revenue rose 16.7% to $824.8 million for the third quarter of 2025, compared to […]

eToro brings CopyTrader to US customers

Online broker eToro has announced that it is bringing its patented CopyTrader technology to US users. Starting today, US users have the ability to instantly copy the investment strategies of real US traders in stocks, ETFs or cryptocurrencies. “We’re excited to bring one of eToro’s most recognized features to the world’s largest retail investment marketplace. […]

The SEC’s lawsuit against Archegos was stayed

The Securities and Exchange Commission (SEC) updated its lawsuit against Archegos Capital Management LP, Sung Kook (Bill) Hwang, Patrick Halligan, William Tomita and Scott Becker. The regulator informed the Southern District Court of New York that the suspension of the case should continue. Due to a lack of federal government funding, as of October 1, […]

ATFX Records Client Trading Volume of US$709.2 Billion in Q3 2025

After a record Q2, leading online broker ATFX saw a slight decline in client trading activity in Q3 2025, achieving a total trading volume of US$709.2 billion (or $236 billion monthly), marking another milestone in a year defined by steady growth, product differentiation and increasing customer engagement worldwide. Second quarter volumes on ATFX were $287 […]

FINRA Fines Independent Financial Group $100,000

Independent Financial Group, LLC has agreed to pay a $100,000 fine as part of a settlement with the Financial Industry Regulatory Authority (FINRA). From April 2022 to November 2022, an IFG registered representative was suspended by FINRA from association with any FINRA member in any capacity. The Acceptance, Waiver and Consent Letter establishing the suspension […]

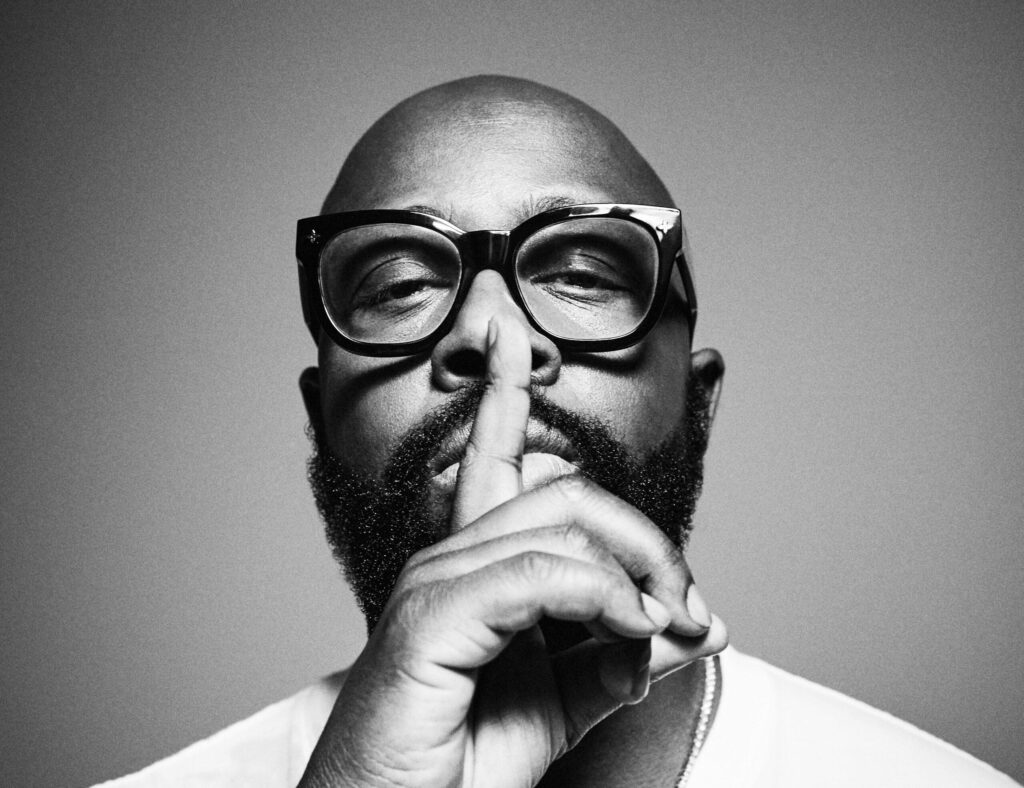

Circle Taps Wyclef Jean as Advisor on World Culture

Circle Internet Group, Inc. (NYSE:CRCL) announced a partnership with Grammy Award-winning artist, producer and composer Wyclef Jean, who joins as Circle’s Global Culture Advisor. This marks the beginning of a strategic partnership to showcase communities around the world using stablecoin technology and realize Circle’s mission through storytelling and performance. Together, Circle and Wyclef will connect […]

SIX selects Aquis Technologies as technology provider to harmonize platforms across its trading venues

SIX and Aquis announced today that Aquis Technologies has been selected as the technology provider to implement a harmonized trading platform for SIX. The implementation of a common trading platform across all exchanges managed by SIX – including SIX Swiss Exchange, Bolsas y Mercados Españoles (BME) and Aquis – will facilitate a unified experience for […]