Cboe Global Markets, Inc. He reported financial results today for the first quarter of 2025.

The $ 21.3 million increase recorded $ 21.3 million increased by $ 16% compared to the first quarter of 2024.

ADNV, which was negotiated on the CBOE FX platform, was $ 51.9 billion for the quarter, up 15% compared to last year’s first quarter, and the net conception rate of a million dollars negotiated was $ 2.77 for the first quarter of $ 20, $ 207 in $ 207.

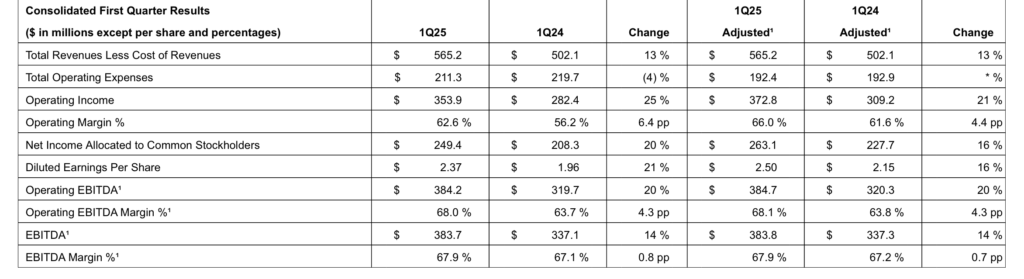

Overall revenue The lowest cost of revenue (referred to as “net revenue”) of $ 565.2 million increased by 13%, compared to $ 502.1 million in the previous period, as a result of increases in derivative markets, cash markets and points.

Total operating expenses amounted to $ 211.3 million versus $ 219.7 million in the first quarter of 2024, a decrease of $ 8.4 million. This reduction was mainly due to the lower depreciation and depreciation, other expenses and travel and promotion costs, which is partially offset by the increase in technology support services and allowances and benefits.

Diluted EPS for the first quarter of 2025 increased by $ 21 % to $ 2.37 compared to the first quarter of 2024. Adapted diluted EPS $ 2.50 increased by 16 % compared to 2024 first -month results.

“The widespread power of our business model was presented during the first quarter, resulting in quarterly files for overall net revenue and customized EPS,” said Jill Griebenow, Executive Vice President of Cboe Global Markets, head of financial director.

“Net derivative revenue increased by 16 %, as we saw record volumes in all our products for the means and the means, the means of single digit and the single digits and our single digits and average digits, 2025. We are confirming the full year of $ 85 million in guidance costs.