Cboe Global Markets, Inc. He mentioned the financial results today for the second quarter of 2025.

A $ 23.6 million worldwide revenue record increased by $ 19% compared to the second quarter of 2024.

ADNV, which was negotiated on the CBOE FX platform, was $ 55.9 billion for the quarter, up 17% compared to last year’s second quarter and the net conception rate of a million dollars negotiated was $ 2.81 in the second quarter of $ 20.

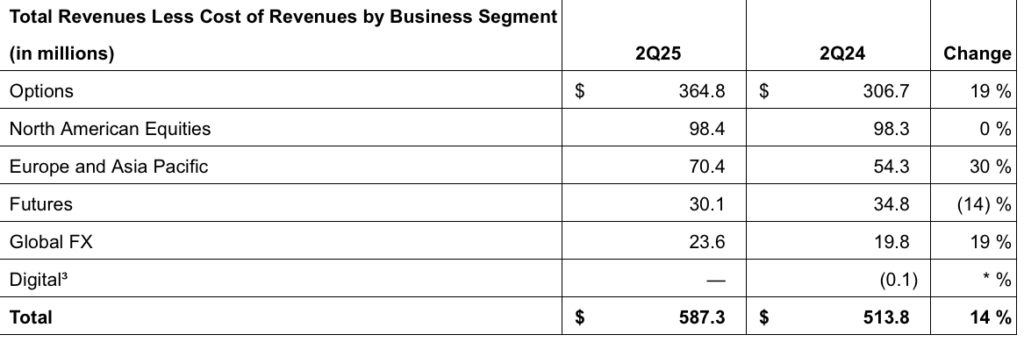

In all business sectors, the CBOE recorded a net record revenue for the $ 587.3 million quarter, increased by 14% of the year.

Diluted EPS for the quarter was $ 2.23, up 68%, mainly due to the non -repetitive deposit of 2024 of the intangible assets recognized in the digital reference unit.

Customized diluted EPS for the quarter were $ 2.46, up 14% of the result registered a year ago.

Craig Donohue, CEO of CBOE Global Markets, commented:

“In the second quarter, the CBOE reported a record quarterly revenue of $ 587 million, diluted EPS 2.23 dollars and tailored diluted EPS1 $ 2.46. Strong double -digit net revenue in all derivatives and data.

Net revenue increased by 14 % and adapted diluted EPS1 increased by 14 % annually, bringing annual growth to 13 % and 15 %, respectively, compared to the first half of 2024. I am excited to rely on the excellent results of the first half of the year. ”

On June 30, 2025, the company had cash and cash equivalents of $ 1,256.3 million and customized cash of $ 1,238.2 million. The total debt on June 30, 2025 was $ 1,442.0 million.

The company paid cash dividends of $ 66.4 million or $ 0.63 per share, in the second quarter of 2025 and used $ 35.3 million, with the exception of supplies and consumer taxes, to reproduce about $ 211,000. dollars per share. As of June 30, 2025, the company had about $ 614.5 million availability that remained under existing stock repurchase licenses.