Cboe Global Markets, Inc. today announced financial results for the fourth quarter of 2023 and the full year.

Global net FX revenues of $18.9 million increased 12% over the prior quarter, primarily due to higher net trading and clearing fees.

ADNV traded on the Cboe FX platform was $47.0 billion for the fourth quarter of 2023, up 15% compared to last year’s fourth quarter, and the net commitment rate per million dollars traded was $2.60 for the quarter, down 3% compared to $2.69 in the quarter. fourth quarter 2022.

Cboe FX’s market share was 21.3% for the quarter compared to 18.4% in last year’s fourth quarter, which set a quarterly record for Cboe FX. The record was driven by new client growth and increased adoption of our diverse set of forex order types and trading protocols.

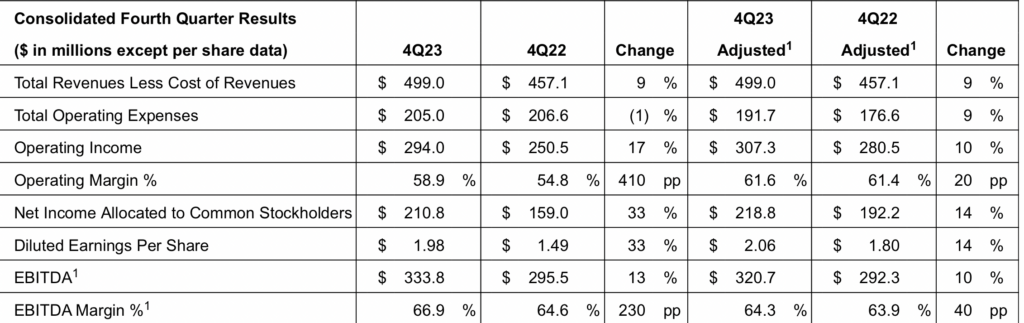

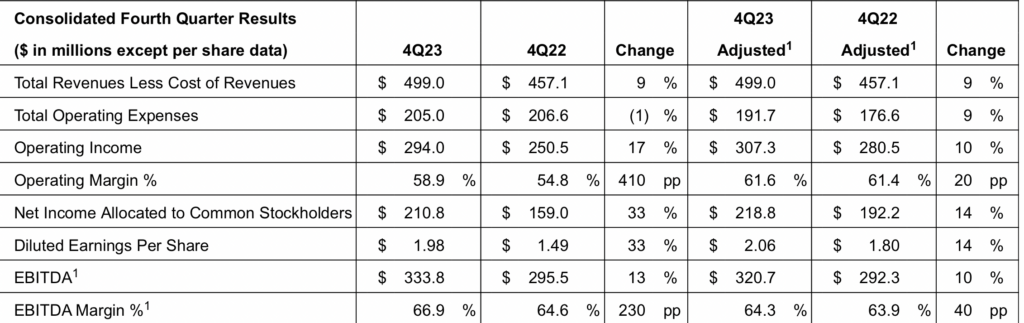

Total revenue less cost of revenue of $499.0 million increased 9%, compared to $457.1 million in the prior period, reflecting increases in derivatives markets and data and access solutions net revenue, partially offset by a decrease in net proceeds of cash and spot purchases.

Total operating expenses were $205.0 million versus $206.6 million in the fourth quarter of 2022, a decrease of $1.6 million. Adjusted operating expenses of $191.7 million increased 9 percent compared to $176.6 million in the fourth quarter of 2022. This increase was primarily due to higher compensation and benefits and technology support services, partially offset by the reduction of other expenses, depreciation and professional fees and external services.

Q4 2023 diluted EPS increased 33% to $1.98 compared to Q4 2022. Adjusted diluted EPS of $2.06 increased 14% compared to Q4 2022 results.

“I am pleased to report that Cboe has delivered another year of strong revenue growth and financial results in 2023,” said Fredric Tomczyk, Chief Executive Officer of Cboe Global Markets. “Our Derivatives and Data and Access Solutions categories contributed to net revenue growth of 10% and adjusted earnings growth of 13% for the year, as both strong secular and cyclical trends helped to strengthen these business lines. In addition, we have made significant progress on our strategic initiatives as a company and are well positioned for 2024. This year we intend to unlock additional value from our global derivatives and securities network by leveraging our core strengths – our global footprint, superior technology and product innovation – to help drive continued strong growth in revenue and financial results.”