Circle Internet Group, Inc. (NYSE: CRCL) has announced results today for the second quarter of the financial year 2025.

In June, the company completed the original public bid of $ 1.2 billion. From the total bid of 39.1 million shares, Circle sold 19.9 million newly acquired shares of Class A shares at a price of $ 31 per share, resulting in net revenue of $ 583 million after deducting discounts and supplies and supplies.

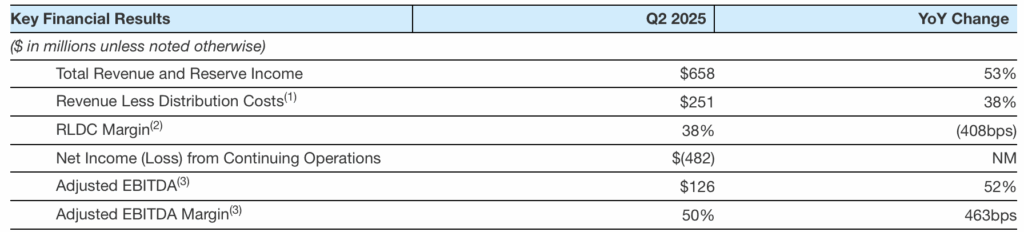

The net loss for the second quarter of 2025 was $ 482 million that largely reflected two impacts not owned $ 591 million-$ 424 million for compensation based on stock-related stocks of the Circh IPO and its Circh IPO Price of share capital.

Reserves revenue increased by 50% on an annual basis to $ 634 million, mainly from 86% increase in the USDC average in circulation, partially offsetting the decline of 103 Bps to reserve return rate.

Other revenue increased by 252% annually to $ 24 million, as subscriptions and services revenue and revenue increased strongly.

Total distribution, transaction and other expenses increased by 64% annually to $ 407 million, mainly from increased distribution payments reflecting the highest USDC traffic balance and the increase in COINBASE’s participation for USDC platforms, as well as distribution payments.

Operating expenses amounted to $ 577 million a quarter, including $ 424 million in compensation costs based on RSU -related stocks in relation to Circle’s successful IPO.

Customized EBITDA increased by 52% on a yearly basis to $ 126 million reflecting the continuing USDC increase in circulation and inherent functional leverage of Circle.

Jeremy Allaire, co -founder, CEO and President of Circle, commented:

“I am proud of Circle’s performance in the second trimester, our first as a public company, where we have proven the continued development and adoption of our platform in a plethora of use cases and with a different set of partners that determine the industry.

Circle’s successful IPO in June marked a central moment – not only for our company, but for the wider adoption of Stablecoins and the development of the new financial system on the internet. This is an excellent moment for our company and industry and we see we speed up the interest in building Stablecoins and working with the circle in every major financial industry, with large internet companies and trade commitment around the world. “