Citigroup Inc. Today she published her financial results for the second quarter of 2025.

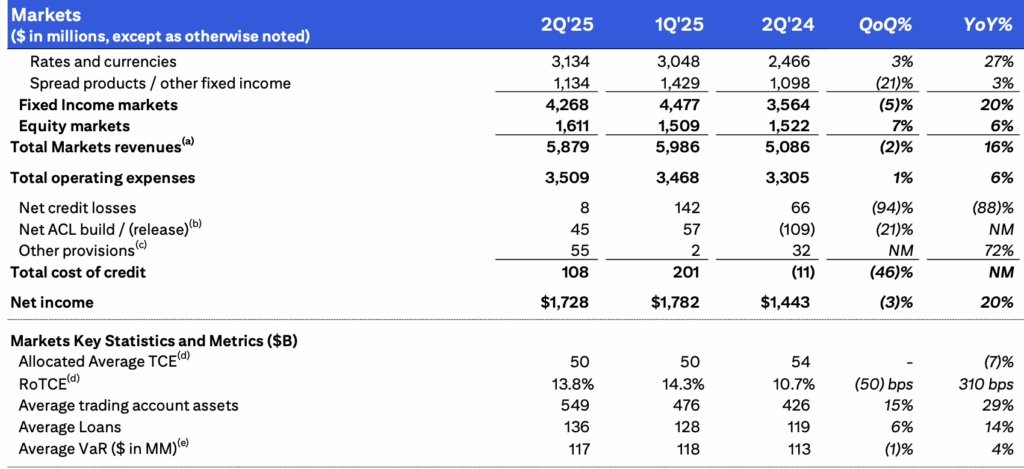

$ 5.9 billion in revenue increased by 16%, resulting in increased income from fixed income and stocks.

Revenue from a fixed income of $ 4.3 billion increased by 20%, resulting in growth between rates and coins as well as spreading products and other fixed incomes. Currency rates and revenue increased by 27%, thanks to increased customer activity and revenue from clients of the corporate and financial institution. Products and other fixed income revenue increased by 3%, on the rear of higher funding and loan growth, which are partially offset by lower credit transactions.

The $ 1.6 billion shares revenue increased by $ 6%, resulting in the momentum in primary services, with records of about 27%, as well as the highest activity of customers and the volumes of the shares and the generation of revenue from market activity in derivatives. B in the previous period.

The net income markets were $ 1.7 billion, compared to net income of $ 1.4 billion in the previous period, supported by the highest revenue, offset partly by the highest expenses and the highest credit costs.

In all departments, Citigroup revenue of $ 21.7 billion in the second quarter of 2025 increased by 8%on a reported basis, resulting in growth in each of the five Citi interconnected companies, partially offset by a fall in everything else. Except for the effects of divestment on both periods, revenue increased by 9%.

Net interest revenue increased by 12%, resulting in the US markets, services, personal banking services (USPBs), wealth and banking, partially offsetting the decline to everyone else. Revenue from non -interests declined by 1%due to all other USPBs, markets and services, offset by banking and wealth increases.

Citigroup’s net income amounted to $ 4.0 billion in the second quarter of 2025, compared to a net income of $ 3.2 billion in the previous period, with the highest revenue increase, offsetting the highest costs and higher costs.