Citigroup Inc (NYSE: C) today reported its financial results for the third quarter of 2025.

$ 5.6 billion in revenue increased by 15%, increasing both in fixed income and stock markets.

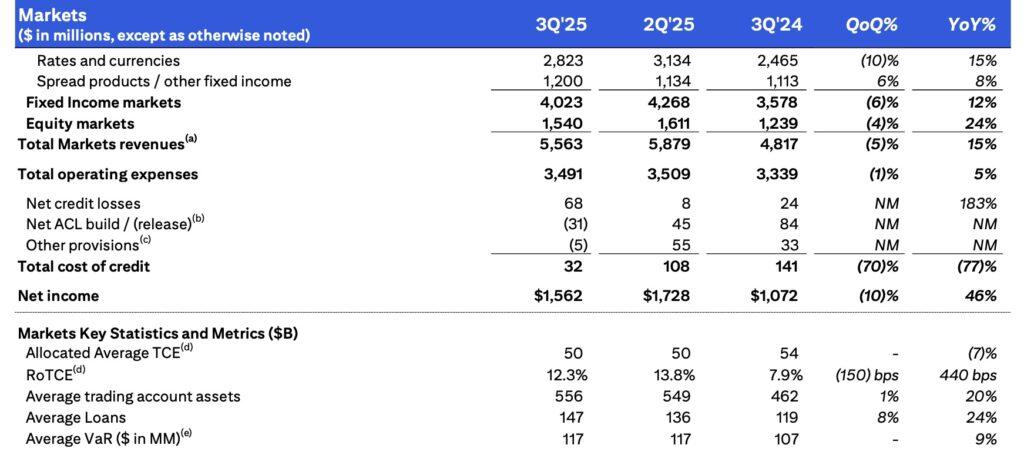

Revenue of fixed income markets of $ 4.0 billion increased by 12% on the rear of growth in both rates and coins and spreading products and other fixed incomes. Currency rates and revenue increased by 15%, largely from higher revenue than rates due to increased customer activity. Products and other fixed income revenue increased by 8%, reflecting higher mortgage loan transactions, higher funding and lower goods.

The stocks of shares of $ 1.5 billion increased by 24%, driven by higher customer activity in derivatives and increased volumes in cash stock shares, along with the continued momentum in prime services, with a record of about 44%(about 44%).

Operating costs of the $ 3.5 billion markets increased by 5%, supported mainly by higher allowances and benefits, along with the impact of FX translation, are partially offset by the lowest transaction and product costs, as the highest transactions have been offset.

Markets net income increased by $ 1.6 billion increased by $ 46%, resulting in higher revenue and lower credit costs, partially offset by the highest expenses.

In all departments, Citigroup revenue of $ 22.1 billion in the third quarter of 2025 increased by 9%on a reported basis, resulting in an increase in each of the five Citi interconnected companies and Citi’s franchises, compensating in part from a reduction in corporate/corporate.

Net interest revenue increased by 12%, thanks to the US markets, personal banking work (USPB), services, wealth, franchises heritage and banking, offsetting partly by reducing corporate/other. Revenue from non -interests increased by 4%, led by the franchises, wealth and inheritance franchises, highly offset the reductions in corporate/other markets, services and USPB.

Citigroup’s net income was $ 3.8 billion in the third quarter of 2025, compared to net $ 3.2 billion income in the previous period, thanks to the highest revenue and the lowest credit costs, highly offset the highest expenses.

Earnings per share of $ 1.86 increased from $ 1.51 per share diluted in the previous year, reflecting the highest net income and the lower shares pending.