The CME Group Inc. International Derivatives Market. (NASDAQ:CME) today announced financial results for the third quarter of 2025.

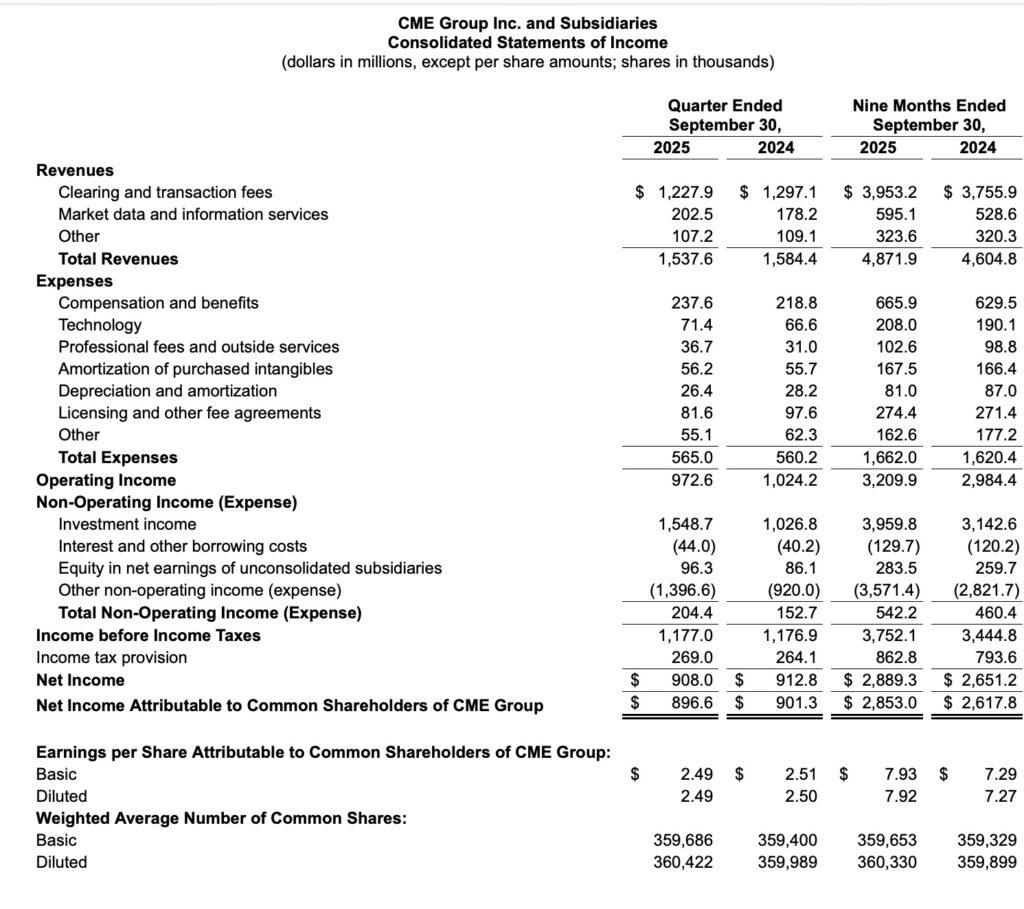

The company reported revenue of $1.54 billion for the third quarter of 2025, down from the $1.58 billion result recorded in the previous quarter.

Operating income for the third quarter of 2025 was $973 million. Net income was $908 million and diluted earnings per common share were $2.49.

On an adjusted basis, net income was $1.0 billion and diluted earnings per common share were $2.68. The financial results presented on an adjusted basis for the third quarter of 2025 and 2024 do not include certain items, which are detailed in the reconciliation of non-GAAP results.

“Global clients continued to rely on CME Group markets across all asset classes as they sought to navigate risk and pursue opportunity amid continued uncertainty in the third quarter,” said Terry Duffy, CME Group President and CEO. “As a result, we achieved our second-highest third-quarter ADV, as well as adjusted net income and adjusted earnings per share in line with last year’s exceptionally strong third-quarter performance. Looking ahead, we remain focused on delivering efficiencies, new products and expanded access for market users, including through our new partnership with FanDuel and 24 Trading options and 24 cryptocurrency.”

Clearing and trading fee revenues for the third quarter of 2025 totaled $1.2 billion. The overall average price per contract was $0.702. Market data revenue totaled a record $203 million for Q3 2025.

As of September 30, 2025 the company had $2.6 billion in cash (including $200 million deposited with the Fixed Income Clearing Corporation, which is included in other current assets) and $3.4 billion in debt. The company paid dividends in the first nine months of the year of about $3.5 billion. The company has returned more than $29.5 billion to shareholders in the form of dividends since implementing the variable dividend policy in early 2012.