The Cyprus Securities and Exchange Commission (CYC) published the relevant today annual statistical report for 2022.

The total number of Cypriot investment companies (CIFs) decreased by 2% year-on-year between 2021 and 2022. At the end of 2022, the total number of CIFs was 225.

At the end of 2022, the total number of CIF clients was 4,147,949. The 26% increase in client numbers between 2021 and 2022 is partly attributable to market growth and partly to a change in client reporting implemented by a range of CIFs following Brexit.

The total number of employees of all CIFs increased by 10% between the years 2019 and 2020, while a significant drop of 20% occurs between the years 2020 and 2022. At the end of 2022, the total number of employees in CIFs reached 4,341.

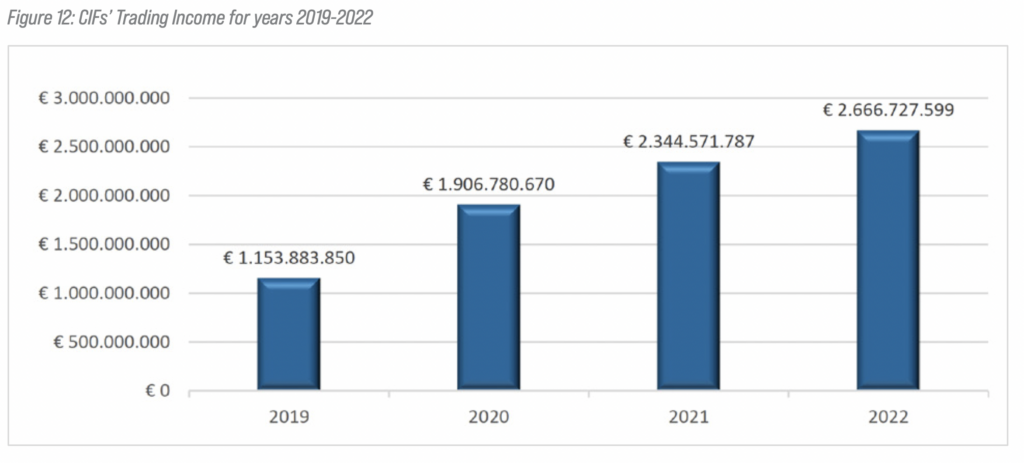

In 2022, revenues from CIF sector activities totaled €2.7 billion. Last year saw the highest trading income. The CIF sector saw an annual growth of 14% in trading revenue between 2021 and 2022.

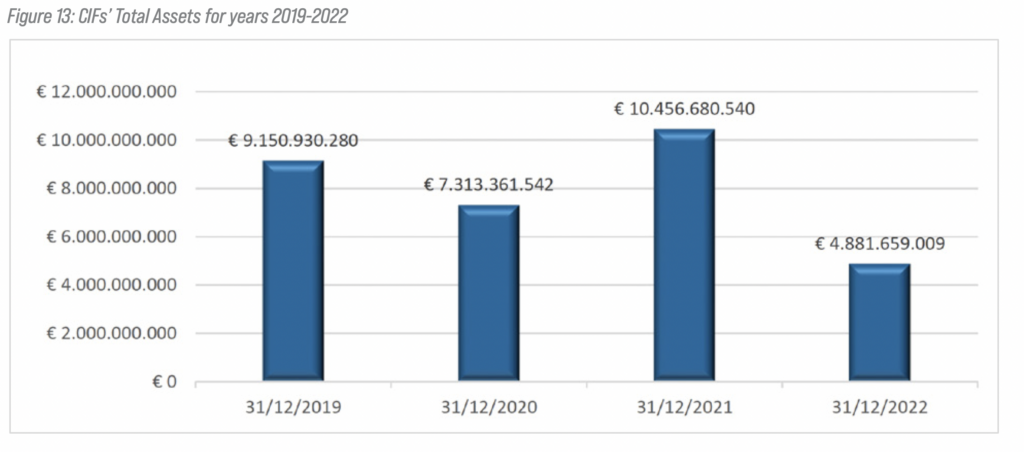

In 2022, Total Assets of CIFs recorded an annual decline of 53%, for the first time in four years. Total Assets of CIFs decreased significantly to €4.9 billion in 2022, compared to €10.5 billion in 2021.

The conflict in Ukraine affected the Total Assets of CIFs due to the imposition of sanctions and a reduction in the volume of CIF business. Another factor that negatively affected the value of CIF assets was the huge divergence of the EUR/USD exchange rate that financial markets experienced during the last quarter of 2022. All CIFs that had their assets in USD were significantly affected by this currency fluctuation.

In addition, a large part of the Assets of the CIFs denominated in Russian Rubles were withdrawn from their accounts, in an attempt to limit their exposure to that currency.

At the end of 2022, EKK regulated and supervised a total of 837 Controlled Entities.