Darwinex has unveiled a new enhancement to the Darwinex platform, vital to providing greater transparency and building greater trust in its investment component, DARWIN.

Starting today, DARWIN prices will be calculated based on investor strike prices instead of the trader’s token account strike prices as they were in the past. It is important to note that the profitability of investors does not change.

Darwinex has spent over a year developing this product enhancement due to its technical complexity (significant platform implications, challenges in testing it in a simulated environment, etc.).

As of September 2023, all uninvested DARWINs have already bid using the new calculation method, and Darwinex has verified that the changes worked correctly in a real-world environment.

From now on, all DARWINs with less than $100,000 investment also go on sale in the new format. In other words, 95% of DARWIN now bids using the new calculation method.

Once Darwinex has thoroughly tested the functionality on these lower investment DARWINs, Darwinex plans to implement the change for the remaining DARWINs on the platform, likely between January and February 2024.

1. If you are a DARWIN provider (dealer):

- In the DARWIN section, you’ll have access to the same information you’ve had so far.

- When all DARWINs are reported without drift, the drift constraint currently imposed on DarwinIA will no longer be used. All DARWINs, except those that are closed to investment, will then participate in DarwinIA (however, note that the current restrictions based on correlation and minimum net worth in the token account will be maintained).

- The returns used to calculate the DarwinIA SILVER score and the monthly return on DarwinIA GOLD will be calculated using the new DARWIN reporting method. Therefore, if a DARWIN experiences slippage issues, these will be reflected in its returns, but it will still participate in DarwinIA.

- The DARWIN index now depends on the quality of investor execution, adding another source of diversification to the signal account performance curve. It is a “minor negative consequence” for the DARWIN provider, which is offset by providing greater transparency to the investor.

- In the event that Darwinex decides to compensate investors for an execution issue, it will proceed to recalculate the DARWIN offer next weekend to show the compensation made to investors.

2. If you are an investor:

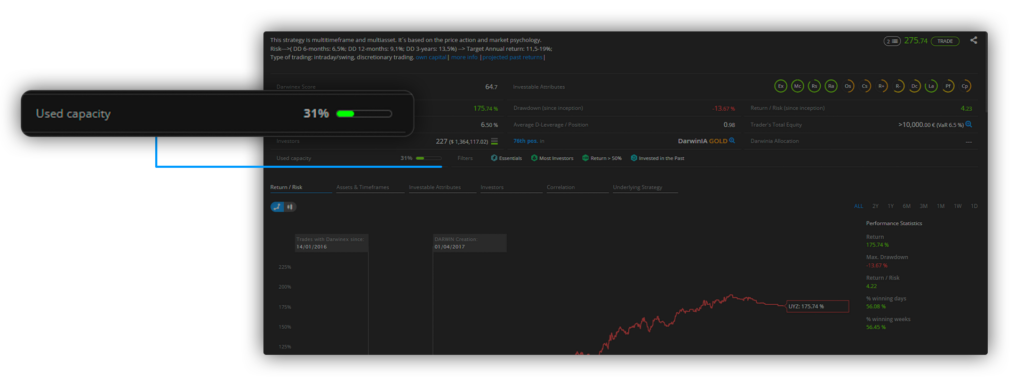

- The concept of deviation disappears from the DARWIN page and Darwinex replaces it with the concept of “used capacity”. The used capacity is a value between 0% and 100%, indicating an estimate of the amount of investment a DARWIN can have before shutting down due to excessive slippage.

- It is calculated based on the existing slippage, calculated to date, and the deviation at which Darwinex closes DARWIN to new investments due to slippage that makes it very difficult for investors to continue generating positive returns in the future.

- A DARWIN will be open to new investment as long as the value of used capacity is not 100%. Once it reaches 100%, it will be closed to further investment until the value of used capacity drops back to 95%.

The used capacity will be displayed using a line with the following colors depending on the value:

- Green (0 to 69.99%) – DARWIN Open

- Orange (69.99% to 99.99%) – DARWIN is nearing shutdown

- Red (100%) → DARWIN Closed

DARWIN’s bid curve will begin to price with investor strike prices, making it much easier to assess the effect of slippage on DARWIN’s performance.

For each DARWIN, Darwinex will display the date from which its offer began to be calculated under the new system.