Well, it looks like the pop aftermarket on Friday was just the appetizer.

After seeing its shares grow by 6% in marketing after Friday’s purchase, after news that hit the S&P 500 index, Neobroker RobinHood Markets Inc (Nasdaq: Hood) observed a much higher, double -digit increase in stock prices by just 16% “real” market.

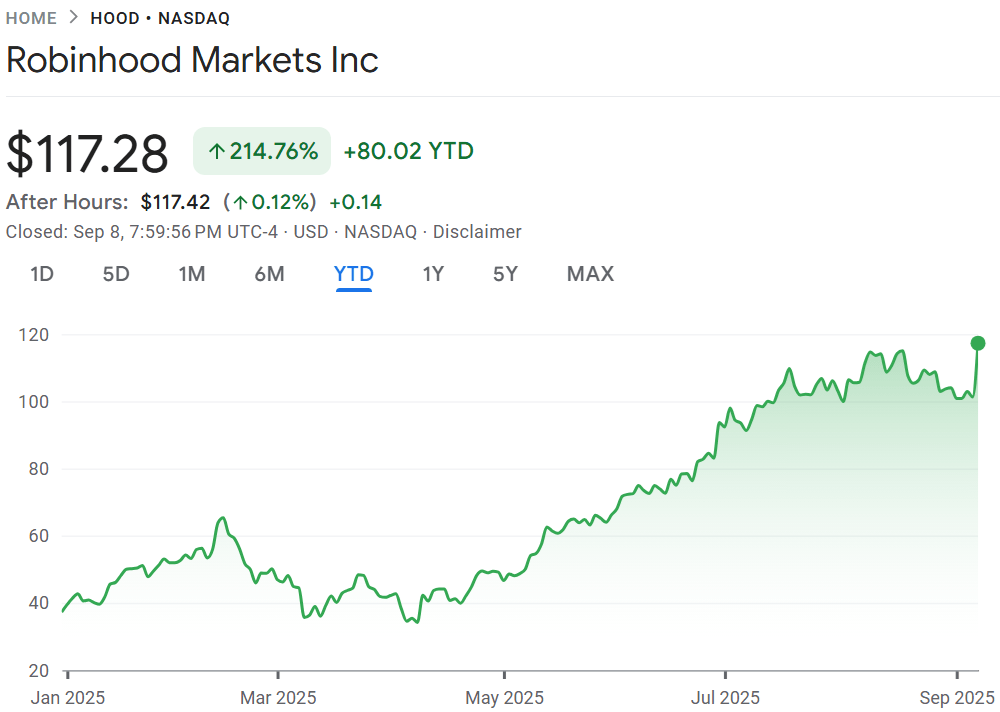

RobinHood’s shares hit $ 117.30 on Monday-Konta at high from $ 117.70 before setting up to $ 117.28, even $ 16% a day. Robinhood shares have tripled so far in 2025, up 214.76% since January 1st.

RobinHood share price 2025 year in year. Source: Google Finance.

Interestingly, research by S&P Dow Jones itself shows that the index Added to a significant stock index has been reduced, from 8% in the last century to the basically zero. However, RobinHood’s shareholders and investors clearly believe that RobinHood’s accession could have significant positive implications for the company.

That could really make sense.

In a very competitive internet mediation business, especially while competing with large volume and large volume accounts, the broker’s reputation is very important, leading to high spending on the brand name of many brokers. A good example of this phenomenon is the increase in brokers’ spending on all kinds of sports sponsorships, especially those involving the leading European football clubs-such as the recent Robinhood sponsor agreement, signed by the French football club OGC Nice.

And the “approval” of the existence of a S&P 500 company will actually help RobinHood under its name between a very important demographic customer.