Fintech payments group Equals Group plc (LON:EQLS) has today provided a trading update for the six months ended 30 June 2024 (“A1-2024”).

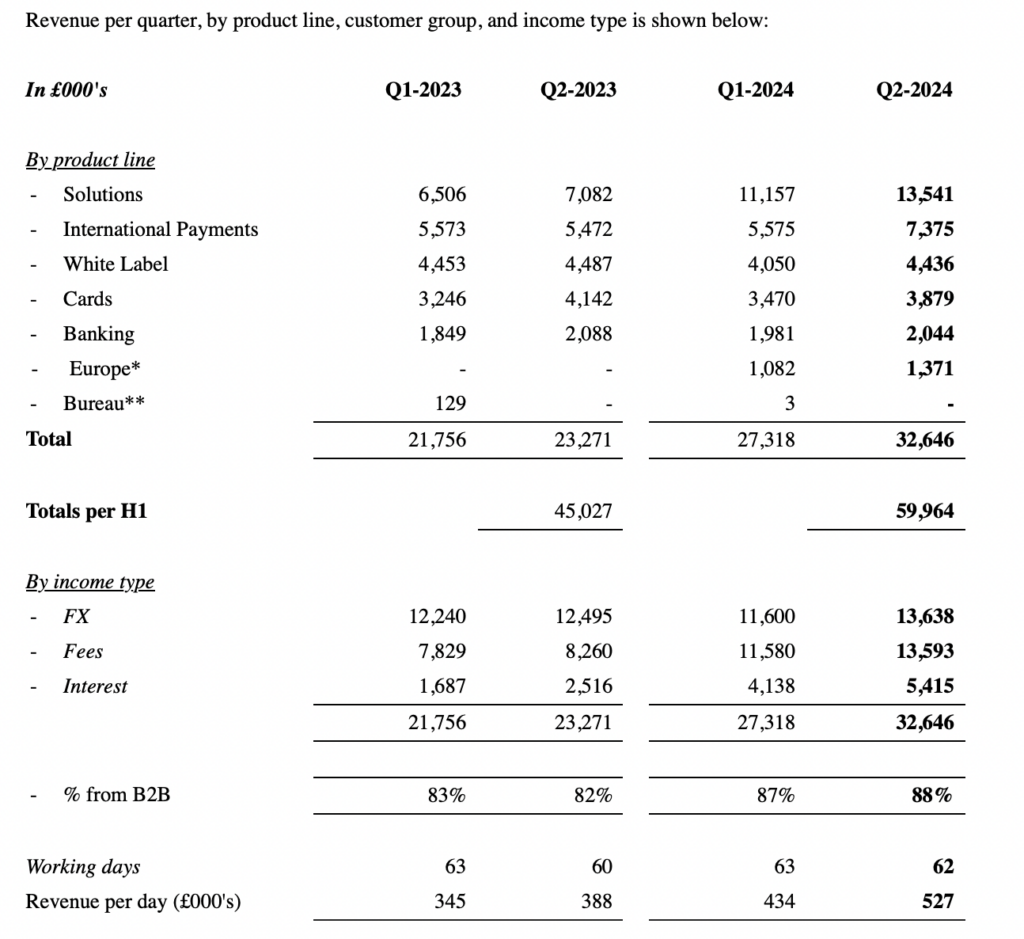

Group revenue increased by £14.9m compared to the same period last year to £60.0m, an increase of 33% year-on-year (1-2023: £45.0m).

Foreign exchange revenues, which incorporate both direct and white chips, depend in part on market conditions and interest rate volatility resulting in increased client activity. After a quiet quarter of 2024, the company saw a strong recovery in Q2 2024. Overall, foreign exchange revenue from B2C customers is subdued due to macroeconomic conditions, while B2B revenue is stronger.

Within Solutions, fee-based revenue is more recurring, as customers typically enter into long-term contracts with agreed minimum monthly fees.

The Group also earns interest income which is primarily earned on secured customer balances held off-balance sheet, in three currencies (GBP, EUR and USD) and four Tier-1 banks.

As at 30 June 2024, the Group was debt free and had cash in the bank of £20.5 million, having already settled the following items during the Period:

- dividend paid to shareholders on 28 June 2024 totaling £1.9 million.

- costs in accordance with previous acquisitions settled during the Period, totaling £1.8m and

- third party costs incurred during the strategic review totaling £0.5 million.