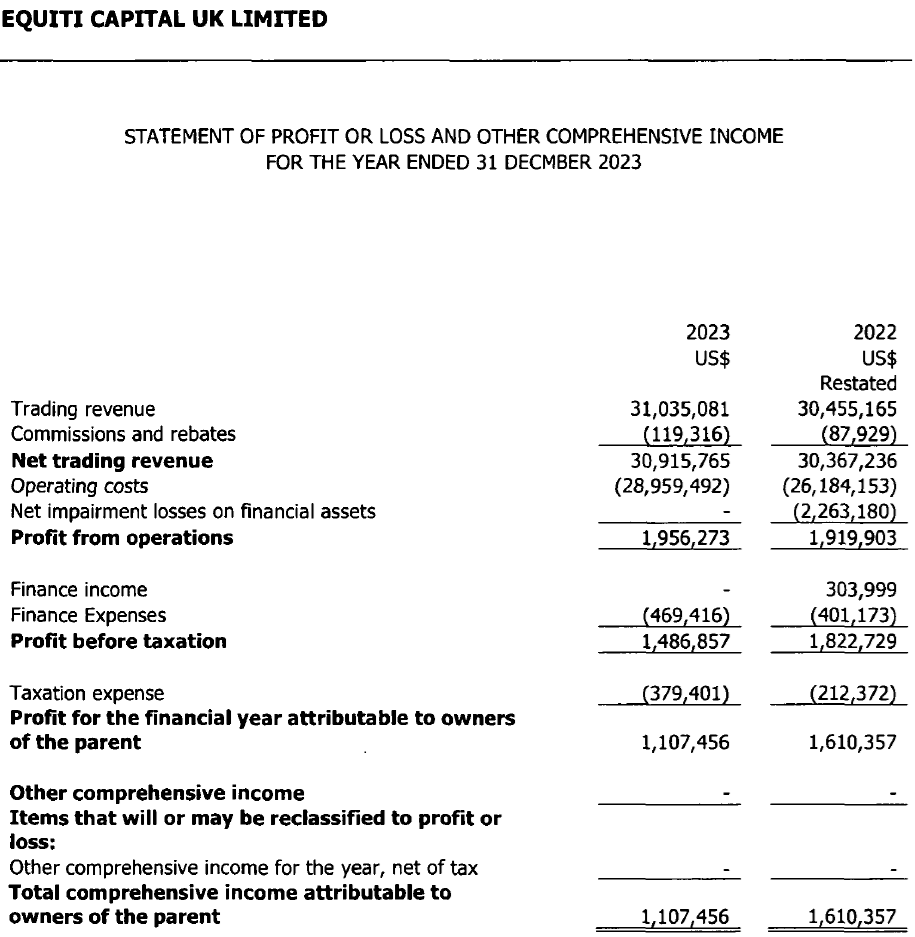

Equiti Capital UK Limited, the FCA-regulated institutional/B2B arm of UAE-based global FX and CFDs brokerage Equiti Group, continued its growth path in 2023, posting a 2% increase in revenue, although the company noted slight drop in profitability.

Revenue for 2023 at Equiti Capital came in at $31.0 million, up 2% from $30.5 million a year earlier, driven primarily by increased transaction volume experienced by the broader Equiti Group. Net earnings totaled $1.1 million, up from $1.6 million in 2020, due to a slight increase in operating costs during the year.

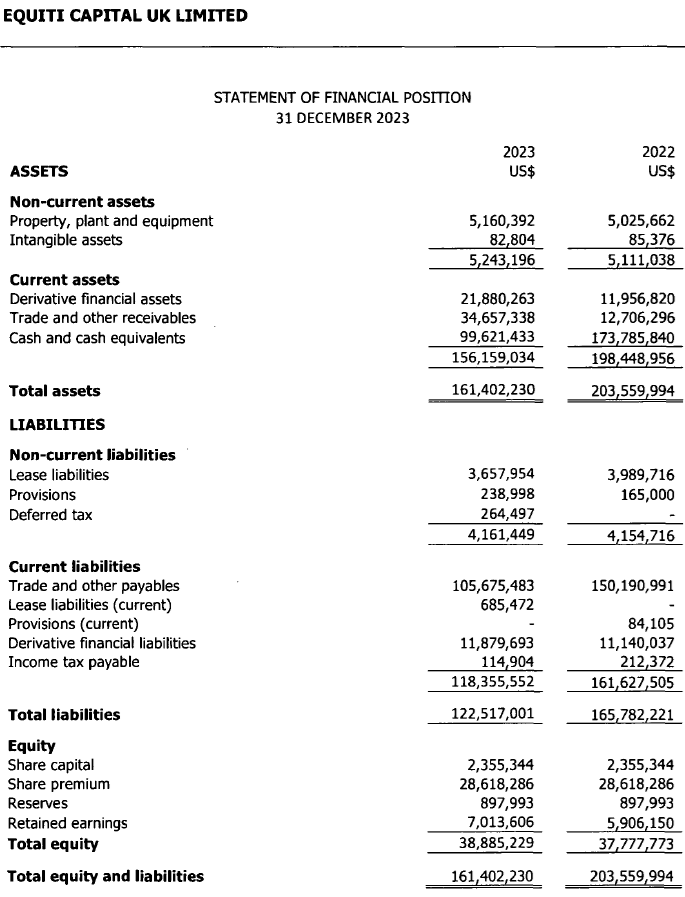

The Company’s balance sheet remains in a strong position, with net assets of $39 million.

Equiti Capital noted that a recent investment in a Digital Marketing team contributed to the growth of the wider Group. This led to an increase in the number of customers and the volume of transactions during the year. Due to the Company’s position in the Group structure, it benefited from this increased transaction volume, resulting in a 34% increase in commission income. This has reduced the Company’s reliance on revenues derived from the provision of voice services, which previously constituted a significant portion of the Company’s revenues.

The Company continues to invest in product development and platform enhancements to ensure high levels of customer satisfaction and retention. During the year, the Company added 1,500 new stocks and ETF CFDs to its trading platform, providing clients with trading opportunities in trendy industries such as artificial intelligence, robotics and renewable energy stocks.

Equiti Capital’s main business is to provide execution-only brokerage services to professional and institutional clients for trading CFDs in spot forex, metals, indices and commodities. The Company also provides risk management and other services to the entire Equiti Group.

During the year Equiti Capital appointed Liam Conway as its new managing director.

Here is Equiti Capital’s 2023 income statement and balance sheet.